Astute observers may have noticed the recent change in our team's logo (top of this newsletter or within in our email signatures). We are excited to officially announce that our team name has evolved from Chernick & Associates Wealth Management Group to Chernick James & Associates Wealth Counsel. While this change marks a pivotal moment for us, it in no way alters the unwavering standard of service you've grown accustomed to - a standard we take immense pride in maintaining.

This new name is a nod to Jack's indispensable role as our investment strategist and portfolio manager. Jack’s extensive background in economics, coupled with his two-decade tenure in investment research and management, alongside his enduring passion for all things market related, has rightfully positioned him in a leadership capacity within our team. Together, we remain steadfast in overseeing your investments, diligently tending to both long-term strategies and day-to-day financial affairs regardless of market fluctuations.

The dedication of our team members - Nevin, Jack, Tom, and Paty – remains resolute as we reaffirm our commitment to delivering unparalleled levels of service, investment expertise, and financial planning that you’ve placed your trust in. We extend our heartfelt gratitude for your unwavering support as we embark on this journey together. Stay tuned for more exciting updates regarding our team’s growth in the near future!

- Nevin.

Market Update: May Market Rebound

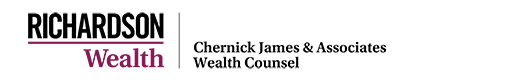

The story of 2024 continues to unfold with strength and resilience. Our last update in April addressed the first challenging month of the year, one which we had identified as a typical pullback in a healthy market after a prolonged positive trend, further intensified by ongoing concerns about escalating conflict. As it turned out, this assessment wasn’t too far off:

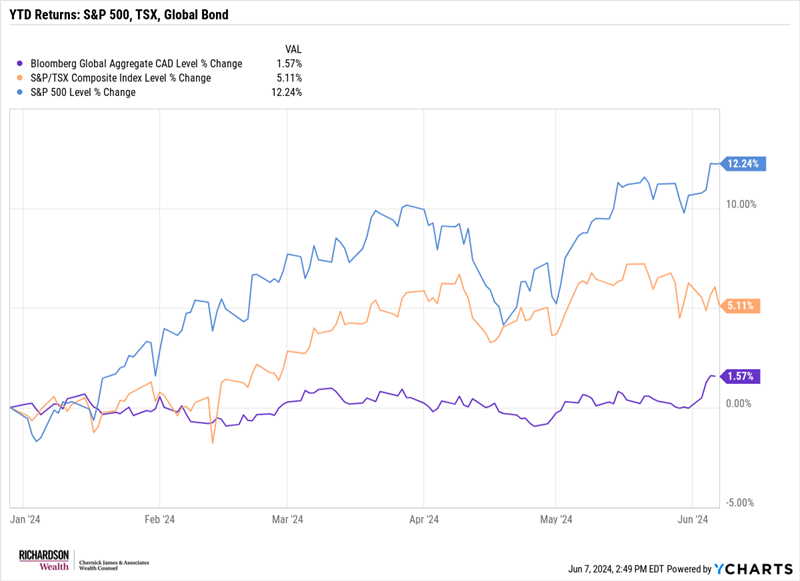

Markets rebounded strongly through May, driven firstly by continued improvements in corporate earnings, reinforcing our view of an early-stage bull market, and secondly by economic data easing inflation concerns and bolstering expectations of rate cuts. This performance reinforced our past year's caution against the "sell in May and go away" adage, a warning founded on tangible data:

Entering June, the focus has shifted back to leading central banks as the anticipation of rate cuts has steadily built against softening economic data across key economies. While financial pundits initially anticipated a swift pivot toward rate cuts in 2024, the more realistic voices we follow predicted mid-year cuts at the earliest. Last week, Canada took center stage as expectations for rate cuts were high against a backdrop of broad economic weakness. As expected, the Bank of Canada made its first 0.25% cut of this loosening cycle, becoming the first G7 institution to do so, followed swiftly by the European Central Bank the next day.

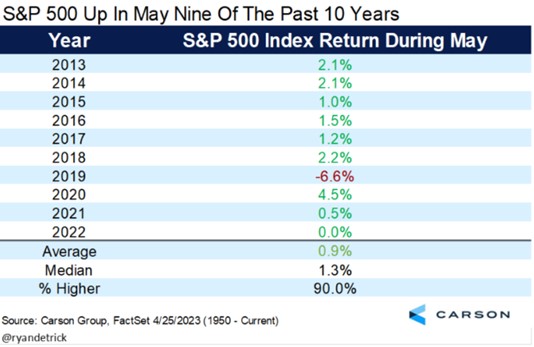

To many, pundits and investors alike, rate cuts may seem counterintuitive given persistently elevated prices. However, the restrictive policies that central banks implemented in 2022 to tame the great inflation spike have largely succeeded in bringing inflation trends below long-term averages:

The conversation now shifts to the future direction of monetary policy. While opinions on this matter can vary widely – and rightly so, given the human element behind policy decisions – we choose to focus not on the timing and magnitude of future cuts, but on broad inflection points and general direction. Based on this approach, we believe the first inflection point of interest was peak inflation in 2022 and our expectation that sustained disinflation would follow. This led to our anticipation of future interest rate normalization and the beginning of today’s inflection point, transitioning us from a period of two years of higher rates toward one that we believe will feature less restrictive (lower) interest rates.

This path will undoubtedly be bumpy, as real-world data can be messy, causing investors to question economic indicators and leading to normal market pullbacks, much like we saw in May. However, we continue to believe that the path to a more accommodative environment will support renewed economic growth and serve as an ongoing tailwind for stocks and bonds. We believe these positive dynamics, combined with an emergent AI catalyst, have the potential to push major market economies toward the next business cycle expansion, as evidenced by early signs of the next cyclical bull market.

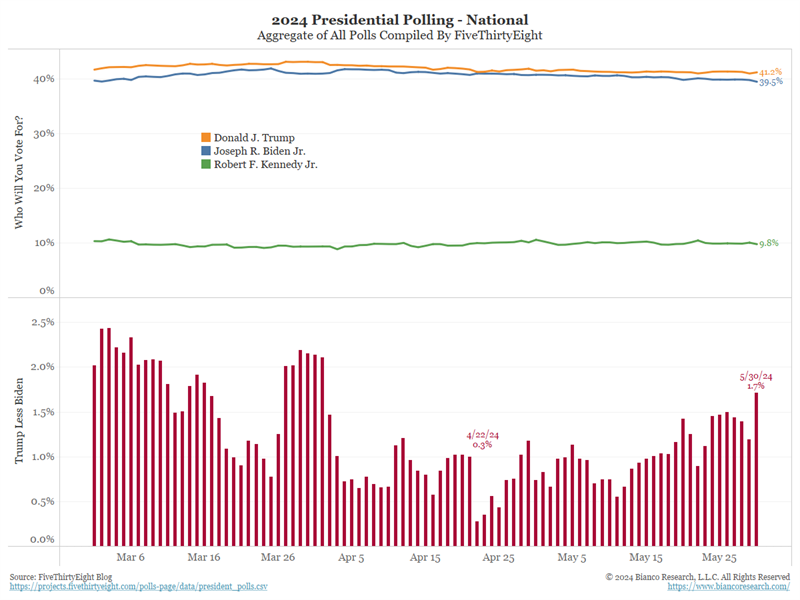

As we move into the summer months, we anticipate this positive trend to continue, supported by major economies pivoting toward looser monetary policy. With market activity expected to decrease as participants take time for summer relaxation, we welcome the prospects of a quieter environment. This calm period is especially welcome as we prepare for the fall, which will undoubtedly bring increased noise and volatility around the upcoming US election – an event that remains incredibly tight and uncertain:

For now, we hope you're focusing less on election noise and more on enjoying the improving weather with your families as you gear up for the summer months ahead. From everyone on the team – here's to a great summer season.

As always, if you’d like to discuss our current market views, your portfolios, or review your financial plans, please don’t hesitate to reach out to the team and set up a time to chat.

- Jack

Should you help your adult child buy a house?

In today’s hot housing market, more parents are opting to help their adult kids financially – whether that’s providing money for a downpayment or co-signing a mortgage. Supporting your child’s homeowner dream can be a meaningful and supportive gesture, but it's important to approach it carefully without jeopardizing your retirement plan.

The article "Should You Help Your Adult Child Buy a House?" explores essential considerations and methods, such as:

- Loaning money

- Gifting money

- Co-signing a mortgage

- Buying a house for your adult child to rent

- Setting up a discretionary trust

Before making any decisions, it's crucial to ensure your financial stability and retirement plans remain secure. For a detailed guide on navigating this significant financial step, read the full article on our website here.

Thinking about helping your child with their home purchase? Let's discuss how to do it without compromising your financial well-being.

Financial Strategies by Alysha: Exploring Property Tax Deferral

As July approaches, many homeowners are receiving their property tax notices, often reflecting significant increases in recent years.

For B.C. homeowners age 55 and over, deferring property taxes can strategically enhance cash flow. By redirecting funds typically set aside for tax payments into investments, savings, high-interest debt repayment, or gifts for adult children, homeowners can experience immediate benefits and positive impacts from their contributions, rather than waiting until later in life.

Leveraging this deferral program could be a sophisticated maneuver within a well-rounded financial strategy. However, it's essential to assess how this fits into your broader financial goals and circumstances. For more information on B.C. property tax deferral, visit: BC Property Tax Deferment and to learn more about associated costs, visit: Tax Deferment Interest and Fees. Consult with us to determine if this strategy aligns with your financial objectives.

- Alysha

How AI Is Unlocking the Secrets of Nature and the Universe

Dive into the fascinating world of artificial intelligence with Demis Hassabis, co-founder and CEO of Google DeepMind, in his recent TED talk, "How AI Is Unlocking the Secrets of Nature and the Universe." In a captivating discussion with TED head Chris Anderson, Hassabis explores the remarkable history and transformative power of AI. Discover how groundbreaking models like AlphaFold have revolutionized scientific discovery by accurately predicting the shapes of all 200 million known proteins in less than a year. Learn about the profound implications of these advancements and how AI holds the potential to unravel the deepest mysteries of our minds, bodies, and the universe. Don't miss this enlightening talk that promises to expand your understanding of AI's role in shaping our future.

▶ Play Video