O Wage Inflation, Where Art Thou?

The labor markets have been improving steadily since the financial crisis. Some people would argue that the US is at or near full employment. Even so, there is one piece of the puzzle that is still missing…higher wage inflation.

The Fed’s mandate is to promote maximum employment and stable prices; thus, wage inflation is doubly important.

In the following sections, we will try to determine why it is not speeding up.

Jobs, Jobs, Jobs

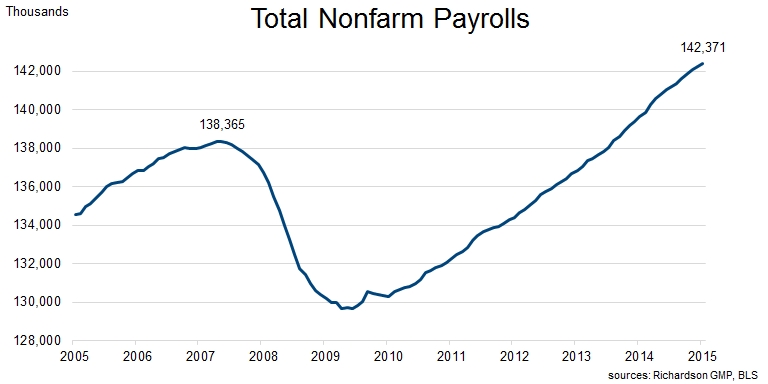

At first glance, the US labor market looks unstoppable. The total number of employees is higher now than it was before the crisis:

Total nonfarm payrolls rose by 12,654,000 from January 2010 to September 2015.

The Phillips Curve

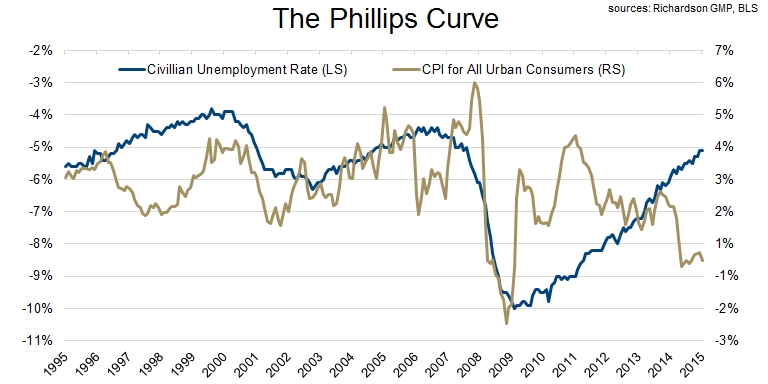

In economics, “the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation…” In other words, falling unemployment tends to coincide with rising inflation. Intuitively that makes sense. If the demand for labour is higher than the supply then unemployment should fall and wages should rise. That said, the relationship has not held true this cycle. The following chart shows the unemployment rate (inverted) vs. the consumer price index:

Prior to this cycle, falling unemployment was accompanied by rising inflation, and vice versa. This time around, both the UE rate and consumer price growth have been falling.

Not Participating

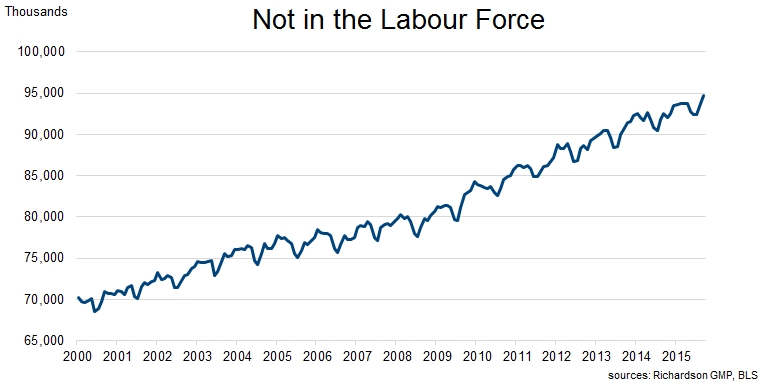

There are two reasons why the UE rate may fall. The first is that the number of unemployed persons (numerator) falls. That is good. The second is that the labour force (denominator) shrinks. That is bad. Regrettably, the unemployment rate has been falling for the wrong reason:

The number of people not in the labour force increased by 10,842,000 from January 2010 to September 2015.

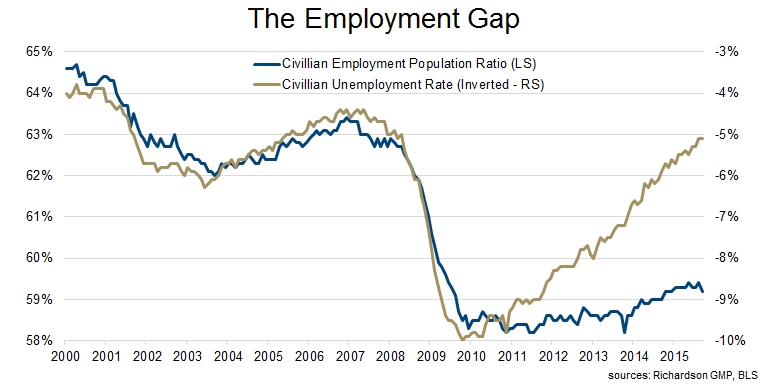

As a result, there is a growing divergence between the unemployment rate (inverted) and the employment rate, which does not consider the size of the labour force:

The UE rate is overstating the health of the US labour markets. That is one explanation for why the Fed has lowered its unemployment target.

Quantity Over Quality

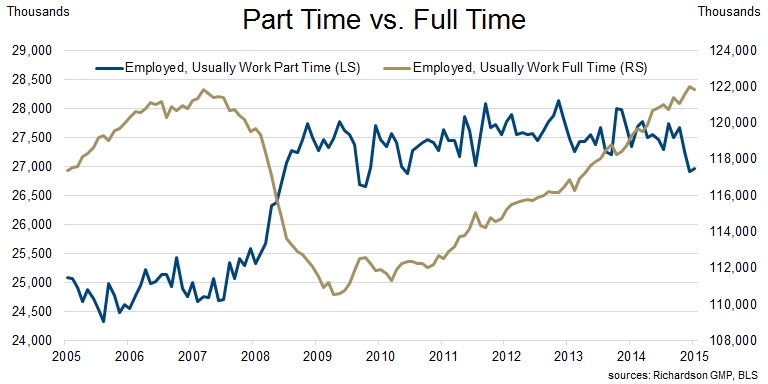

Another reason that wage growth remains muted is the abundance of part time jobs. During the crisis, part time employment rose while full time employment fell. Part time employment has been relatively flat since then:

Full time employment is back to where it was before. That said, the high number of part time jobs may be putting downward pressure on wage inflation.

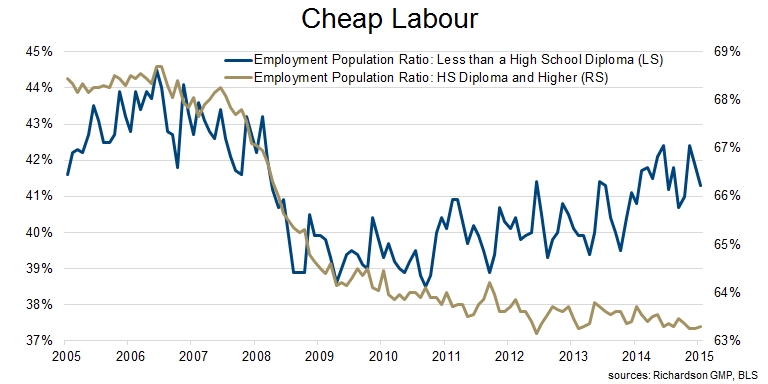

Along the same lines, many of the jobs that have been added are “cheap labour.” What that means is that they are not high paying jobs. The next graph shows the employment to population ratios by education level:

Contrary to what we may expect, the EP ratio for people with less than a high school diploma has been improving while the ratio for people with more than a high school diploma has been worsening. Therefore, it is logical to assume that many of the jobs that have been added are low quality ones.

To Hire or Not To Hire

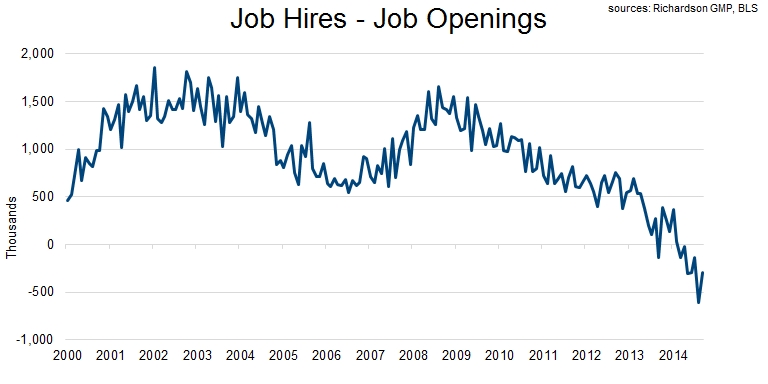

In the US, there has been a lot of talk about job openings, which are at multi-year highs. Naturally, it makes sense to assume that more openings would imply a larger demand for labour. That, in turn, would lead to higher wages. The problem is that openings do not always get filled. As we will see in the following diagram, hires are lagging behind openings:

Said another way, the number of openings is rising faster than the number of hires is. Part of the cause for this trend is the mismatch between what employers want and what candidates have. In addition, employers are being extra choosy “and are intensifying their hunt for the “purple squirrel” – candidates with the perfect combination of skills, education and experience…”

Wage Growth or a Lack Thereof

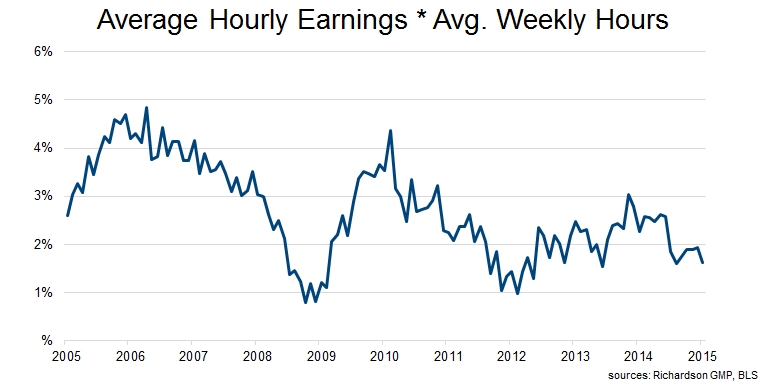

After the financial crisis, wage growth rebounded quickly and then peaked at 4.37% YoY in October of 2010. Wage inflation has been relatively steady since early 2011:

The upper bound is ~3% while the lower bound is ~1%. Currently, wage growth is the middle of that range; the last reading was 1.63%.

Not So Full Employment

Positive wage growth is a good thing. Still, it is not accelerating the way it would if we were at full employment. The US labour markets are not weak but they are not as strong as some of the headline data suggests they are.

If we look beneath the surface then it is clear that there are multiple explanations for the lack of growth in wage inflation. Many people are leaving the labour force, some of the jobs that have been added are low quality ones and openings are outpacing hires.

There is still slack in the labour markets. Maybe that is why the Fed has not moved yet.

If our analysis is right then what are the implications? Rates will stay lower for longer.

Follow us @ConnectedWealth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.