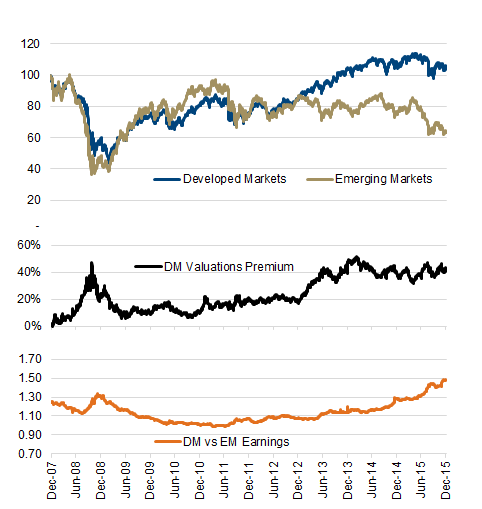

We have witnessed three consecutive years of emerging markets underperforming their more developed peers, and since 2012 it was roughly a tie, one could argue this relative performance dates back more than half a decade. Valuations, based on consensus 12-month forward earnings estimates, are 40% cheaper in emerging markets (11.0 vs 15.7x). Weak commodity prices, notably energy, has come at a time that global trade has slowed, impacting just about every emerging economy and market. For a contrarian bet, this one is teed up. But we are not budging from our “no emerging market” allocation.

Valuations are not nearly as important in the Emerging Market (EM) vs Developed Market (DM) debate, as is earnings growth. Since earning growth is stronger in DM at the moment, and has been since 2012 (orange line is relative earnings, a rising line means strong earnings growth in DM), we are not motivated to try and bottom fish.

Valuations are not nearly as important in the Emerging Market (EM) vs Developed Market (DM) debate, as is earnings growth. Since earning growth is stronger in DM at the moment, and has been since 2012 (orange line is relative earnings, a rising line means strong earnings growth in DM), we are not motivated to try and bottom fish.

There are also structural issues weighing upon emerging economies that we believe will outweigh the positive demographics in the near term. Low commodity prices and slowing global trade are weighing upon each market, testing their fragility. This may continue to trigger turmoil or bigger issues in the coming quarters or even years. This is not a new risk in the EM space, but given the dramatic changes in commodity prices we worry that there is more tensions and thus turmoil risk brewing.

Then there is the Fed. Zero interest rates and quantitative easing in the U.S. certainly had a positive spillover effect in years past and it remains difficult to ascertain how much capital found its way into EM. As the Fed ended QE and has now started to tighten monetary policy, this may entice capital outflows from EM. We don’t think this will be too disruptive, but as the world adjusts to a tightening Fed emerging markets simply aren’t the best place to be.

Finally, we are in year 7 of a bull market. The better times for EM tend to be earlier in the cycle, not late. For us to budge, we would likely need to see some sort of combination of improving earnings momentum, a more positive view on commodities and/or the market to become more adjusted to the Fed’s new direction. For now it’s the sidelines.

Source for charts are Bloomberg

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited