Last week there was some bearish media reports on market valuation based on an old concept called Tobin's Q. The economist James Tobin created this measure a long time ago that essentially measures replacement value. So if you sold every share of every company in the US and used the proceeds to buy all the factories, machines and inventory, you would have 10% of cash left over.

I'm going with the view this is useless. OK, maybe not useless, that is pretty strong. It does highlight that during this bull market corporate spending has remained restrained while most profits have flowed into dividends and share buybacks. One report indicates 95% of 2014 profits were returned to shareholders. Low interest rates have encouraged many companies to borrow to pay shareholders and be more acquisitive. As a shareholder, I love this. But do acknowledge this may not be the best use of profits. It is perhaps a symptom of central bankers zero rate policy and quantitative easing elevating asset prices. But that is a longer blog.

As a market timing tool, Tobin's Q may have been useful in the past but isn't today. Our economy has become much more service oriented which means human capital is an ever rising ingredient for a company. Consider a law firm that has limited physical assets but certainly has the ability to make money. Or the financial advice business. My team generates revenue by managing investor assets, yet we have no factory, machines or inventory. Perhaps we do have some machines in the form of a chair, computers and monitors (many monitors). Or consider Facebook, it has a Tobin’s Q of over 5. You could not replace the value of Facebook by purchasing a bunch of servers, foosball tables and Menlo Park real estate.

Even companies that produce a final hard product don’t get a fair shake from Tobin’s Q. Procter & Gamble has a Tobin’s Q of 2.0 as this measure doesn’t capture brands or customer loyalty.

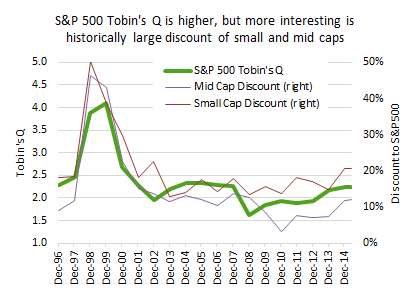

Now we did learn something in writing this blog that may have some investment implications. The Tobin’s Q is at 1.12 and is based on Federal Reserve data that attempts to captures all businesses (nice long term chart HERE). As we are more focused on publicly traded companies, we calculated Tobin’s Q for the S&P 500, weighting each company by their market capitalization. Not surprising this was considerably higher than the measure based on all companies as many constituents of the S&P 500 have strong brands and are more established. We calculated Tobin’s Q at 2.2 for the S&P 500 and also calculated the measure going back to 1996. There was clearly a bubble in 1999, in case you forgot. But today’s value is a bit higher than the past few years but not outrageously so.

Now we did learn something in writing this blog that may have some investment implications. The Tobin’s Q is at 1.12 and is based on Federal Reserve data that attempts to captures all businesses (nice long term chart HERE). As we are more focused on publicly traded companies, we calculated Tobin’s Q for the S&P 500, weighting each company by their market capitalization. Not surprising this was considerably higher than the measure based on all companies as many constituents of the S&P 500 have strong brands and are more established. We calculated Tobin’s Q at 2.2 for the S&P 500 and also calculated the measure going back to 1996. There was clearly a bubble in 1999, in case you forgot. But today’s value is a bit higher than the past few years but not outrageously so.

The interesting part came when we did the same analysis for the S&P mid cap and S&P small cap indices. As these are less established or known companies, they trade at lower Tobin Qs of 1.97 for mid cap and 1.78 for small cap. However, the discount to the S&P 500 large cap Tobin’s Q ratio has been rising. Mid caps are 12% below, which is the highest discount since 2005 and small caps have not been at a 21% discount since 2002.

Conclusion – we don’t think Tobin’s Q is a useful valuation tool for market timing and current levels are not extended. However, we are intrigued by the discount in small and mid caps based on this very old measure. Time to do some more work on the small / mids.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.