On July 5, 2024, the unemployment rate in the U.S. was announced at 4.1 percent. This report appears to have triggered an extremely reliable recession indicator.

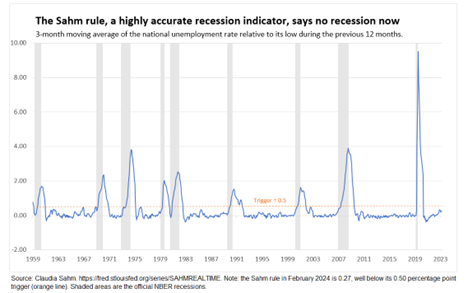

The Sahm Rule, named after former Federal Reserve economist Claudia Sahm, says that if the unemployment rate rises by 0.50 percent from the bottom a recession has already started.

Is the U.S. economy in recession?

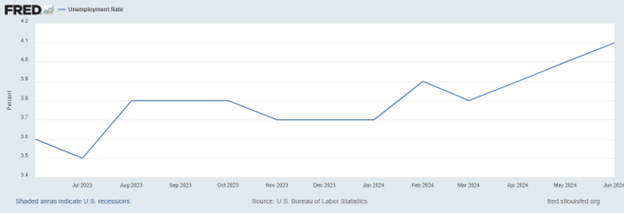

The closely watched U.S. unemployment rate bottomed last year at 3.5 percent as measured by a 3-month moving average (see second chart). The unemployment rate in May was 4 percent, and the 3-month moving average is 4.0 percent. A one half-point increase in unemployment has excellent reliability in determining when the U.S. economy is in recession. The indicator does not say if the recession we are in will be mild or severe.

The Sahm Rule says that if the unemployment rate rises by 0.5 percent from a bottom in the last twelve months the unemployment rate will rise by 2 full percentage points soon after. The idea is that the 0.5 percent trigger represents a tipping point, indicating that the economy is already slowing, and the deterioration will accelerate in a non-linear fashion. We see in this chart that in past recessions the unemployment rate always increased by more than 2 percent after the Sahm Rule threshold was breached.

This chart was updated on July 5. To bring the average up to 4.0 percent, the monthly report for June of 4.1 percent is sufficient, after 3.9 and 4.0 in the two previous months.

Sahm was searching for a reliable recession indicator that would allow early action to inject stimulus. Since governments did a massive injection of fiscal and monetary stimulus in early 2020 (not because of the Sahm Rule) and CPI inflation soared after that there is no chance of early government stimulus being adopted this time. But the indicator is still useful for other reasons.

Since the 1970s the Sahm Rule has been triggered early in recessions and never outside of a recession, which is seen on the first chart where recessions are shown as vertical gray bars, and the trigger is a horizontal dotted red line.

Since the stock market often detects a weakening economy well before the start of a recession and, in some past cycles, a bear market started more than a year before the date of the official recession announcement. Investors would love to have an earlier indicator of the start of a recession, in order to adjust their risk exposure by selling stocks closer to the start of the bear market.

For example, the longest expansion in history lasted a decade from March 1991 to March 2001. The U.S. market peaked in March 2000, and a recession started one year later in March 2001. The official announcement of recession arrived on November 26, 2001. This date was more than eighteen months after the market peaked!

The Sahm Rule is very useful for investors to detect a recession and act.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.