In our post earlier this week titled The Broken Dollar - part 2, we laid out our rational to lower our Canadian exposure and increase our international weight, specifically by adding the iShares MSCI Japan ETF (EWJ) to two of our investor profiles. In this post, we will expand on our Japanese thesis.

Currency matters. It matters the most for exporters, of which Japanese has no shortage. Though Japanese exports have been declining as a percentage of global exports, aggressive steps from the Government led by Prime Minister Shinzo Abe and the Bank of Japan have helped the fiscal balance sheet, pumped enormous sums of capital into their financial system as stimulous and effectively decimated the Yen. The so called ‘Abenomics’ have effectively ended two decades of economic stagnation. CPI Inflation is also beginning to see green shoots, which may bode well for domestic consumption.

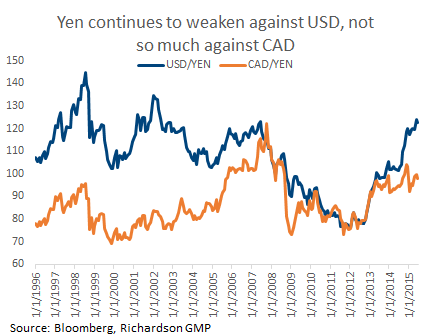

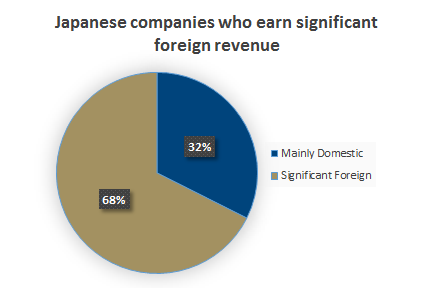

The Japanese currency has declined by over 60% against the U.S. Dollar since early 2012. Against the Loonie, the Yen has devalued since the lows in 2012 but has actually but has actually appreciated over the past couple of years. The significantly devalued Yen is helping corporate Japan. Many of Japans largest companies rely heavily on foreign revenue. Specifically, companies who generate over 40% of sales from outside of Japan account for a 68% weighting on the Nikkei. Japanese profits are in a solid uptrend, and their profit margins are at an all-time high.

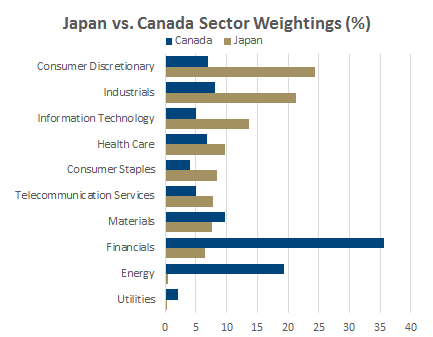

The makeup of their market actually serves as a good contrast to Canada. From a sector standpoint, Japan is overweight in the sectors that Canada is quite light. The chart below demonstrates the stark disparities from a sector perspective. While Canada is overweight Financials and Energy, Japan is overweight in Consumer Discretionary and Industrial stocks. Most of which rely heavily on exports (noted above) and benefit from a weaker yen.

For two decades Japan has proven to be the one outlier in the ‘buy and hold’ mandate purported by most of the investment industry. Although it’s proven to be an excellent counter point to those to recommend to sit back and let time takes its course we believe that its competitiveness is on the rise, and that a tactical shift to gain exposure is warranted.

Chart Sources: Bloomberg, Richardson GMP

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.