Speculation in stock markets has been growing for many months. But the latest review of several reliable indicators of speculation shows that a shocking amount of speculative fever has appeared in stock market activity.

Does this degree of speculation always lead to a stock market crash?

The highly respected GMO LLC quarterly letter compiled a list of signs of speculation in the markets recently and their research shows that indicators of excessive speculation are growing in number and severity.

According to Ben Inker of GMO, “highflyers are likely to fall back to Earth”.

You can access his report here.

Inker defines speculation this way: “The deployment of capital to achieve an expected gain based on an investor’s prediction of how future prices will differ from market’s expectations”.

Since the stock market presumably incorporates all of the good news that is coming for the corporations that make up the stock market index, the speculator has to believe that there will be a future that is even better (or worse for short sellers) than the collective wisdom of what investors expect.

Since there is no way to calculate what investors expect from the market the speculators have to rely on other short-term indicators like individual stock momentum and price charts. Terms like “death cross”, “breakout” and “filling the gap” pepper most writing from newsletters targeting speculators as the audience.

On the other hand, investing is boring. Since most of the news is usually baked into the stock price the investor has to wait patiently, sometimes for years, to see a return that justifies his optimism regarding that investment. As Inker says, “you are unlikely to get rich quick from investment activities” while speculation “offers the potential for large and/or quick gains”. Why would anyone not choose instant gratification over boring long-term investing that may or may not work out?

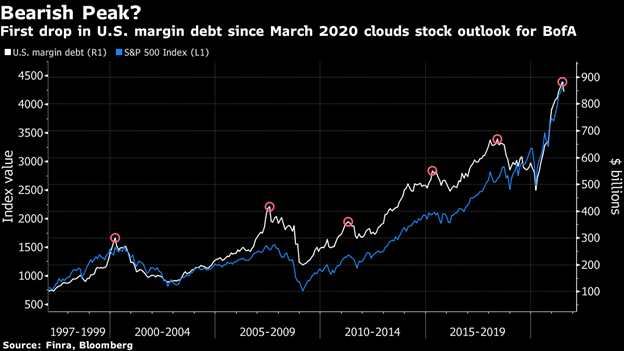

One reliable indicator of excessive speculative activity is margin debt growth. Margin debt represents loans that support stock market speculation. This chart from Bloomberg’s Dave Wilson:

Borrowing soared 84 percent from April 2020, near the depths of the COVID crash, to June 2021.

The level of margin debt today in the U.S. is three times the level in 2000, one of the major speculative peaks in the stock market. That surge in margin debt came just before a market crash. From March 2000 to December 2002, the market declined by 50-84 percent.

An early indicator of a break in the speculative urge is a drop in the level of borrowed money.

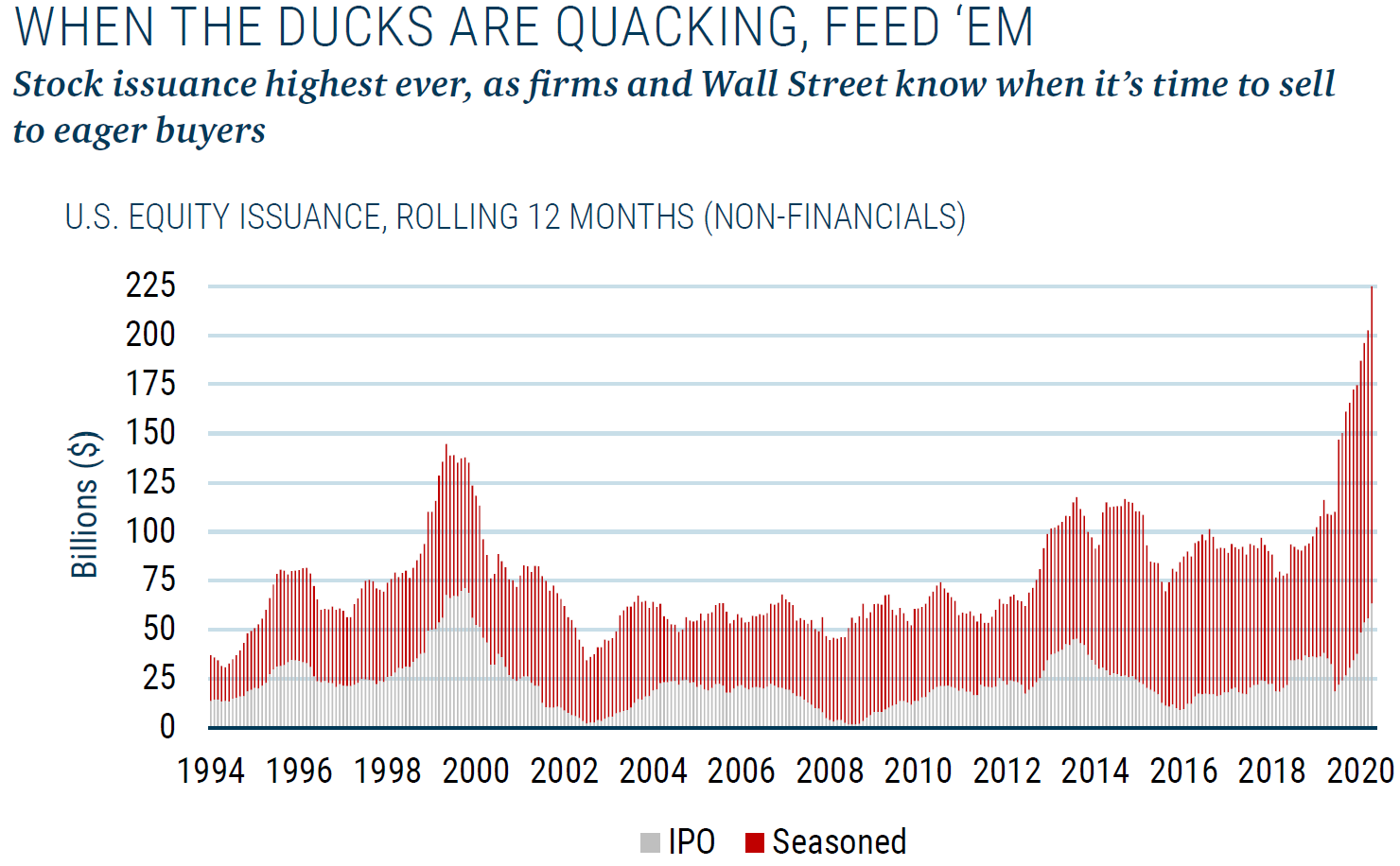

Indicators of speculation highlighted by Inker are short-dated single stock options volume, equity issuance as a percent of U.S. GDP and increases in house prices for housing bubble countries like Canada and Australia.

In a related piece from GMO, the stock issuance trend shows another problem with today’s market:

Source: GMO, The U.S. Federal Reserve – Chart title is a phrase that has been attributed to the head of First Boston’s equities trading desk in May, 1991, but that cannot be confirmed.

Since the company and Wall Street determine the timing of share issues, it is certain that issuers believe that share prices are high, and it is time to sell.

Caveat emptor!

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.