Index investing, or passive investing, is taking over from the human portfolio manager, also known as active management. This trend is gaining momentum and will not reverse until the next bear market.

Individuals now expect above-average returns with high liquidity and low risk, and, most importantly, the lowest fees on the street.

Providers of index funds, in the form of Exchange-Traded Funds (ETF), promise all those things.

Will the ETFs be able to deliver on any of these promises? Are there risks in ETF investing?

I’m biased, obviously. I’ve been managing money as an investment advisor and portfolio manager for more than 40 years. I believe that many active portfolio managers add value well in excess of their fees.

But the trend toward “passive” investing is winning over many investors. I had an experience recently that highlighted this. An acquaintance informed me that index funds give him superior returns, are risk-free and are provided at no cost to him. He does his investing himself, without an advisor, and is doing very well. He would be classified as a sophisticated investor.

His view is an example of a shocking misunderstanding of how index funds work.

Institutional money managers control at least 80 percent of the U.S. stock market in pools such as mutual funds, trusts, pension plans, endowment funds and insurance companies. These professional money managers are measured by performance against a benchmark. Because these managers have little chance of beating the stock market, they opt for the goal of avoiding a big mistake as their main career target. Jeremy Grantham of GMO LLC calls this “managing career risk”. Avoiding a career-ending mistake leads to “herding”, where large pools own the same stocks. Their problem can be described like this: “It’s fine to be wrong if the investing crowd is wrong in the same way but being wrong by making unusual or eccentric investments is unacceptable and will lead to dismissal.”

So, most money managers spend their time copying the current popular strategy. Since the performance in the U.S. market has been good, and the bulk of that performance has been produced by just a few large-cap stocks, concentration in the U.S. stock market has increased to unprecedented levels.

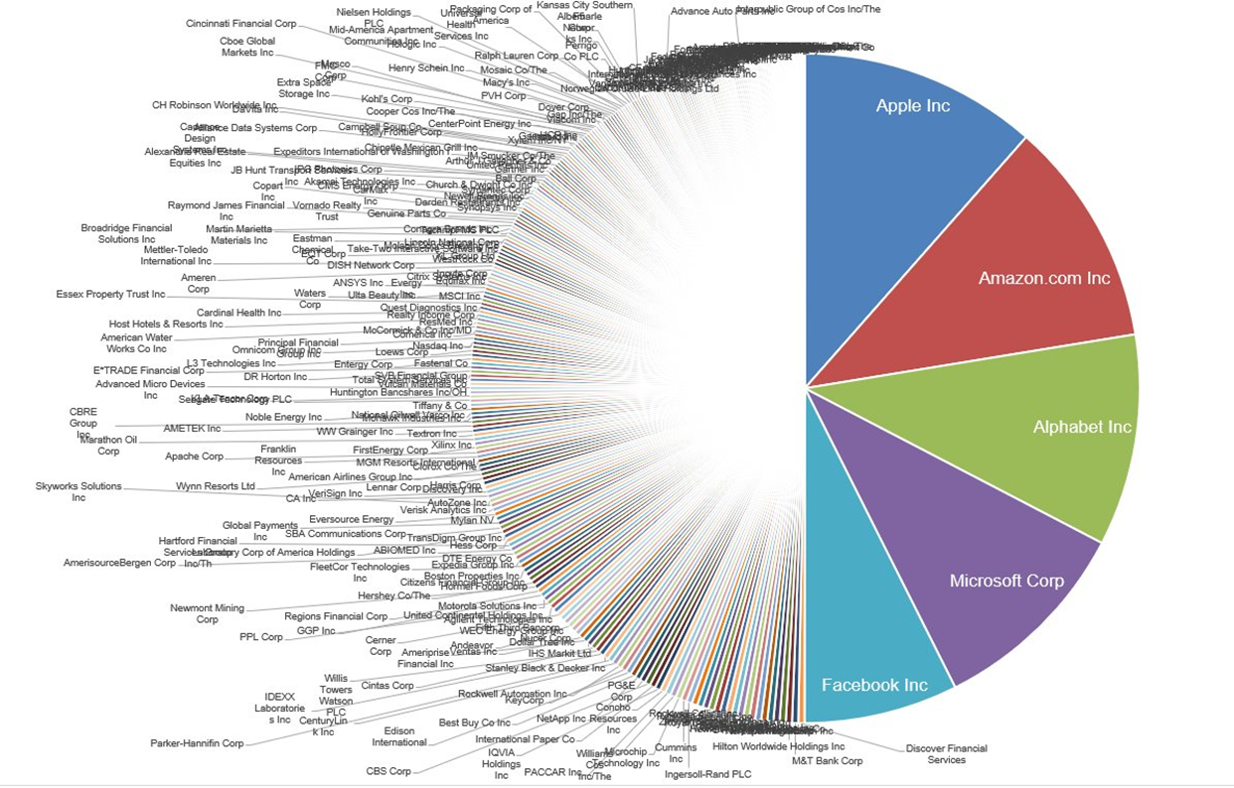

Consider that just five stocks in the S&P 500 are worth the same as the bottom 282 companies:

Source: Michael Batnick, director of research at Ritholz Wealth Management

An argument can be made for investing in each of those five companies, but this level of concentration should be a cause for concern.

So, how does an extreme situation in the markets relate to passive investing in ETFs?

As money flows into ETFs, the ETF operator/sponsor buys individual stocks in proportion to their weighting in the index. Since the most heavily weighted stocks capture the bulk of the new money, this inflow tends to inflate the value of the biggest companies, making those stocks even more expensive. This means that those large-cap stocks will outperform the market during the bull market, attracting even more buying from the institutional investors who are managing their career risk and giving the illusion of excellent performance.

The popularity of ETFs increases as index funds perform better than other investors and portfolio managers who are taking the more sensible, and less risky, path of avoiding the most expensive companies.

According to Steve Bregman of Horizon Kinetics, in an interview with The Financial Times, there is a distortion that comes from too much money flowing into one place: “This particular distortion … is probably the largest in history.”

It’s not all bad news. There is a silver lining in this cloud. Concentration creates an opportunity for those who are willing to go against the herd, as we do in our investment practice. The stocks that are being ignored by ETFs and institutional money managers are likely to be undervalued and will outperform the market, at some point. Of course, it takes time and effort to discover which companies have merit.

The next bear market will give passive investing a severe test. If this time is like prior occurrences when a market fad has become very popular, ETFs will fail to deliver on their promises, in a dramatic fashion.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.