China starts 2024 with drastic measures to head off further losses in the stock market. These actions echo government rescue efforts in 2021-2023 for the property market which have been unsuccessful.

Could China stock markets rebound this time?

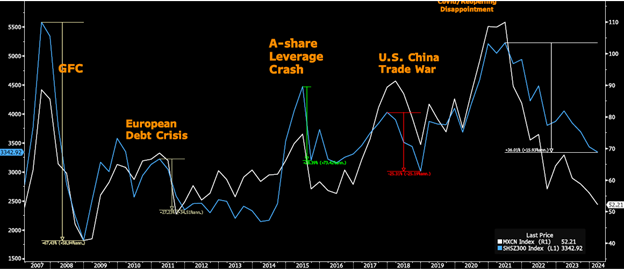

The meltdown in Chinese stock markets is historic. This chart shows the cycles over the period from 2007 to the end of 2023. In November 2008 China announced a stimulus package of 4 trillion yuan (US$586 billion) which worked to enhance GDP growth but was followed a 67 percent loss in stock markets.

Source: Bloomberg

This time the Chinese stock market (A-shares) peaked in February 2021 and has declined by about 40 percent since. The U.S. market (S&P500) declined about 20 percent from its peak and has recovered all of that decline.

The most recent disappointment in China happened in 2021 when expectations for a stock market boom after the end of the Covid lockdown were dashed.

The Chinese property market has also been hit hard over the last few years. The bankruptcy of China Evergrande and other developers have been a drag on the economy and is hurting sentiment among local investors. Foreign investors are wondering if they will recover much from their loans to property developers. According to Barclays Research 60 developers have defaulted since 2020 for a value of US$140 billion.

Several government policies have been announced since the trouble with China Evergrande first appeared in 2021. But none of those has made a substantial impact.

This time might be different as Premier Li Qiang’s call for actions to stabilize the stock market has led to a Reserve Ratio Cut to increase bank lending as well as musing about direct purchases of shares on the stock exchange.

Premier Li called for “forceful measures” before the Lunar New Year. The leadership knows that families talk during the holiday break and markets, both properties and stocks, will be a major topic.

But the $2 trillion yuan package might be insufficient. After all, the stimulus during the GFC was twice as large and it only worked for a brief period. Today the problems are greater. The package is equivalent to only 3 percent of the A-share market capitalization and three days trading volume.

One of the most important factors in the market sell-off is disappointing GDP growth. Forecasts of 4.5 percent growth in 2024 are well below 2023 gains of 5.2 percent. Youth unemployment is high with official data showing 14.9 percent.

But the most important headwind for markets is the downturn in property prices. The average family has much larger investments in property than in the stock market and the problems in property are top of mind.

Sources: Bloomberg and Gavekal

Unless the government can find a way to boost real estate prices, sentiment will remain very negative. This will cause investors to remain cautious about the stock market, even if prices are cheap.

A lasting rebound in stock markets and property prices is still in doubt.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.