How many stocks should you own in an equity portfolio to be properly diversified? Or equally important, should an actively managed portfolio be completely diversified? We manage a number of different equity strategies and in this blog will share our views on how much diversification is enough.

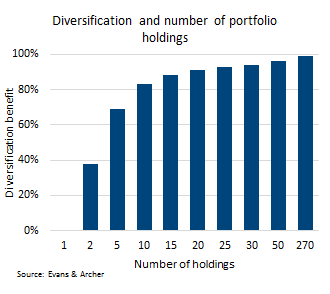

Let’s start with the academics. Pick your study, most indicate that by about 20 stocks just over 90% of the diversification benefit has been achieved. Diversification being the removal of unsystematic risk (yawn). It is a curve of diminishing gains, by adding the 20th company the gain is small and the 21st company is even smaller. The benefit of moving from 20 to 25 companies is marginal. Based on this analysis one would think 20 or so is the magic number but it is not that simple for a host of factors.

The Study – most of these type of studies are based on equal weighted portfolios, average correlations between stocks, randomly selected securities and other simplifying assumptions. While still offering some insights, they should not be taken as gospel.

Sizing – One area we add value in our investment process is in sizing or in other words not simply equal weighting positions. Some companies have higher risk and to mitigate this risk we often begin with a lower than average weighting. Sizing also enables rebalancing trades to adjust weights as the markets move, being more opportunistic. As a result this tends to increase the number of holdings in a portfolio.

Multiple Markets – many portfolios incorporate both domestic and some international stocks. We are big fans of this approach, especially for Canadian focused portfolios. The Canadian equity market is certainly lopsided with relatively high weights and number of companies in some sectors while other sectors are underrepresented. For example, Financials are 35% of the TSX while Energy is 22%. Contrast this to Health Care at 5% (mostly in one company), Technology at 2.5% is clearly lacking. Incorporating a handful of non-Canadian companies can provide better exposure to underrepresented sectors and better portfolio diversification. This leads to more individual positions.

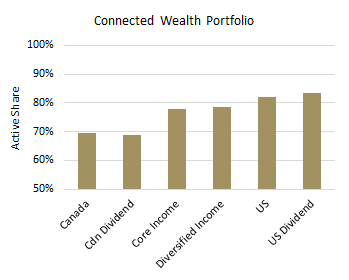

How diversified should a portfolio really be - The craft of active portfolio management is to add value relative to the index. This objective of adding value can take a number of different forms including relative performance, higher dividends or less volatility are three of the big ones. To add value the portfolio manager makes active bets relative to the index, either by individual company selection, industry concentrations or portfolio characteristics. This is actively taking unsystematic risk or seeking to be less diversified than the market. And certainly highlights that in most portfolios, the holdings often share certain attributes. Value managers buying lower valued stocks, growth managers buying companies with greater growth prospects. Clearly portfolio holdings are not randomly selected as in the academic studies. However if a manager is not making these active bets, then often best to avoid paying higher fees and buy a more cost effecient index (aka ETF). A popular measurement for how different a strategy is relative to the index is “active share”. Based on holdings, this measures how different a portfolio is relative to the index. If low, then a portfolio is similar to the index while if high then there are certainly strong bets within the portfolio. Having few positions or higher concentrations certainly contributes to a higher active share, but so does concentration in certain industries or focusing on companies with certain characteristics. The general rule of thumb is an active share 60% or lower may be sustpect of closet indexing.

Connected Wealth – within our portfolios we find a good balance between 25-30 positions. We believe this provides enough concentration to enable our higher conviction calls or recommendations to have a meaningful impact on performance. While providing enough diversification and flexibility to mitigate the negative impact should a position really not workout. This also puts our active share between 70-80%, meaning we are clearly making active portfolio bets and safe to say we are not closet indexers.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.