Tesla announces a new low-cost sedan which will sell for about $25,000 in U.S. dollars.

This vehicle will be available in mid-2025 and will be manufactured initially in Austin, Texas.

Will this new model be enough to justify Tesla’s valuation?

For the 2023 year Tesla announced revenue of $25 billion while the stock market value is at $600 billion. That is a very stretched valuation, but it is not nearly enough to make Tesla comparable in stock market value to the other six in the Magnificent Seven — Nvidia ($1.5 trillion), Apple ($3.0T), Microsoft ($3.0T), Amazon ($1.6T), Meta ($1T) and Alphabet ($1.9T).

Elon Musk gave a vague outlook for growth after repeatedly issuing a target of 50 percent annual growth in the past. This hurt the stock the day after, plunging 9 percent to $189.

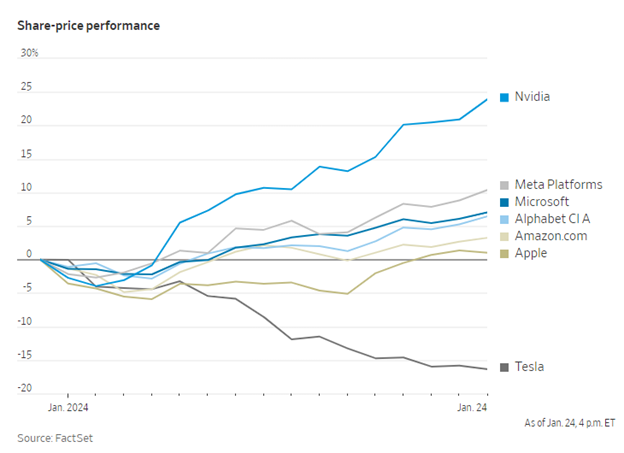

Tesla is the weakest in the group. And for the first month of 2024, Tesla lags far behind the others in stock market performance.

The company earned about $2.61 per share, which makes the price-to-earnings (P/E) multiple about 80. The S&P 500 carries a P/E multiple of 22, while the Mag 7 trade on average at 50 times earnings.

The three most expensive stocks in the Magnificent Seven — Tesla, Nvidia and Amazon — trade at 80 or higher, while Apple trades with the lowest P/E at 32 times.

It is unlikely but possible that these companies could grow into their extreme valuations by having rapid earnings growth. For example, to get Tesla to 20 P/E earnings would have to quadruple, while the share price stays where it is now.

Tesla makes cars and batteries primarily, although it also has AI, robotics and solar panels. The Tesla optimists point to the potential of Fully Self Driving, the Optimus robot, and stationary storage as new additions to growth prospects.

Source: Tesla

But for now, Tesla will be judged as a car company:

Tesla has announced that it wants to make 20 million vehicles by 2030. Let’s assume that the average selling price for a Tesla drops to $30,000. A 10% profit margin on each vehicle gives a total profit of $60 billion. This would put Tesla’s current value of $600 billion at 10x, a very low multiple for a world-leading brand. Tesla will likely trade at more expensive levels than that.

Can the new model push sales up 10-fold?

Each factory can produce about 1 million vehicles, so they need 15 new factories. Tesla can build factories quickly but with only six years to go they would have to build more than 2 per year. A tall order, and perhaps that is why the codename for the new sedan is Redwood, referring to a tree that grows extremely tall.

Elon Musk stated that 2024 will see modest growth, positioning it as a transition between two growth waves.

It is imperative to have a successful launch for this new model in mid-2025.

Musk has succeeded many times in the past, but this will be his biggest challenge ever.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.