Brinkmanship is the practice of maneuvering a dangerous situation to the limits of tolerance in order to secure the greatest advantage, especially by creating diplomatic crises (thanks dictionary.com). Ok, so what happens when the limits of tolerance are exceeded? We shall call that event today in the markets. I mean a referendum to ask if voters want austerity? I know the answer. So we have European equities down 3.7%, the Nikkei is off 2.9% and the futures are pointing to a 1% lower open in the U.S. (that was close to 2% last evening). Bond yields are jumping lower with 14bps off the U.S. 10-year, back down to 2.33%. More telling in Europe as we see divergence in the bond market. UK, Germany, France yields have all dropped (bond prices moved higher) as these are the safe havens. Meanwhile, bond yields in Italy, Spain and Portugal all moved higher. The euro is lower and the US dollar is higher. Plus, most commodity prices lower. Gold moved higher but only by $10 at one point, and is now flat. Some day gold will regain it's safe haven characteristics, just not yet.

The events over the next few days will likely unfold very quickly and guessing on what occurs is, well guessing. We have seen deals struck when it looked like there was no deal to be struck, which would clearly be seen as a positive by the markets. Even if it is simply kicking the can down the road. Wearing an impartial economist hat, without a reduction of the debt owed, Greece won’t be able to grow out from under it. Forgiving some debt has the problem of encouraging other countries to try similar tactics for debt relief. Then there are the Russians. Lots of moving parts here.

So last minute deal is the best outcome for the capital markets, which puts a Greek exit from the euro combined with a default as the worse. The uncertainty around the mechanics, riots or worse in Greece, will likely put downward pressure on risk assets such as equities. This could expand into an actual correction (10% drop in the S&P 500), and many would argue we are long overdue. However, corrections don’t usually come from such visible and widely reported on risks to the market. We still believe the next period of market weakness will come from the market’s reaction to higher yields or if the China bear market reverberates to other markets.

Sorry, a little off topic, back to Greece. This Greek odyssey is now five years old, about half the length of Odysseus’s adventures. But five years is long enough for folks to get out of its way or properly manage exposures. It is estimated about 80% of Greek debt is owned by the ECB, IMF and European Union, which implies limited financial market exposure. Not to mention with QE in action from the ECB, the mechanisms to control risk are already in place. The world has had five years to prepare for a potential exit, perhaps it is time.

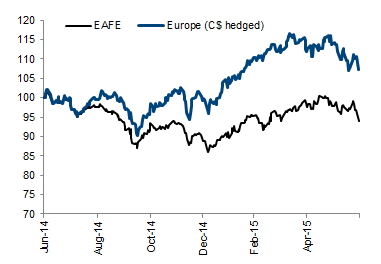

Portfolio Thoughts – This is triggering a risk-off trade in the markets which we believe will prove short lived. From an asset allocation perspective, we do not believe these events pose a risk to the current bullish phase of the market cycle. Global economic growth, outside Russia & Brazil, is decent and improving. Excesses have not built up enough, in our view, to have us contemplating an end of cycle. There remains lots of liquidity in the market. And if we see material weakness develop in the markets, we would be buyers adding to international developed markets in Asia and Europe.

Portfolio Thoughts – This is triggering a risk-off trade in the markets which we believe will prove short lived. From an asset allocation perspective, we do not believe these events pose a risk to the current bullish phase of the market cycle. Global economic growth, outside Russia & Brazil, is decent and improving. Excesses have not built up enough, in our view, to have us contemplating an end of cycle. There remains lots of liquidity in the market. And if we see material weakness develop in the markets, we would be buyers adding to international developed markets in Asia and Europe.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.