Mag 7: The Most Expensive Stocks in History

The top stocks in 2025 make the dot-com bubble leaders look cheap.

Back in 2000, the leaders were Microsoft, GE, Cisco, Walmart, Exxon, Intel, and NTT.

Today, it’s the “Magnificent 7” — Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla.

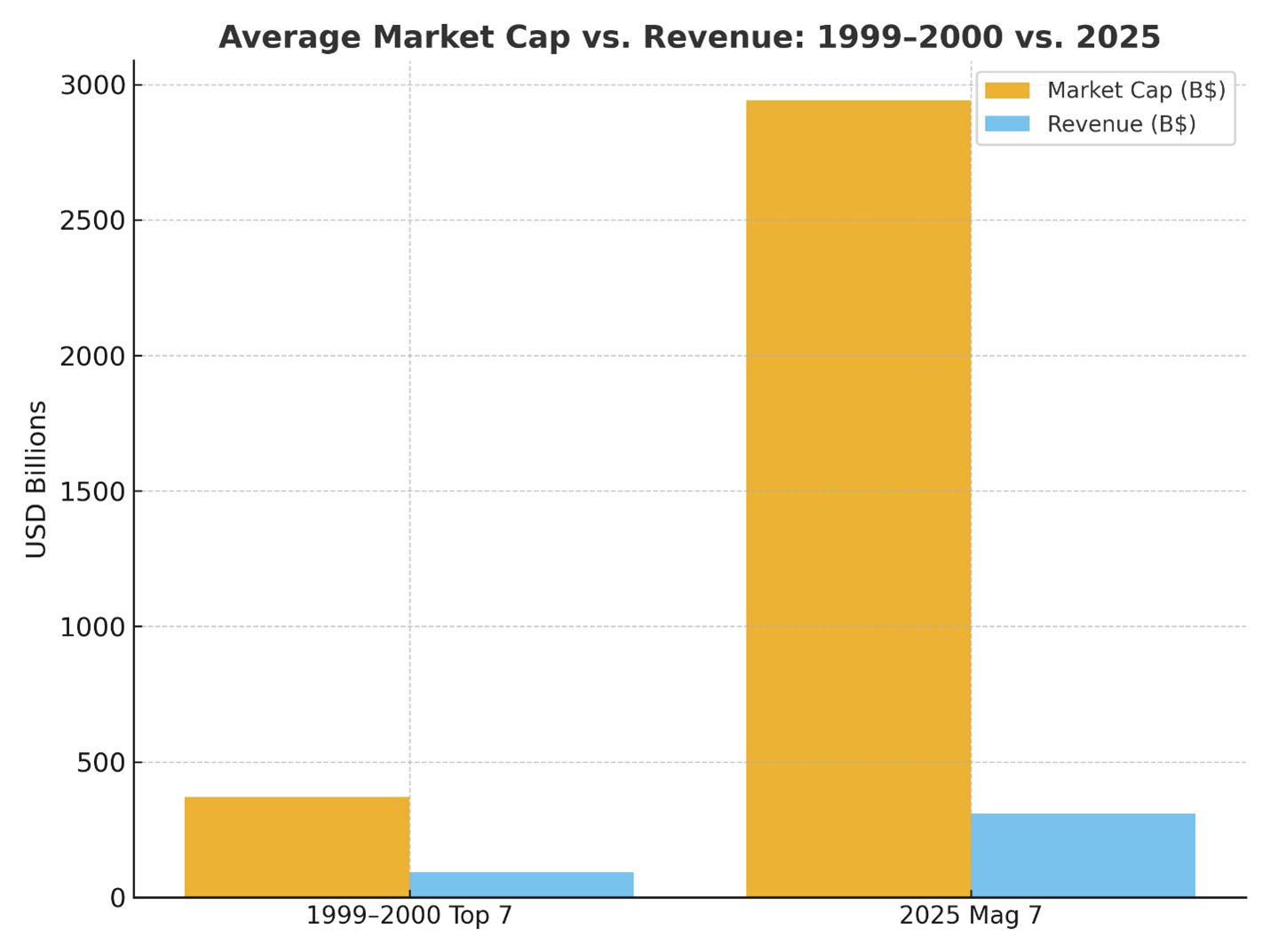

Here’s the shocker:

- The Mag 7 is worth 8× more than the top 7 of 2000.

- Yet they generate only 3× the sales.

- Average market cap today: $2.9 trillion per company.

Source: Macrotrends, S&P Global

Nvidia alone is valued at $4.3 trillion. Microsoft, the giant of 2000, topped out at “just” $602 billion.

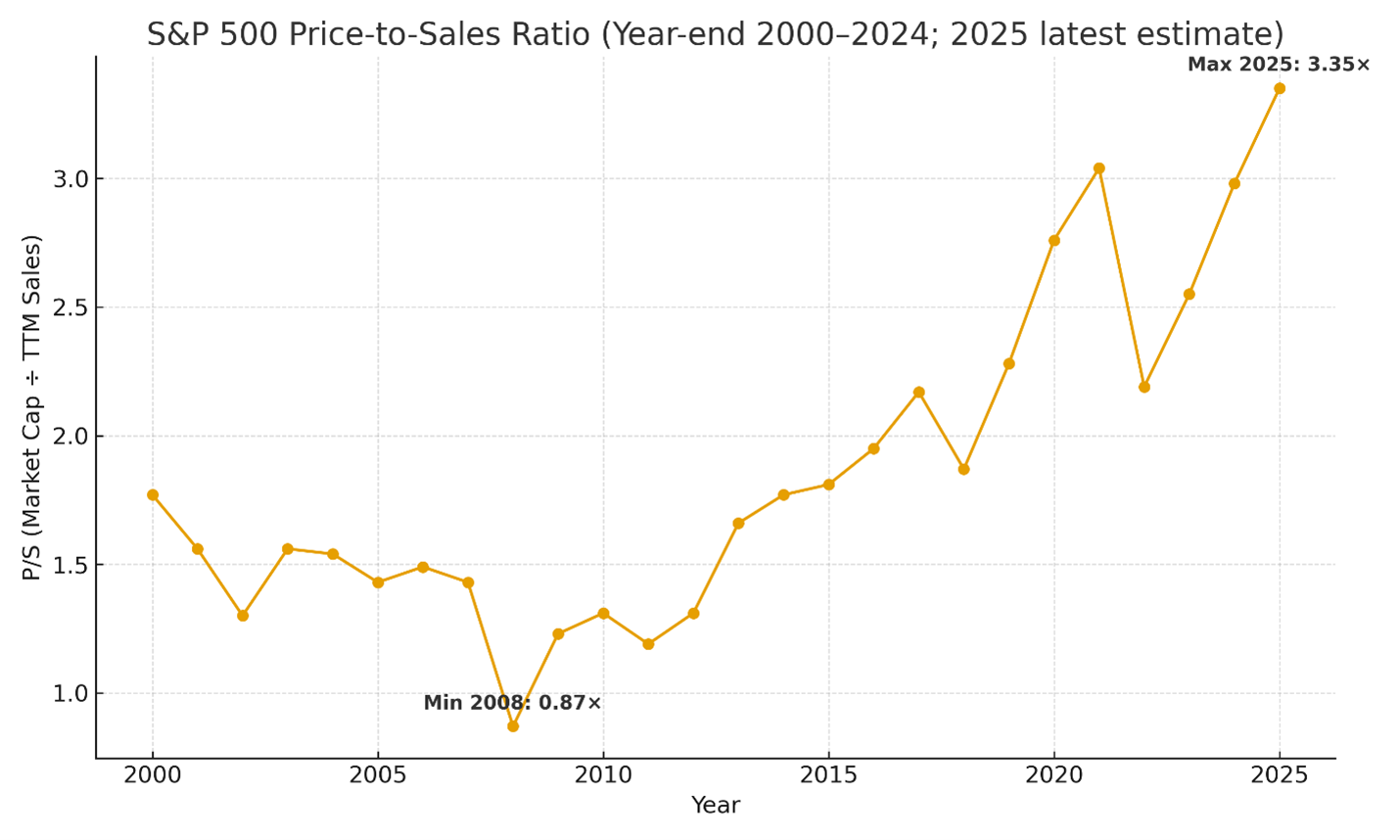

The problem? Valuations have run far ahead of sales. The Mag 7 trade at 9.4× sales, compared with a long-term S&P 500 average of 1.8×. The S&P 500 trades at 3.35x today. In the last crash (2008), the ratio fell to under 1.0.

Source: Macrotrends, S&P Global

If today’s leaders simply revert to the S&P 500 average, share prices would fall 80 percent. If they overshoot to 2008 crisis levels, the wipeout would be more than 90 percent.

Sounds impossible? Amazon fell 95 percent after 1999. It has happened before.

Investors are betting AI will deliver endless sales growth. History suggests otherwise.

This market is priced for perfection — and perfection never lasts.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.