With the bull market beginning to show its age, investors are left yearning for growth as developed market advancement has been anemic. Growth has been grinding lower in the U.S., which is struggling to produce a mere 2% growth. With Canada in a technical recession and with China gliding (rather quickly we would not) towards a soft landing, we have to widen the lens looking for meaningful economic expansion. Through emerging markets have their issues, our lens at the moment is focusing in on India. We will discuss the state of the economy, the markets and the country's changing demographics.

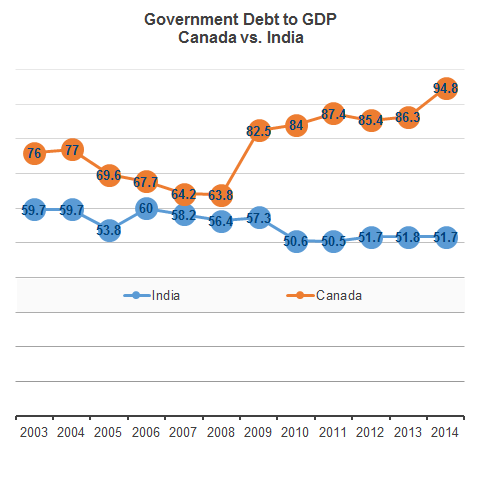

The macro-economic background is lined up nicely for this emerging market growth darling, which many are hoping fills the shoes of a slowing China. India’s $2.1 trillion economy, which is bigger than Canada’s, is expected to grow at 7.8% this year. It has an enviable fiscal balance sheet with just 52% government debt to GDP.

To put that in perspective, most developed countries are sitting above 100%. India is heavily reliant on energy imports to support its consumption. As such, its fiscal situation is poised to improve this year as oil prices have fallen to their lowest levels in 13 years. That said, the government has not passed through all of the savings to consumers. Rather, it has used the cash influx to reinvest in infrastructure and jobs. In aggregate, the outcome should be very positive.

India’s demographics are among the best in the world with a median age of 27, compared to 42 in Canada. The middle class of a population tends to be the most influential for economic expansion as consumers move out of poverty and into a position that allows for discretionary spending. India currently has 100mm people in its middle class, a cohort that is expected to grow to 475mm over the next 15 years.

Economic reforms are centered on learning from others mistakes, implementing best practices and balancing infrastructure investment with consumption and exports. Under the leadership of Prime Minister Modi, there have also been pro-business reforms such as lower foreign investor restrictions and lower corporate taxes, which have led to higher levels of private sector involvement.

source: Excel Investment Council Inc.

Clearly, there is an opportunity to invest in this high beta economy; however, with the prospect of outsized returns comes coinciding risk. India is in no way immune to a global slowdown, currency depreciation or a rebound in the price of oil. All of these concerns are evident when we look at the recent performance of the Nifty 50, the most widely followed index in the country. The problem with the Nifty is that it is a small sample of the largest companies in the country and does not properly represent the growth opportunity present in the more than 8,000 publically listed securities.

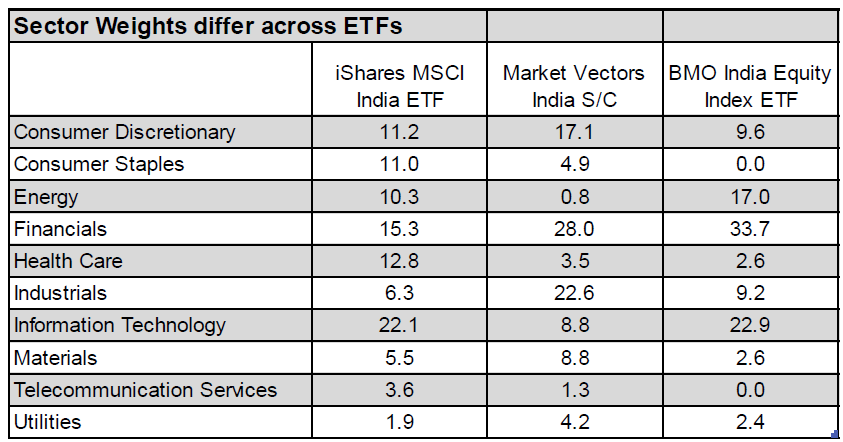

India is best known for its IT and textile exports, both of which are in a deflationary pricing environment. As a result, these sectors are unlikely to outperform the broader market. Areas of opportunity reside in several subsectors identified in today’s guests’ presentation. The financial services sector is egregiously underdeveloped, with less than 10% of population having equity ownership and less than 4% life insurance penetration. Power and infrastructure have been allocated $650bb USD in capital over the next 20 years. This should provide an onslaught of investible opportunities.

The other investment prospects reside in an emerging middle class, which is increasing demand for health care. This should lead to improvements in quality and to more private investment. Internet users are projected to almost double in the next five years; driving more online sales, payments systems and mobile app downloads. Lastly, local automakers and suppliers should benefit from a propensity for consumers to want passenger vehicles as they move up income brackets.

Investment implications: There are several ETFs that track India such as the iShares MSCI India ETF & Market Vectors India Small Cap ETF, both of which trade in the U.S., and the BMO India Equity ETF, which trades in Canada.

However, after looking further into the construction of the popular Indian indices, active management is likely the way to go. Passive investments are great; however, they rely heavily on market efficiency. This is why U.S. asset managers often have a difficult time beating the S&P 500. India's markets are not very efficient. Therefore, if you're interested in gaining some exposure to India, we suggest investing with local managers who can add value through their boots on the ground approach and through specific sector and stock selection.

The research above is prepared by Richardson GMP Limited and is current as at the date on page 1. Richardson GMP Limited is a member of the Canadian Investor Protection Fund and IIROC. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

This research has been prepared for the use of the clients of Richardson GMP Limited and must not be copied, either in whole or in part, or distributed to any other person. If you are not the intended recipient, you must not use or disclose the information in this research in any way. Nothing in this research shall be construed as a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction. This research is general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice you should therefore consider the appropriateness of the advice having regard to your situation. We recommend you obtain financial, legal and taxation advice before making any financial investment decision. Past performance is not a reliable indicator of future performance. There are risks involved in securities trading. The price of securities can and does fluctuate and an individual security may even become valueless. International investors are reminded of the additional risks inherent in international investments, such as currency fluctuations and international stock market or economic conditions, which may adversely affect the value of the investment. This research is based on information obtained from sources believed to be reliable but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. No member of the Richardson GMP Limited accepts any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research.

Richardson GMP Limited or its associates, officers or employees may have interests in the financial products referred to in this report by acting in various roles including as investment banker, underwriter or dealer, holder of principal positions, broker, lender, director or adviser. Further, they may act as market maker or buy or sell those securities as principal or agent and, as such, may effect transactions which are not consistent with the recommendations (if any) in this research. Richardson GMP