The Canadian dollar has hit a 12 year low. It could be worse, at least nobody is talking about the benefits of adopting the U.S. currency, yet. Currencies tend to move in long cycles, the average span is roughly eight years. The Canadian dollar (loonie) has undergone periods of significant increases in valuation, followed by sustained period of devaluation. The lowest value in history was set on January 21, 2002 at 61.7. The highest point in history was on November 7, 2007 at 1.103 US Cents, 79% higher. With the CAD/USD exchange rate just under $0.70 at the moment, the fall from the high is about 36%. In the latest quarter alone the Loonie has fallen by 8%. The US is our primary trading partner. It is also a popular destination for tourists and snowbirds escaping the winter chill. As such, the current and future moves of the Loonie are important to many Canadians.

So why do currencies move? In the long run, real exchange rate differentials between countries are of significant importance. Dig up an old economic textbook, and you’ll find the concept of Purchasing Power Parity (PPP). Theoretically, it should be constant; however, in the real world, it never is. Big Macs have different prices anywhere you go around the globe. Though the theory may explain long term trends, it fails to give any explanation for the shorter term, high frequency movements in exchange rates. There are a number of factors besides PPP which influence the Loonie. Chief among them are the direct appreciation of the U.S. dollar, monetary policy divergence, the devaluation of our primary exports (oil and other commodities), and a unique ‘igloo factor’.

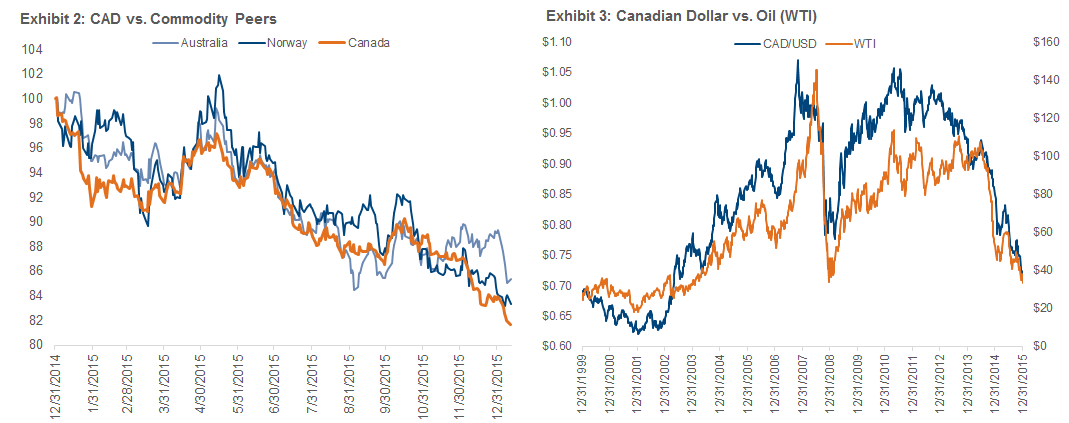

These factors are not mutually exclusive. The dollar’s strength has been a contributor to the weakness in the commodity market and so has China. We are not alone in this commodity club. Other commodity producers have undergone significant devaluations as well. (Exhibit 2) Compared to our commodity-dependent peers, Canada moved mostly in step. The overlay of the Loonie and oil just shows why it’s also called a petro currency. It’s no surprise that both the Canadian dollar and oil prices are near where they were back in 2003 and 2004. (Exhibit 3)

Unwinding a decade of imbalances is not always easy. Canada got off rather easy during the great recession. If you have seen the movie Final Destination, cheating death only delays the inevitable. Excesses just don’t disappear by themselves, it takes some pain. It’s unclear whether or not this will happen on its own. It may require a push in the form of a global recession. That being said, the weakness in the currency isn’t explained only by oil, in and of itself. Until the rest of the world believes Canada has a foundation of structural stability, the loonie will not be in high demand. Our forecast is for the loonie to weaken into 2016, to experience swings of volatility with oil and to remain cheap relative the USD until our economies and monetary policies get back in sync. A lower loonie is simulative to the overall economy; however, the hollowing out of much of the manufacturing base, and increased competition from Mexico will leave the value of the loonie depressed for some time. At $0.70, the easy money has been made with U.S. exposure. If we should see the loonie weaken a few more cents then switching to hedged products will likely have a better return looking forward.

Key Points

- U.S. dollar cycle is mature and has been capped multiple times over past 12 months. Interest rate spreads will be determined more so by the Fed, and by whether or not it raises rates four times this year

- The market is not expecting four hikes, meaning that if the market begins to believe in that possibility the dollar will likely rally to new highs (negative for Loonie and commodities)

- BofC remains a wild card because it is unknown how accommodative Poloz will be. At the moment, the BofC seems content with a weaker currency, though after last year’s surprise rate cut, the market believes that anything is possible

- The price of oil is a primary driver, but don’t expect the Loonie to rally quite as hard on an oil rebound since the country still faces other structural imbalances (i.e. high debt levels and housing concern)

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.