Investors are coping with a high degree of uncertainty in the world, with at least three armed conflicts active now.

The Israel/Hamas war was the top concern. But now the Houthi situation in the Red Sea, related to the Gaza conflict, has become top-of-mind. And what about Russia and Ukraine?

Will these conflicts spread? How would that affect the stock market, oil and gold?

When the U.S., UK and allies bombed Iran-backed Houthis in Yemen because they attacked a U.S. ship — called Gibraltar Eagle — in the Red Sea, the Israel/Hamas/Gaza widened geographically and escalated with U.S. involvement.

The possibility that the war could expand to include Iran and/or Hezbollah in Lebanon is the most serious concern.

Armed conflict in the region of Israel is not new, and it seems to have been with us on an almost continual basis since 1948 when the state of Israel declared independence.

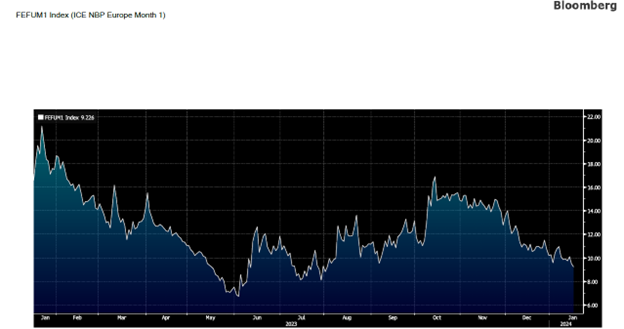

We also have the Russia/Ukraine war, a more traditional conflict over territory with tanks, missiles and soldiers which is nearing its two-year anniversary. Investors have become complacent about this conflict as concerns that Europe would freeze in the winter when Russian natural gas was cut off turned out to be overblown. The price of natural gas has reverted to pre-conflict levels.

Natural gas in Europe in USD is priced at one-half from a year ago.

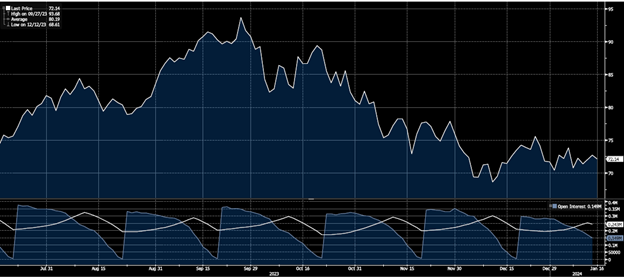

The attack by Houthi rebels on shipping in the Red Sea that started in November and escalated in January might have pushed crude oil prices much higher, given the sensitive nature of that route. But the price of crude has stayed in a range of $70-75 since then. Crude oil peaked over $90 before the attack by Hamas on October 7 and has been weakening since then.

Source: Bloomberg

The conflict in Ukraine has been fully discounted by the markets, even though Russia is one of the largest exporters of crude oil in the world. The rapid rise of oil production in the U.S. to about 13 million bbls/day has filled any supply gap that resulted from the invasion.

The stock market (S&P500) rebounded from a low (3800) in 2022 to reach a level just below the all-time high of 4800. So, there’s been little impact on that market from the conflicts.

Last week we looked at the price of gold, and there’s no large gyrations there either, although the price has firmed up a bit.

What would increase the level of uncertainty to the point where markets would have to react?

The main concern should be a widening of the Middle East conflict to involve direct confrontation with Iran.

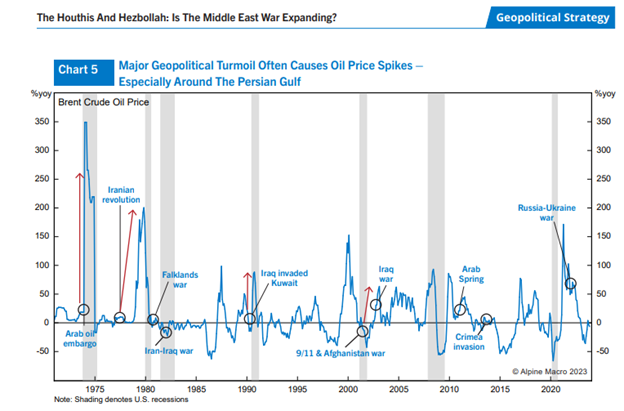

Any disruption to oil transport in the Persian Gulf would lead to higher prices, at least temporarily. Geopolitical turmoil usually involves higher oil prices, according to Dan Alamariu of Alpine Macro:

A surge in the price of Brent Crude often precedes a recession.

Keep your eyes on the Middle East conflict and watch for direct confrontation between Iran and the U.S. in the Persian Gulf.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.