The S&P/TSX Composite Index (TSX) underwent rebalancing last week, the event was overshadowed by a meeting amongst the FOMC members but was meaningful for several Canadian stocks. The new additions were Kinaxis and New Flyer Industries, with four commodity focused names being removed. Scotiabank and Brookfield were impacted by rebalancing with roughly 4% of their average daily volume being sold in the process.

This event triggered us to do a deeper dive into the constituents of the S&P/TSX 60 Index (TSX 60) to identify potential additions and deletions for 2016. Passive investing is a growing rapidly, there is over $2 trillion in ETF’s globally and over $100 billion in Canada. When there are changes to the indices these passive investments follow, this can have a profound impact on the underlying buying and selling support for the stock.

With the tumultuous year experienced in Canadian equity markets one would assume there would be a shake up in the underlying indices that track the market. However, there is a complex, and ambiguous, set of rules for the TSX 60 that make changes less frequent. The seven member index team prefers minimal turnover with the primary goal being for the TSX 60 to achieve sector balance that is reflective of the TSX Composite. The other nuance is that they consider the stocks’ free float turnover, not simply the market cap of the company.

Considering these factors we dissected the discrepancies in sector weights and industry groups between the two indices, then screened for the largest float weighted constituents in those industries; conversely considering the opposite side of the coin looking for deletion candidates. The purpose being that selling / buying pressure typically comes in advance of the actual index change. This is because what we are doing with this exercise is not a novel idea; other portfolio managers are aware of this opportunity as well.

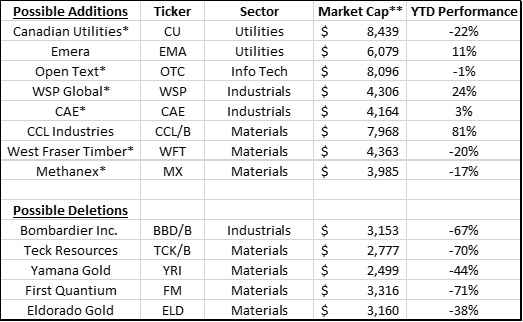

Relatively speaking the largest mismatch is within Utilities, with the TSX 60 meaningfully underweight compared to the TSX. The likely addition from that group would be Canadian Utilities or Emera. Telecommunications is the next largest misnomer, but this would likely be resolved by a weight reduction spread across the big three telcos. Information Technology, Industrial and Materials are all drifting away from the TSX and could see and addition in the near future. Below is a list of the potential additions and deletions during the next tranche of changes.

Like almost all investing, this process is a mixture of art and science. With no predetermined date, changes happen as needed and typically only when merger and acquisitions change the fabric of the index or when weights become egregiously out of line. Upon conclusion we were happy to see that several of our portfolio holdings seem to be on the precipice of being included and none seem to be on the brink of deletion.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Insurance services are offered through Richardson GMP Insurance Services Limited in BC, AB, SK, MB, NWT, ON, QC, NB, NS, PEI and NL. Additional administrative support and policy management are provided by PPI Partners. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.