Stock markets in China are getting even cheaper. The Hong Kong-based Hang Seng Index is down more than 20 percent from its January 2018 high.

The Chinese government is cracking down on the largest technology companies. Investors are getting spooked by these anti-market moves.

Is this sell-off a buying opportunity?

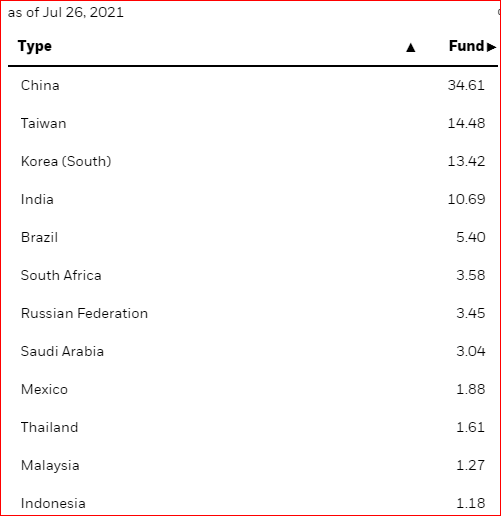

Investing in China means dipping into the emerging market category. There is a view among respected investors that emerging markets offer the most attractive opportunity over the next decade, especially companies in the “value” segment. Chinese stocks make up the largest portion of market capitalization in emerging markets.

The MSCI Emerging Markets index covers emerging markets and an ETF by iShares (EEM) tracks that index. China and Taiwan are one-half of EEM’s value.

Source: iShares

Some stock markets in mainland China, such as the Shanghai and Shenzhen markets, partially restrict access to foreign investors. So investors use the Hang Seng or ADRs in the U.S. to invest. There are about 248 Chinese stocks listed as ADRs in the U.S.

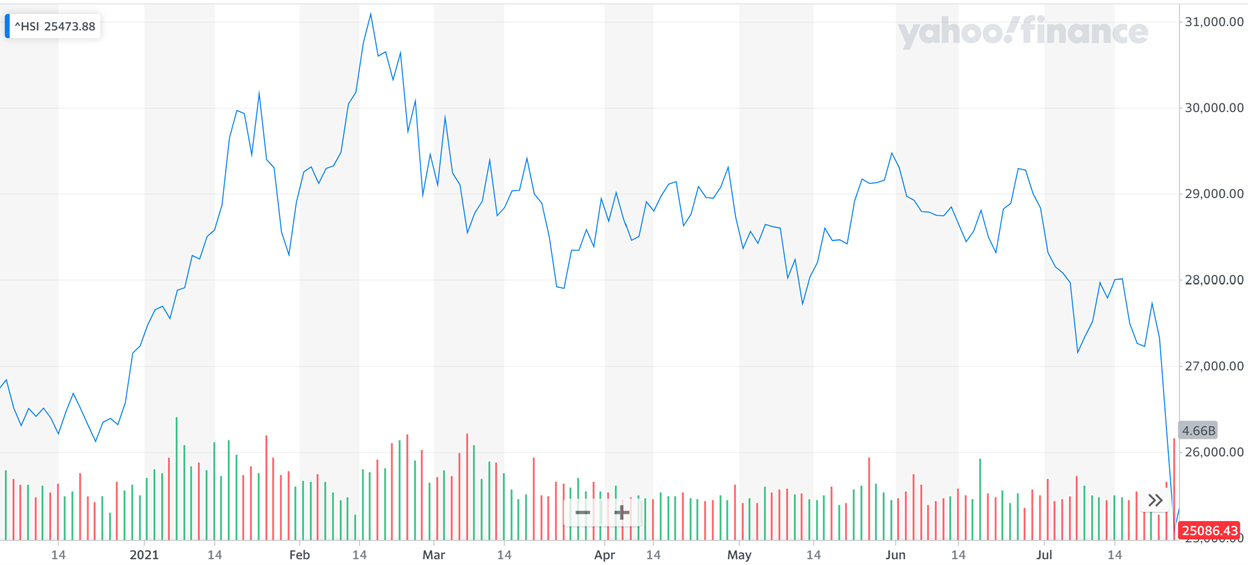

Source: Yahoo! Finance

The Hang Seng index plummeted this week after the news of the government edicts.

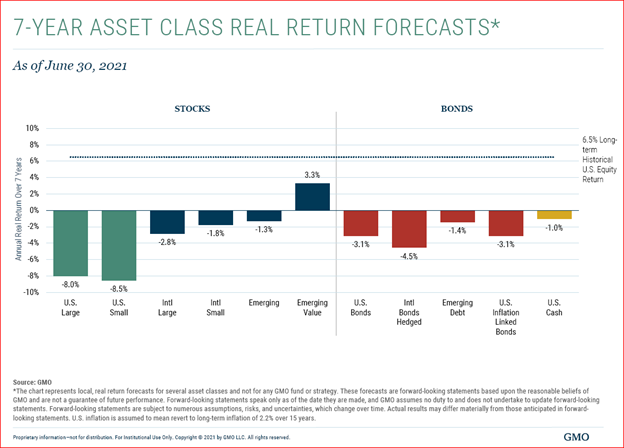

With valuations of the S&P 500 at record highs, surpassing 1929 and 2000 by some measures, the outlook for returns in the U.S. stock market is poor when compared to cheaper markets like China.

GMO LLC offers a 7-year forecast based on valuations. At this time, the only area that offers a decent future return is “emerging value”, and even that return is below average.

Source: GMO LLC

“Emerging Value” in the GMO chart refers to a distinction between the growth and value styles of investing.

The banks are considered to be in the value category, and several Chinese banks are in the top ten banks in the world, ranked by assets.

Technology stocks in the Chinese market were spooked this week by curbs announced by Beijing on the online education industry. A series of edicts by the central government have impacted many of the large technology companies, as Beijing is putting those companies under the gun.

The highest valued Chinese technology company, Tencent, lost $100 billion in market value during the first two days of trading this week. WeChat, a Tencent subsidiary with 1 billion users, was forced to undergo a “security technical upgrade” prompted by a regulator. Investors viewed this as another attack on an important tech company.

The valuation gap between world stock markets and China markets has seldom been this wide. The chart below shows the Emerging Markets index compared to the S&P 500 over twenty years:

In the long run there is little doubt that emerging markets and especially China are good bets, especially when compared to a market like the U.S. which is trading at record-high valuations. But investors are worried about China’s government.

So the next few months might bring a return of volatile emotions dominated by fear and greed. Buying opportunities are always best when investors are in the grips of a panic, as we saw in March 2020.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.