Elon Musk is wrong about how government deficits work. He is firmly in the camp that says that government budgets must be balanced because otherwise a government will go bankrupt.

He compares the government deficit problem to a household spending crisis.

Does Musk understand what he is getting into?

Elon on X, formerly Twitter, has posted many times about government deficits in the U.S. Here are some examples:

“Inflation is caused by the Federal government spending more than it earns, because they just print more money to make up the difference. To solve inflation, reduce wasteful government spending. Your tax dollars should be spent well, not poorly.”

“We’ll try to reduce the budget deficit by $2T, that’s the best case outcome. If we try for 2T we have a good chance of getting 1T, and if we free up the economy to have additional growth, there’ll be no inflation. That would be an epic outcome.”

“The system prevents you from spending money effectively. If you don’t spend all your money, your budget gets reduced, so people spend money on nonsense stuff. It’s a perverse incentive to waste money, and you get punished for not wasting money. It’s bananas.”

The majority of voters in the U.S. would probably support much of what Musk has said on X. But there’s a major problem. The numbers just don’t add up to a balanced budget.

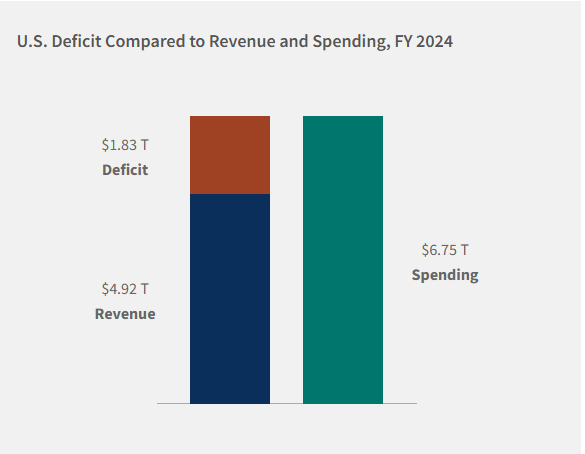

Here’s the U.S. deficit compared to revenue and spending for 2024:

Source: U.S. Treasury

Projections for the deficit in the new fiscal year are $2 trillion.

Spending would have to be cut by 30 percent to balance the budget. The difficulty of cutting that much without touching Defense ($1 trillion), interest on the debt (1$T), Medicare and Medicaid ($1.9T) and Social Security ($1.4T) is insurmountable. The total is $5.3T, or about 79 percent of $6.75T total spending.

So, that is one issue with the DOGE initiative. Without an increase in revenue balancing the budget is impossible.

In fact, Trump has promised to make the deficit even worse by extending the tax cuts that expire near the end of 2025 and adding new tax cuts.

In 2017 during Trump 1.0 the Tax Cuts and Jobs Act was passed. Many tax cuts were made on a temporary basis. Here are some highlights:

Marginal tax rates were cut across the board with the highest rate going from 39.6% to 37%.

The estate tax exemption was doubled from about $14 million to $29 million for married couples.

The corporate tax rate was cut from 35 percent to 21 percent and Trump has promised to cut it further to 15 percent.

If these changes are made permanent the loss of revenue is about $0.5T per year, increasing the deficit by about 25 percent.

So, Musk’s attempt to find enough waste in government spending to cut even $1T appears to be doomed to failure.

But Elon Musk has shown that he can accomplish some amazing things in the past so we will watch closely.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.