The weak, and potentially short term oversold Canadian dollar, does have a silver lining in that it will help the Canadian economy which has been losing momentum. And while it may cause slightly elevated inflationary pressures, lackluster economic growth will likely be a stronger influence. This should limit upward pressure on bond yields and increase the spread to those in the US. That is good for the Canadian market as it should limit the risk associated with the more interest rates sensitive sectors. On the other side of coin is our reliance on commodities. Demand from emerging markets is soft at best and continued strength in the U.S. dollar will continue to keep commodity prices under pressure. Not to mention the global glut in oil and risks associated with changes in policy in Alberta.

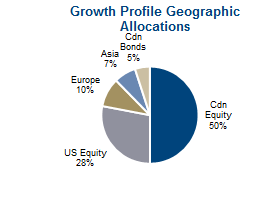

Market Weight Canada - As a result we are reducing the overweight Canadian equity tilt in all three of our investor profiles back to benchmark weight. We are effecting this trade by reducing passive ETF exposure as we believe active and those strategies focused on dividends are the better strategy for the Canadian market at this point. Growth, Balanced and Conservative are all reducing iShares TSX 60 (XIU) weights by 5%.

Buying Japan - In the Growth and Balanced we are using the proceeds to open new 5% positions

in iShares MSCI Japan ETF (EWJ). This increases the international equity weight for both profiles, increasing the non-U.S. developed market allocation. The EWJ has a strong tilt towards exporting companies in Japan that continue to benefit from the very weak yen, which is weak against the Canadian dollar as well. But it goes much further than just a currency trade. The Japanese equity market does trade at a slight premium to the U.S., at 20x compared to 18x. However in Japan earnings are growing much faster and profit markets are finally improving as more companies shake off past habits and focus more on shareholders.

The Conservative profile is using the proceeds from the XIU sale to increase BMO Short Corporate Bond ETF.

Chart Sources: Richardson GMP, Bloomberg

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.