“So ends the bloody business of the day” – Homer

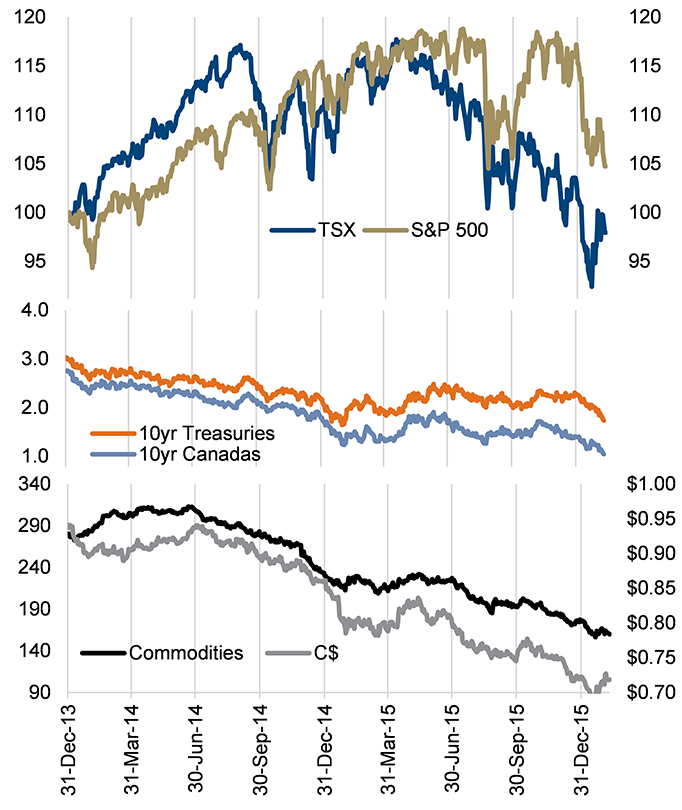

The vast majority of major markets are firmly in correction territory with a few even in bear market territory. Today’s drop in the TSX isn’t helping. This market weakness has been persistent, to varying degrees since last summer. The difference in the last few sessions has been the apparent tooth decay of FANG (Facebook, Amazon, Netflix and Google/Alphabet). FANG and other high momentum organic growers were the darlings of the past year. Of the NASDAQ 100 companies, which include all four FANG members, there are only ten that are up on the year, clearly a tough environment.

Things get only marginally better for Canadian equities. Yes, the TSX is holding up better in 2016 but that is because it went down so much last year and because a healthy gold weight is helping. Still, not much to get excited about given a barrel of oil fetches a mere $30/bbl.

Source: Richardson GMP Asset Management, Bloomberg

Current woes of the market

There are a few factors that are converging to cause this market weakness. Be pre-warned, reading this list will not make you feel good.

1) China – Slowing economic growth as the world’s second largest economy deals with too much debt and overbuilding in both industrial capacity and real estate. This isn’t new but capital market stress in the Kingdom has worries rising.

2) Earnings – Q4 earnings season has been average with an increasing number of companies posting negative earnings growth. A few quarters back, it was only the Energy sector suffering from earnings contraction, now they are joined by Materials, Industrials, Financials, Technology and Utilities. Guidance has not been great either.

3) The Fed – Immediately after raising rates in December, the first such hike in almost a decade, members of the committee spoke of four hikes in 2016, even with the global economy losing momentum. With the recent weakness, the market is now pricing only a 30% probability of one hike this year. However, there are concerns the Fed may still move to save credibility. The speeches tomorrow by Yellen and Williams will be closely scrutinized.

4) Oil – Sure, everyone says it’s just too much supply and taking too long to adjust. Still, such a drop is destabilizing for many countries and industries. While great for the consumer, big oil drops have preceded some recessions.

5) Europe – Their banks are in free fall, down 27% so far this year. China, negative deposit rates, increased regulations are contributors with the greater concern being there is a negative surprise lurking.

These are all legitimate concerns in the market. We believe many of these are rather minor if put into perspective. Earnings growth in the U.S. is being held back by the drop in oil and the dollar. The S&P 500 earnings are much more sensitive to corporate spending while the U.S. economy is more sensitive to consumer spending. Given about one quarter of corporate spending comes from the energy sector or related industries, the drop in oil has had a more pronounced impact on earnings beyond just the energy sector. The good news is with the economy more consumer, low gasoline prices should continue to support the economy, and it should be noted the strongest earnings are coming from the Consumer Discretionary sector. Turning to the drop in oil prices, while destabilizing it can be explained by over investment following technological advances in energy extraction (this happens every time there is dramatic technology change). China matters, but not to the extent of the headlines. Europe is a bigger concern at the moment as is the Fed’s actions in the months to come.

Market Clock Keeps Ticking

Correction or the end of the current market cycle? That is the big question, as one is a buying opportunity and the other isn’t.

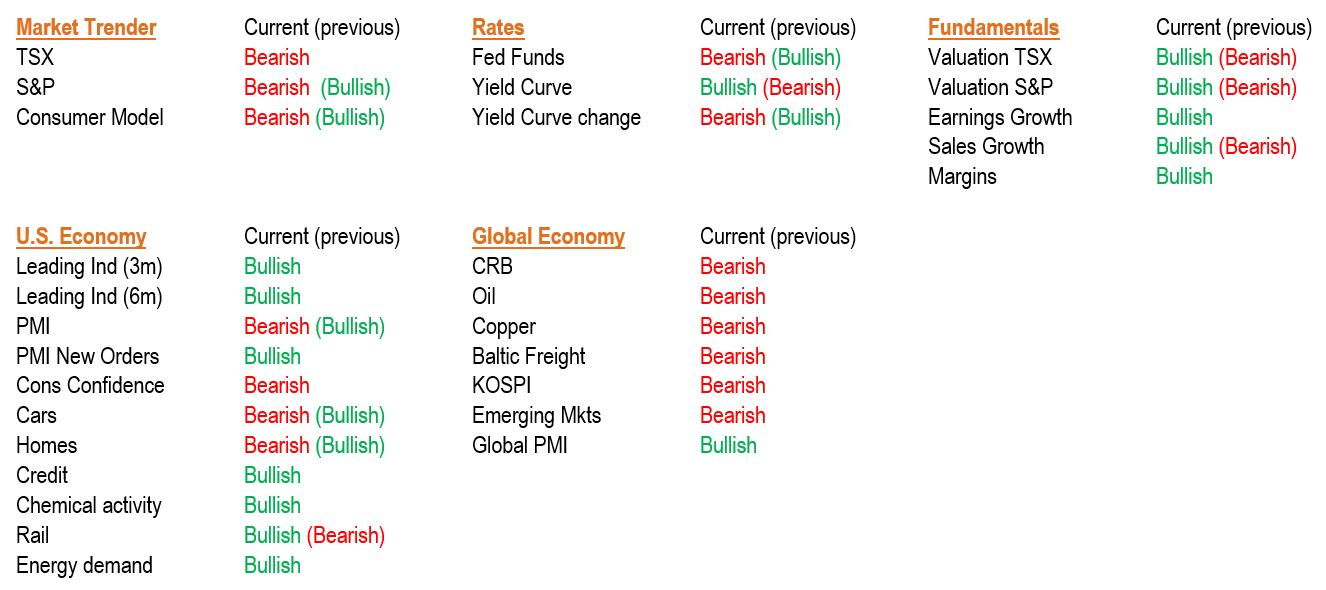

Market Clock Update – Our market clock asset allocation framework incorporates a host of inputs in guiding our outlook. Some are economic, some are commodity based, some are fundamental and some are technical. The table below includes most of the inputs with the current reading and the reading a few months back in parenthesis if there has been a change.

Market Trender which measures momentum in the market has clearly turned bearish. We have also seen some mixed signals in Rates as the Fed started tightening. The global economic inputs remain bearish, which has been the case for a year. The U.S. economy had been stronger. While some loss of momentum does raise an eyebrow, the majority of indicators still tilt toward the U.S. economy expanding. Valuations are the big improvement as lower prices have just about all our valuation indicators turning bullish.

While clearly there has been some deterioration, the model is not at the bear market indication point. This does give us more confidence that we are in a correction. Of course these indicators change and we will be posting regular updates on our blog.

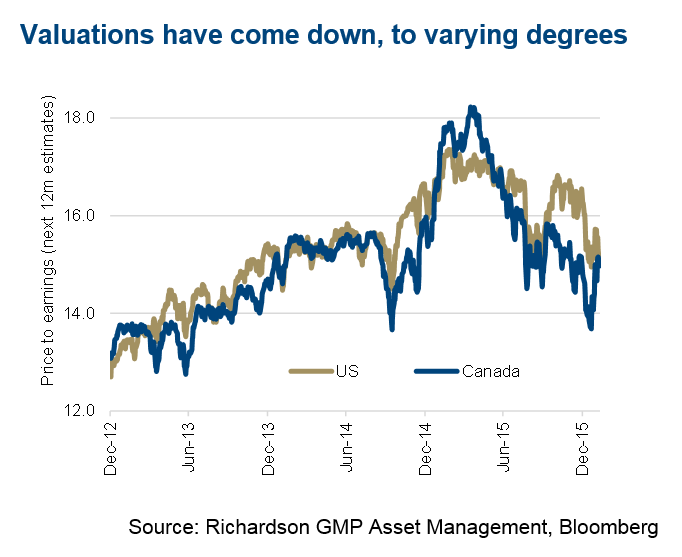

Pricing in what?

Market valuations have come down significantly during the past year, bringing the TSX down to 14.7x and the S&P 15.0x. These are much more reasonable levels compared to the past few quarters. It does get even more interesting in some sectors. For instance Financials in both the U.S. and Canada are trading at or below recession trough levels. This is based on either price to earnings or price to book. 28% of the S&P 500 constituents are trading less than 12x earnings. For the TSX about 25% are trading below 12x.

There is a lot of value in this market.

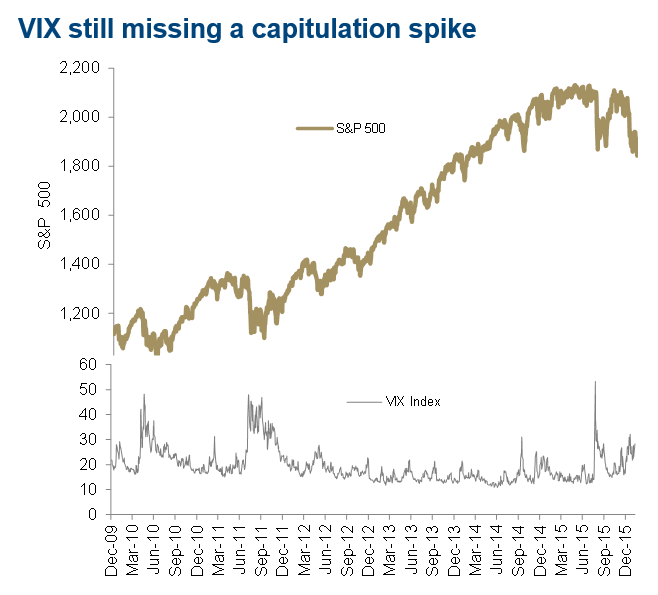

Still missing a capitulation day

Typically when there is continued selling pressure or corrections there is a capitulation day. We saw this in late August after which the S&P 500 managed a 10% recovery (albeit not sustained as we are back down to the August lows). Some capitulation characteristics are present but some are still missing. The ratio of puts to calls on the market has risen to almost 1:1 which is often a buy signal. However the VIX at 27 is still well below capitulation levels that can jump above 40.

There are also too many bullish investors. Based on the American Association of Individual Investors, 28% of investors are bullish with 35% bearish. We tend to get more excited about the market and this contrarian indicator when there are many more bearish investors. The next survey will be released on Thursday.

How we are trading it

- Within our investor profiles we have made similar changes to both the Growth and Balanced mandate. We exited our position in the MSCI Europe ETF, bringing our overweight Europe to a slight underweight. We still have Europe exposure via an EAFE ETF. The proceeds were invested in Canadian equities, reducing the magnitude of our underweight. We also rolled the U.S. regional bank ETF into U.S. financial services.

- Within the portfolios we manage, we have reduced Consumer Staples and Regional Bank positions. The proceeds were added to Technology and Consumer Discretionary names. This is a tactical move to take advantage of the market weakness.

- There may be a capitulation day on the horizon and we will be monitoring a number of indicators. If this does develop, we would expect to be buyers again looking at some of the oversold names of good quality.

For more information about Connected Wealth and our services, please visit www.connectedwealth.com

The research above is prepared by Richardson GMP Limited and is current as at the date on page 1. Richardson GMP Limited is a member of the Canadian Investor Protection Fund and IIROC. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

This research has been prepared for the use of the clients of Richardson GMP Limited and must not be copied, either in whole or in part, or distributed to any other person. If you are not the intended recipient, you must not use or disclose the information in this research in any way. Nothing in this research shall be construed as a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction. This research is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice you should therefore consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before making any financial investment decision. Past performance is not a reliable indicator of future performance. There are risks involved in securities trading. The price of securities can and does fluctuate and an individual security may even become valueless. International investors are reminded of the additional risks inherent in international investments, such as currency fluctuations and international stock market or economic conditions, which may adversely affect the value of the investment. This research is based on information obtained from sources believed to be reliable but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. No member of the Richardson GMP Limited accepts any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research.

Richardson GMP Limited or its associates, officers or employees may have interests in the financial products referred to in this report by acting in various roles including as investment banker, underwriter or dealer, holder of principal positions, broker, lender, director or adviser. Further, they may act as market maker or buy or sell those securities as principal or agent and, as such, may effect transactions which are not consistent with the recommendations (if any) in this research. Richardson GMP