The Bank Cuts Again — But the Real Problem Is Housing

The Bank of Canada trimmed its policy rate by 25 basis points this week to 2.25 percent, pulling Canada’s official rate well below the U.S. Federal Reserve’s 3.75 percent — also lowered this week. But don’t expect these cuts to save the economy from a recession.

In its statement, the Bank warned:

“The Canadian economy faces a difficult transition... The structural damage caused by the trade conflict reduces the capacity of the economy and adds costs.”

That’s central-bank code for “we’re out of ammunition.”

This marks the ninth rate cut since May 2024, when the policy rate stood at 5 percent. Governor Tiff Macklem’s successor now hints that the Bank is done cutting and is handing the baton to Ottawa’s fiscal side — to Prime Minister Mark Carney and his first budget, due November 4.

Yet, in the entire press release, the Bank never mentioned the housing collapse — the most dangerous threat to Canada’s financial system. Home prices are falling sharply, household debt is sky-high, and confidence is cracking. That’s what these rate cuts are really about: buying time.

Unemployment has climbed to 7.1 percent, and GDP growth is projected below 2 percent, compared with nearly 4 percent in the U.S. During the 2009 financial crisis, Canada escaped with a housing-fueled stimulus — but that trick can’t be repeated. Household debt is now more than 220 percent of GDP, leaving little room to borrow our way out again.

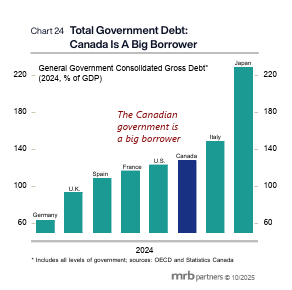

Ottawa will try to cushion the blow with more spending, but government debt is already elevated. When you add provincial debt, Canada’s total public burden now exceeds the U.S. — though still below Italy or Japan.

The Bank’s latest Monetary Policy Report paints a picture of an economy on the edge. The tariff war may get the headlines, but the real story is domestic: a housing bubble bursting under record debt.

The Carney government faces a trilemma — revive growth, fight a trade war, and deflate a housing bubble — all at once. Something will have to give.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.