The U.S. Federal Reserve hiked rates again and signaled that there will be more increases to come as the U.S. economy continues to gain strength.

The second hike of this year came this week. Now most observers expect two more increases before 2018 draws to a close.

Will the Fed continue hiking rates for too long, beyond the start of the next recession?

The new chair of the Federal Reserve, Jerome Powell, continued the steady pace of rate hikes, following in the footsteps of his predecessor, Janet Yellen. There have been 6 hikes of 25 basis points in the last 18 months.

What is new at the midpoint of 2018 is the reality that the US economy is at, or beyond, full capacity, and, pumped up by a massive tax cut by the Trump administration, the pace of growth is accelerating. The unemployment rate is at 3.8 percent, equal to the lowest in records that go back to 1969.

So, an “easy” monetary policy no longer makes any sense.

Chair Powell is relatively new to the central banking game and, unlike his predecessors Ben Bernanke and Janet Yellen, he is not an academic. But Powell doesn’t need a PhD in economics to realize that it’s important to bring to an end to the era of unusually easy monetary policy where rates were kept low for a very long time. This is no justification for that stance with unemployment at record low levels and inflation starting to creep higher.

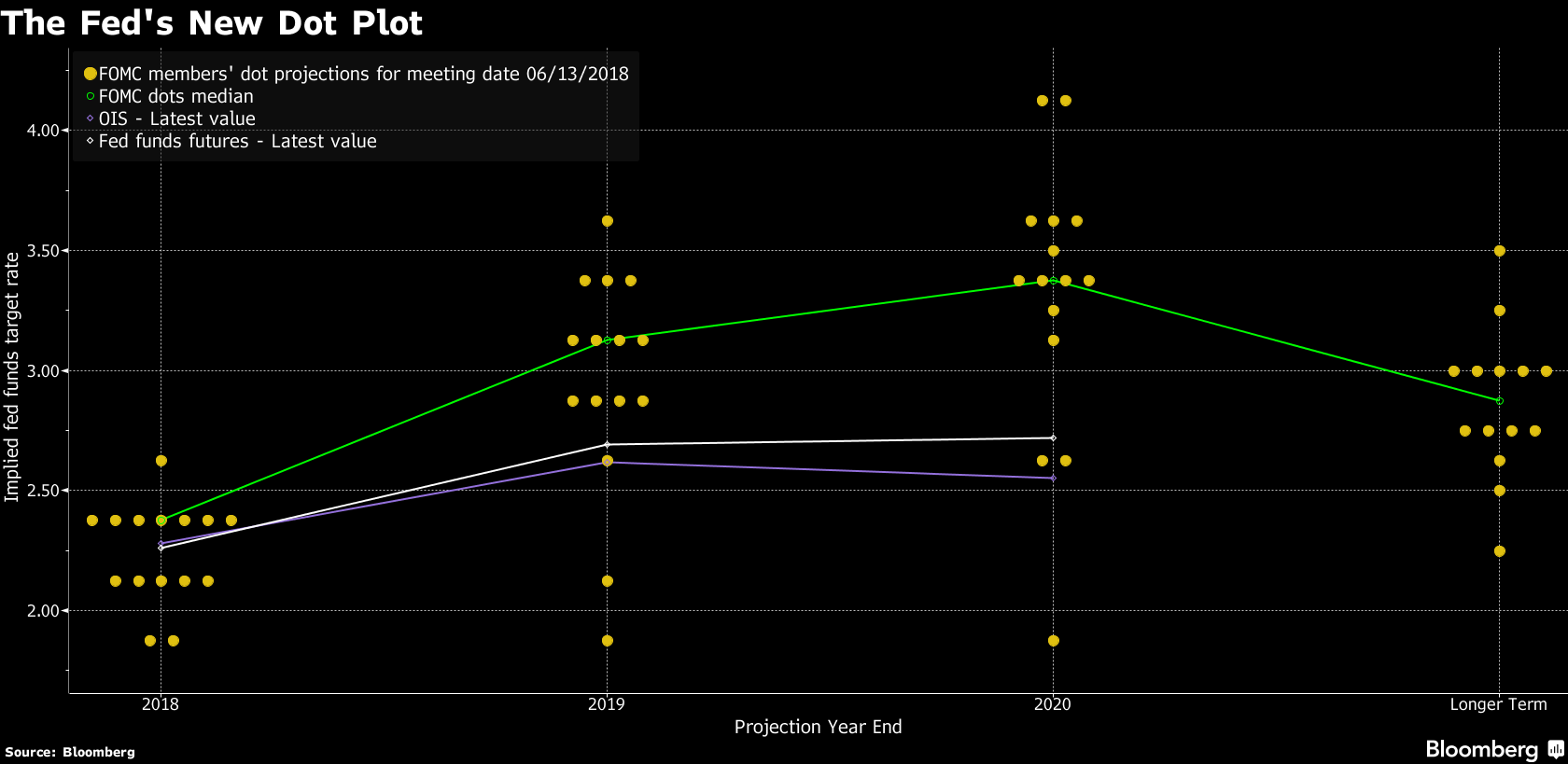

At the current pace the Fed Funds rate would reach about 3.50 percent by 2020, according to the Fed’s “dot plot”:

Source: Bloomberg

In the closely-watched Fed statement, words like “moderate” were replaced with “solid” in referring to economic activity. And the Fed removed this phrase: “the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run”. This removal will be considered “hawkish” by most, meaning that they expect that the Fed will become more aggressive in hiking rates.

Monetary policy is prone to mistakes in timing. This means that central bankers keep rates too low for too long, as we have seen in the U.S. in the last few years and then they hike rates beyond what is needed before they realize they’ve gone too far. Adjusting interest rates is a very blunt instrument of questionable impact, but it’s the only tool available right now.

The U.S. National Bureau of Economic Research (NBER) provides the official record of when recessions start and end. That group took 11 months to recognize the start of the recession that began in December 2007 and 15 months to determine that the recession had ended in June 2009. The lag time in determining the turning points around recessions ranges between 6 and 21 months, according to the NBER.

Given such substantial delays in identifying beginnings of recessions it’s inevitable that the Fed will get it wrong, as they will fail to adjust their policy based on the timing of the cycle until many months after the turning point. And, even if they were able somehow to guess that a recession was beginning before the NBER identified it, it is questionable whether they would have the tools and the determination to do what it would take to force the economy to start growing in time to avoid the next recession.

So, it’s a sure bet that the Fed will continue to hike rates past the start date of the next recession. And it has been an unusually long time, 9 years this month, since the end of the 2009 recession in the U.S.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.