Worldwide demand for battery electric vehicles is soaring. The cost of materials needed for vehicle batteries is rising even faster.

Will the cost of batteries bring the electric vehicle revolution to a sudden halt?

In some countries, such as Norway, the conversion to battery-electric vehicles (BEVs) is very advanced. With punitive taxes on internal combustion engine cars (ICE) and zero tax on BEVs, Norwegians are choosing BEVs. About 84 percent of new car sales were electric in January 2022. In 2021 about 2/3s of all sales were electric.

Tesla has the biggest market share in Norway, while the Volkswagen all-electric vehicle came in a close second.

Chinese consumers are buying electric vehicles, up to about 20 percent of total sales. China has incentives for new electric vehicles also. Europe is slightly ahead of China with EV adoption at about 24 percent.

In North America BEV adoption rates are only in the 8 percent range, but the upward trend is accelerating.

The key component of BEVs is the battery. Most electric vehicles use the lithium-ion battery for power. Car batteries, made up of many small cells, are like those found in smartphones and laptop computers.

BEVs need to reach a minimum of 400 to 650 kilometres range to be acceptable. Faster charging times will be expected also, and a nationwide network of fast chargers with easy access for the public is essential for widespread acceptance. And reasonable vehicle purchase costs are mandatory too.

The main ingredient of the battery is lithium. Nickel, cobalt, graphite and other minerals are also used. Lithium as a raw material is easily found and mined as there are large deposits all over the world. Most lithium-ion batteries are made in China while Tesla is increasing capacity and inventing new technology also.

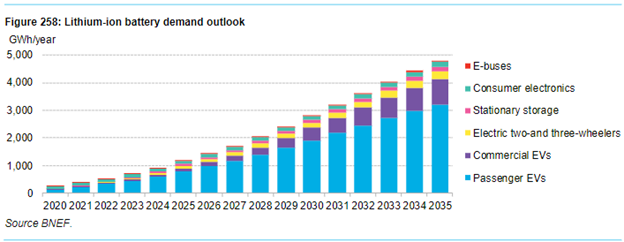

Bloomberg New Energy Finance (BNEF) forecasts for lithium battery demand:

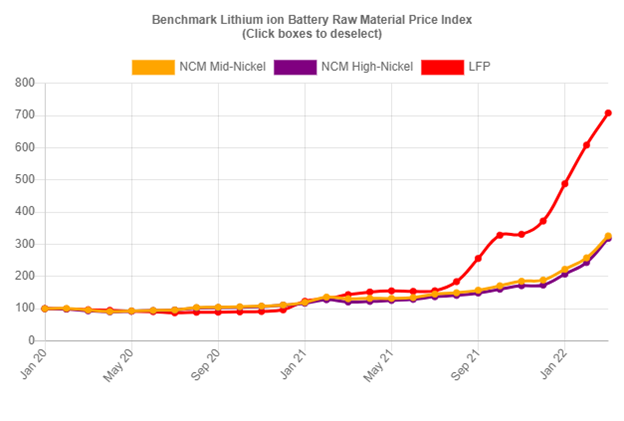

Battery costs are already rising. The raw materials for the most common type of battery are getting more expensive.

Source: Benchmark Mineral Intelligence

The cost of raw materials for the increasingly popular lithium iron phosphate (LFP) format has increased 7x from January 2020.

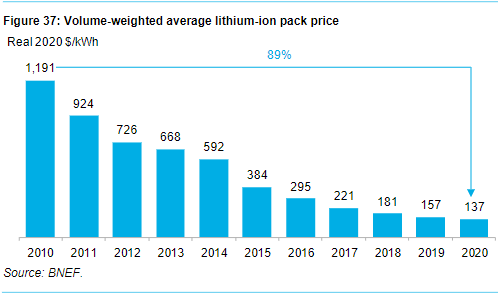

Prior to this, battery costs had been dropping precipitously. There was a surplus of lithium. From 2010 to 2020 prices had declined 89 percent!

Until the recent uptick in raw material prices lithium mining and refining had not been very profitable as lithium prices had been too low.

Now that lithium prices are going up, we will see a surge in investment in new mines and new production capacity to supply the EV market.

Aggressive forecasts for BEV adoption will be met or exceeded despite the recent uptick in costs. BNEF expects that total sales of BEVs will reach 65 million by 2040. The share of sales for BEVs will reach 50 percent to 90 percent.

As it becomes clear that electric vehicles are here to stay, and consumers are switching rapidly, suppliers will take the chance that large profits can be earned by supplying new battery materials.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.