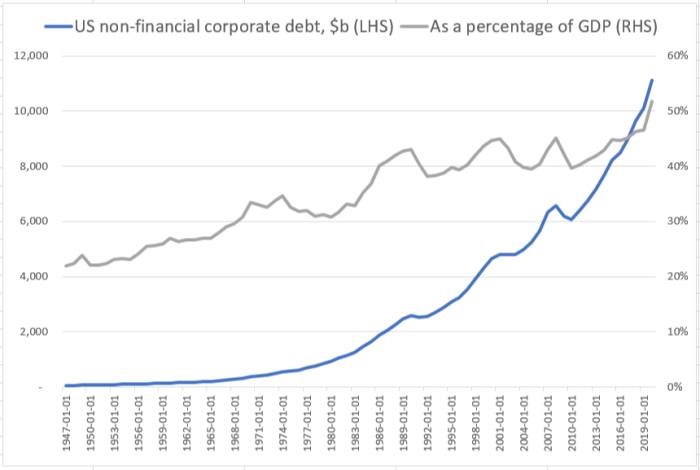

Corporate indebtedness has been increasing at a steady rate for years. The rate of increase has even accelerated since 2008. This amount of debt in the corporate world makes the economy more vulnerable to new shocks.

Will elevated corporate debt trigger the next financial crisis?

From the FT.com (paywall) “Unhedged” Robert Armstrong writes:

“Corporate debt has never been higher … from 2010 to 2020 (it) grew at over 6 per cent a year, almost twice the rate of the economy.”

Source: Financial Times

We can see that the rate of increase has increased from prior decades with the Debt/GDP reaching a new high of over 50 per cent.

Armstrong writes about the level of equity in corporations, which has increased dramatically during the same time. The argument is that the debt is not a problem, or at least not as serious a problem as it first appears. This justification is practically identical to the one made regarding Canadian housing when household debts hit new record highs and some economists retort that house prices have increased even faster so it does not matter how high debt goes. These arguments are rubbish in both contexts and Armstrong points this out:

“If a company, or companies in general, get into a nasty situation where servicing or rolling over their debt is a worry, that equity value is going to disappear fast. It is an umbrella companies can only use when the sun is shining.”

One important angle to the debt fad is not discussed in the article. There is a reason that corporations have built up so much debt. This debt is the result of the current fashion that goes by the phrase “returning capital to shareholders”.

There are basically two ways to return capital to investors. First the company can pay a dividend and increase that dividend payment as earnings grow. And second, the company can go into the stock market and buy back its own shares and cancel those shares from the shares outstanding. This shrinkage in the equity base of the company increases the value of investors’ holdings in proportion to the reduction in the number of shares cancelled. So, for example, if a company buys back 5 percent of its shares, the value of shares held by each investor goes up by that amount, if the share price remains the same.

Long-term investors prefer that the company create value by expanding or investing in new plants and equipment and new technology that is necessary for the company to survive. But many company executives prefer the short-sighted route of repurchasing their own shares to prop up the share price which is a key performance indicator for management.

In decades past profits would be the source of funding share purchases. But increasingly companies are borrowing money at extremely low rates to reduce the share count. Some will object that this increases company leverage, as measured by Debt-Equity.

That type of thinking is just old-fashioned. After all, what could possibly go wrong?

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.