Powell’s Quandary: Bad and Worse Options

Chair Jerome Powell of the U.S. Federal Reserve admits he is in a bind: the economy is flashing both weak job numbers and rising inflation. What’s a Fed to do?

This week the Fed trimmed its policy rate by 25 basis points to 4.125 percent — still about 1.4 percent above the latest inflation rate of 2.9 percent. Such a small cut will hardly move the needle, but markets are betting on a series of further cuts. Pressure from the White House is mounting for much bigger ones.

Stephen Miran, President Trump’s recent appointee to the Fed (who still works inside the White House), is openly unhappy with Powell’s cautious approach. Miran wants five cuts in three months to juice growth ahead of next year’s midterm elections.

Powell’s rationale for cutting now is weak employment, which he sees as the bigger risk compared to inflation still running above 3 percent. It’s a gamble.

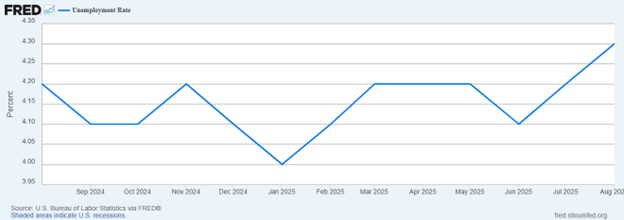

Jobs: Slipping, But Not Collapsing

Source: FRED - St. Louis Federal Reserve

Unemployment bottomed out at 3.5 percent in early 2023. It has since drifted up to 4.3 percent. Hardly a five-alarm fire, but enough to rattle politicians desperate for re-election.

Inflation: Cooling, Then Heating Again

Inflation has inched higher — from 2.7 percent in July to 2.9 percent in August. Core inflation ticked up to 3.1 percent, with shelter costs still climbing above 4 percent. Food, rent, and services are all running above 3 percent. Goods’ inflation, however, remains subdued despite tariffs that were supposed to push prices up. Maybe tariff related inflation is coming soon.

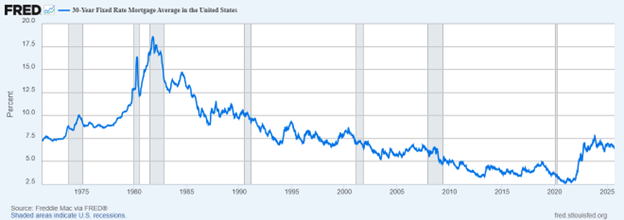

Mortgages: The Key Transmission Channel for Monetary Policy

Source: FRED - St. Louis Federal Reserve

The 30-year mortgage rate sits at 6.35 percent — high compared to 2010-22, but normal for most of the last 50 years. Since monetary policy works mainly through housing, Powell knows lower rates are needed to revive demand. But cheaper mortgages also mean higher home prices, which feed directly into CPI via shelter costs. That’s the Catch-22.

Fiscal Backdrop: Red Ink and Broken Promises

Meanwhile, U.S. deficits are running at levels comparable to the 2020 pandemic and even WWII. Efforts to rein in spending — remember the DOGE fiasco with Elon Musk’s promised waste cuts — have gone nowhere.

The Bottom Line

By shifting focus from inflation to jobs, Powell risks repeating the Fed’s past mistakes. Inflation at 3 percent may feel tolerable, but the most important mandate is to protect the purchasing power of the U.S. dollar — not to fine-tune election outcomes. Recession is part of the cycle; inflation is corrosive for the long term.

The Fed should focus on its 2 percent inflation target, even if that displeases powerful people.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.