The latest investment hype is based on widespread investor interest in Artificial Intelligence (AI). Nvidia, a company that makes computer chips for AI, is trading at huge multiples of earnings that have only been seen in extreme bubbles like the dot-com era of 1999.

Is AI a genuine investing opportunity?

AI is generating a frenzy among speculators, causing some stocks to trade at ridiculous premiums to the usual multiples of earnings, sales and other stocks. These premium valuations were previously seen during bubbles in 1929 and 1999 in the US and 1989 in Japan.

A well-known example of AI is OpenAI Inc.’s ChatGPT which uses large samples of data, harvested from the internet, to respond to questions in a human-like way. OpenAI is a private company.

Bloomberg predicts that Generative AI will be a $1.3 trillion market by 2032. About one-half of that will be computer hardware.

Nvidia (NVDA) is the largest chipmaker to benefit from the hype. Nvidia was best known in the past for its computer gaming chips.

In May 2023 Nvidia announced quarterly revenue up 19 percent from the previous quarter but down 13 percent year-over-year. But the share price jumped due to its AI potential. Profits were up 28 percent year-over-year. The value of the company soared to $1 trillion, a 30 percent increase.

An excerpt from the CEO’s comments:

Some scientists have expressed major concerns about AI.

A professor at the University of Toronto, Geoffrey Hinton, is considered a founder of AI.

His work was incorporated as DNNresearch in 2012 and acquired by Google in 2013 for $44 million. He founded DNN with two grad students, Alex Krizhevsky and Ilya Sutskever. DNN was researching deep neural networks, which were expected to copy the type of activity performed in the human brain. At the time his machine-learning research was said to have “profound implications for … speech recognition, computer vision and language understanding.”

But Hinton left Google in 2023 as he became concerned that AI could be used for negative purposes. Now he is outspoken about some serious risks of AI.

Source: Geoffrey Hinton

Hinton worries about the ability of neural networks to copy and share information. The individual human could acquire only a fraction of the information that AI machines acquire, retain and share with other machines. This ability of AI machines could be dangerous and could eliminate many jobs that humans currently perform.

Autonomous weapon systems is one malicious and disturbing use of AI. Drones could be programmed to eliminate people on a selective basis, similar to what was seen in movies like The Terminator (1984).

But investors are ignoring those concerns.

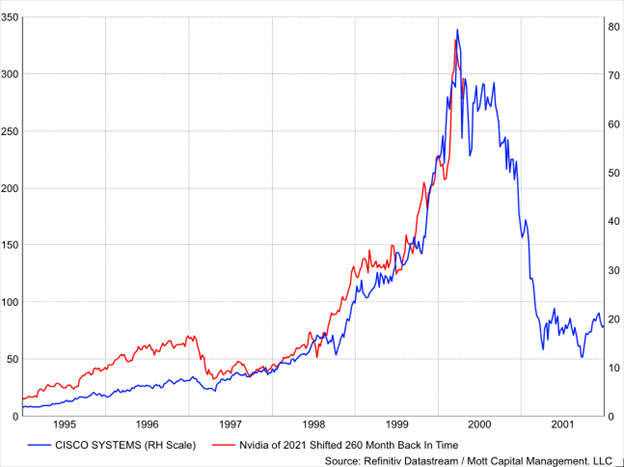

The stock market’s reaction to AI hype has been explosive. Here is Nvidia in comparison to Cisco, a leading stock in 1999:

Cisco was a leader in the dot-com bubble, but it later plummeted. At its peak CSCO traded at 197 times earnings. Nvidia trades at 202 times.

Investors should be very wary of the hype around AI in 2023.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.