Everyone has their own views on environmental investing and how to weigh investment performance vs personal ideals. How far do you take it?

There are many approaches to applying personal values to investing… everything from the mercenary “I don’t care about what I invest in, I just want to make as much money as possible” on one end of the spectrum, to the altruistic ‘impact investing’ approach, summed up as “I don’t care what I make or don’t even care if I lose money, as long as it makes a positive environmental impact” on the other. Most people fall somewhere in between, as investors generally don’t like to lose money or make poor investment returns on purpose, but also want to have some say as to where their money is invested.

In the past, a common request from investors was to omit companies like tobacco or weapons manufacturers from their investment selection, as these types of companies are generally viewed as unsavory from an ethical standpoint. Tobacco and weapons manufacturers make up a relatively small portion of the overall economy, so avoiding these types of companies is relatively easy and doesn’t have much impact on overall investment returns. With environmental issues now at the forefront, the common request nowadays is to omit ‘fossil fuels’ from portfolios. This is a much more complicated issue as the upstream energy sector makes up a large portion of the TSX index. The other piece of the issue that is largely ignored is that nearly every company in existence uses energy in some part of its business.

Aside from individual investors, university endowments and pension funds have made the policy decision to avoid ‘fossil fuel’ producers from their investment portfolios. In many cases, the decision is put to a vote by students and faculty of the university and has seen support of 75% or more for the move away from ‘fossil fuel’ investments by their institution. Does this mean that the university should also take out 75% of the parking spots in the student and faculty parking lots? Or turn off the heat in the buildings and provide only cold water in the showers in the gym for 3 out of every 4 hours during the day? The irony is that the same pension fund or endowment will continue to own shares in airlines, shipping companies, railroads, steel producers, cement producers, power generators, automotive manufacturers, or really any other company that consumes energy, which is basically every company either directly or indirectly. Even the server farms of technology companies like Google, Facebook (now known as Meta) and Microsoft consume massive amounts of electricity which comes from a variety of sources, including fossil fuels. It is almost as though the world has been led to believe that the production of oil or natural gas is the only environmental issue that matters and simply avoiding owning shares in these companies will solve climate change. The reality is far more nuanced and complicated.

The latest theme in the investment world is around the concept of ESG or Environmental, Social and Governance. This feel-good acronym rates companies on the basis of their environmental footprint, social impact and governance structure of the board and company management. As a result, many ‘ESG focused’ investment funds have been launched in the past few years to fill the investor demand. Many funds avoid the energy sector entirely, while others include only the companies with the highest ESG scores.

Source: The Narwhal

An active participant or a seat on the sidelines?

In May of 2021 environmental activist fund Engine No. 1 shocked the investing world by unseating three Exxon board members at the annual shareholders meeting and replaced them with more environmentally minded individuals they put forward on the ballot. The fund owned approximately 0.02% of Exxon shares but was able to convince other shareholder groups to vote along with them. As one of the world’s largest oil producers, Exxon has long had a reputation for supporting causes that are not necessarily in-line with the mainstream environmental movement and have been accused of funding anti-climate change research and other related causes. For a relatively small investment fund to unseat 3 of the 12 board members of one of the world’s largest companies was a shot across the bow for the entire industry. While this doesn’t change what Exxon is doing overnight, it could certainly change the direction of the company in the long-term.

The approach that this fund took to affect change should be noted by other environmental groups, as it accomplished far more than complaining about the issue to feel good about themselves or pretending it would go away by simply not owning shares in companies that produce a useful commodity that the world would starve or freeze without a sufficient supply of. While environmental protesters show-up outside the annual meetings of oil companies on a regular basis to disrupt proceedings and have their message heard, this fund was not only in the room at the meeting but used the democratic process of a shareholder vote to make a significant change to the company’s oversight and future direction. If they didn’t have any ownership in the company they could not have succeeded, as they wouldn’t have had a voice at the table or a vote in the matter at all.

It begs the question, what are the investors who refuse to own shares in energy companies really able to accomplish when they no longer have a say in a company’s direction?

Does choosing where or where not to invest really make a difference?

What has a bigger impact – not buying shares in an oil company like Shell or not buying gasoline for your car from a Shell gas station? While there is a theoretical impact that not purchasing shares in a company will have on its business, it is more academic than directly impactful. If enough investors avoid buying the shares or holding the debt of companies in the energy sector, the cost of capital will theoretically increase as they will have to issue shares at more attractive prices to investors or pay a higher interest rate on issued debt.

Not purchasing a company’s products, however, has a direct impact on a company’s bottom line – for example, if a company has 20% margins, large fixed costs and its topline sales fall by 10%, then the overall profits don’t fall by 10%, but 50% as half of their margins are eroded. If the same company trades at a multiple of 10X P/E (Price to Earnings), a relatively small 10% drop in revenue could theoretically cut the share price in half. This is perhaps an over-simplified example, as not all costs in a business are fixed and the investors use a combination of methods, including P/E ratios, to value companies and establish the value for their shares in the stock market. It does illustrate the case reasonably well for oilsands companies that have large plants that cost roughly the same to run on a daily basis and can’t realistically be throttled down to find significant cost savings. If the environmental movement really wanted to put energy companies out of business, the focus should be on reducing or eliminating the consumption of fossil fuels, and not solely on vilifying the idea of owning shares in the energy industry. This is a much harder problem to sell to the public however, as it is relatively easy to avoid owning shares in an oil company, but much harder to get to work or pick up children from school in a vehicle with no fuel in the tank.

Source: Innovation Origins

Blissful ignorance

I’ll keep the details of the story vague to not offend or reveal the identity of the participants. Not long ago, I was at a dinner party in Toronto and the topic of conversation inevitably moved to politics. Being a born and raised Albertan visiting Toronto is always tricky water to navigate when the discussion turns to politics, but I couldn’t bite my tongue when the hosts asked “Why doesn’t Alberta simply diversify its economy and move away from oil and gas?”

How to respond to this question tactfully? I asked them “How do you get to work?... How do you get to the grocery store?... How do you get to your cabin in Whistler three or four times per year?” The answers to my questions were that they drive a car to work and to the grocery store and fly from Toronto to Vancouver on a regular basis. Clearly, the link between the personal consumption of oil and the source of it were not at all connected in their minds.

While it is an idealistic thought to simply ‘diversify away from oil’ or ‘phase out’ the oilsands projects, the reality is much more complex. Even if Alberta were to shut down oil production entirely, the demand would be filled by oil coming in from other jurisdictions. In the name of ESG (Environmental, Social and Governance) the ’E’ seems to take far more prominence over the S and G. Would we rather produce our own secure supply of oil and have a stable and productive industry, the associated jobs and economic activity, a strong source of export dollars and tax revenue at home in Canada, or be dependent on other nations across the ocean? While the debate over how ‘dirty’ the oilsands really are compared to other sources is a topic that could fill another blog post, the S and G (Social and Governance) parts of the ESG acronym seem largely ignored by comparison. Canada does have high labour and environmental standards, well-run public companies, and an energy sector that, while not perfect, is striving to improve on all fronts. By comparison, other state-run entities in less stable parts of the world are run by dictators or autocratic governments where the treatment of workers, women and other groups is borderline medieval.

Source: Oilprice.com

While the green movement might feel good by chalking up a so-called ‘win’ when newly elected US President Biden blocked the Keystone pipeline on his first day in office, the minute the price of gasoline at the pump went up, President Biden called on Saudi Arabia and OPEC to pump more oil. Do we really want to buy more oil from places where women aren’t allowed out of the home by themselves, voting is non-existent, and the press is far from free? (Saudi Arabia’s government hardly ever sanctions the murder of journalists… except for that one time that made the news but was quickly forgotten).

Logic dictates that every barrel of oil that is produced is also consumed and burned at some point downstream. While upstream energy companies, refineries and oilsands producers in particular do share some of the burden in the emissions released from their own upstream operations, the vast majority of the emissions are produced when fossil fuels are burned in the engine of the car, truck, ship, train, airplane, power plant, home furnace, boiler or factory. For conventional oil and gas production the split of emissions generated from upstream production vs downstream combustion is roughly 10% upstream and 90% downstream. For oilsands producers, the ratio is closer to 15% upstream and 85% downstream. While this ratio is slightly worse, the burden still falls largely with the consumer.

Set-up for a price shock?

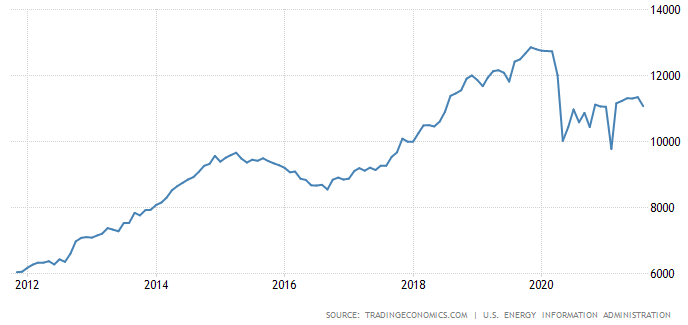

In late 2015, the OPEC oil cartel made the unprecedented decision to flood the market with oil to fight against the threat of new production coming online from the large US shale reservoirs, and to a certain extent new oilsands projects in Canada. The US saw remarkable growth in the years prior and grew domestic production from around 5 million barrels per day to over 12 million barrels per day in about 6 years (shown in the graphic below). For context, Canada produces roughly 4 million barrels per day of oil from all sources (Oilsands and conventional oil combined) and has been growing this number steadily for the past 100 years or so. The fact that our neighbours to the south added 1.5x Canada’s production in less than a decade is a remarkable feat.

United States crude oil production — barrels per day (1000s)

After the OPEC decision, prices remained in the $40-$60 per barrel range from 2016-2020, with only brief periods above and below these levels. The prior 5-10 years saw prices steadily in the $75-$100 range with OPEC supporting prices at these levels, as evidenced below.

Price of WTI crude oil per barrel

Source: Trading E-commerce

However, even during the low-price environment from 2016-2020, numerous large oil projects continued to come online, as they were sanctioned and funded or partially complete and construction was well underway before the price of oil fell. While some projects were scaled-back or cancelled, the economics of most still justified completion as opposed to totally abandoning a large project in the middle of construction. Despite lower prices for roughly half of a decade, oil supplies continued to grow and meet new demand.

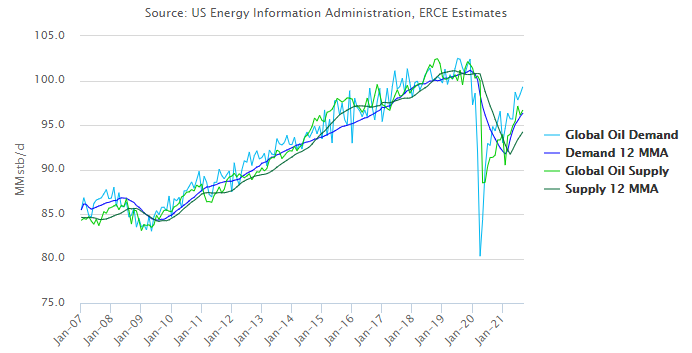

Fast-forward to today, to a world where companies are nervous to fund new large-scale fossil fuel projects that require years of construction and capital commitment, and the result is there are basically no new mega-projects under construction or in the works around the world. The Covid-19 pandemic and resulting slow-down in travel and commuting reduced the demand for oil for an 18-month period recently, but as the world emerges from the slowdown, there is massive pent-up demand for holidays, seeing family or friends or even just getting out of the house. Excess capacity in the global energy supply system and storage inventories are at the lowest levels in decades. In the background, global population and demand from the developing world continued to grow and is still growing at a steady pace. New consumers from the developing world aren’t in the market for $60,000+ Teslas, and are more likely to purchase small and affordable conventional combustion engine vehicles, scooters or motorbikes.

Global oil demand vs global oil supply — million stock tank barrels/day

Be careful what you wish for

The combination of reduced investment in new energy projects and growing demand from consumers globally is setting up for a much tighter energy market and higher prices. In recent months, Europe has seen shortages of fuel at gas stations, skyrocketing natural gas prices and rolling power outages. Governments are now faced with balancing the environmental promises that got them elected with angry consumers who may have trouble affording fuel for their cars or natural gas to heat their homes. Farmers need fuel for their tractors and fertilizer plants require natural gas for feedstock. Rising costs of both fuel and fertilizer increase food prices and further hurt consumers on the lower end of the income scale. The harm that is caused by higher food and fuel prices and rising inflation to people living paycheck to paycheck (the same people that our elected officials claim to want to protect the most), shouldn’t be ignored.

While the transition to a greener world is certainly an important issue, solving the problem needs to be approached in a reasonable way. Vilifying an important industry and starving it of investment capital, while at the same time relying heavily on its products in nearly all aspects of daily life doesn’t seem like the most sensible approach. Regrettably, politicians are elected on four-year election cycles, so the promises made today that sound good and appeal to the twitter feeds, internet memes and the soundbites of the 24-hour news cycle will be in the rearview mirror long after they are out of office.

While it is never a platform that would get a politician elected, the true answer lies in everyone shifting their consumption habits and not the misguided idea that simply boycotting the ownership of energy company shares will solve the issue of climate change. Rather than investors putting their head in the sand and hoping the problem will go away by avoiding it, perhaps an active approach with a seat at the table to affect positive change from within to shift the direction of the companies in the energy sector is a more constructive approach.

Besides, what fun is watching from the sidelines when you can be a part of the action?