Copper prices surged this week after Donald Trump announced a 50% import tariff starting August 1, aiming to boost U.S. self-sufficiency. But for copper, the move is more optics than impact — it won’t kick-start domestic output anytime soon, and manufacturers (and consumers) will foot the bill.

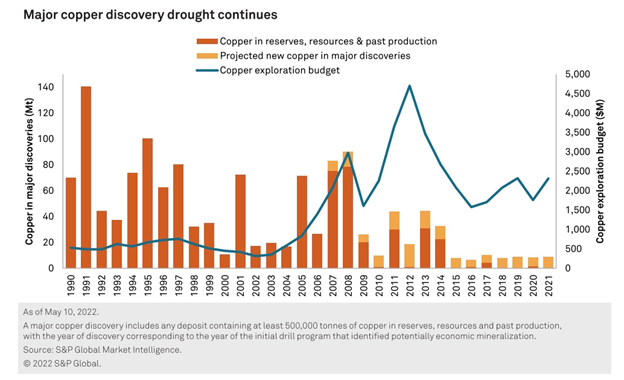

Global supply remains constrained despite copper’s crucial role in energy and EVs. Exploration budgets peaked in 2012, yet discoveries and proven reserves have lagged. The U.S. produced just 1.1 million tonnes last year, enough for only half its needs — the rest is largely imported from Latin America.

Developing a copper mine in the U.S. typically takes over a decade. Even fast-tracked projects like Taseko’s Florence mine in Arizona, set to begin production later this year, are the exception, not the rule. Hudbay’s Copper World — one of the most advanced mining projects in the U.S. — isn’t slated to begin production until 2029, and interestingly, the company behind it, is Canadian. For mines still in the permitting or discovery phase, 15 years to production is a more typical timeline.

And mining is only half the equation. Smelting and refining capacity in the U.S. is even more limited. America produced under 900,000 tonnes of refined copper in 2024. China, by contrast, refined over 12 million. Environmental opposition and high capital costs make new smelter construction in North America an economic longshot. The last smelter built globally — Freeport’s $4-billion Indonesian facility in June 2024 — was mandated by the government, not driven by market forces. No such mandate exists in the U.S., and no one’s lining up to build a smelter in their backyard.

Source: Visual Capitalist

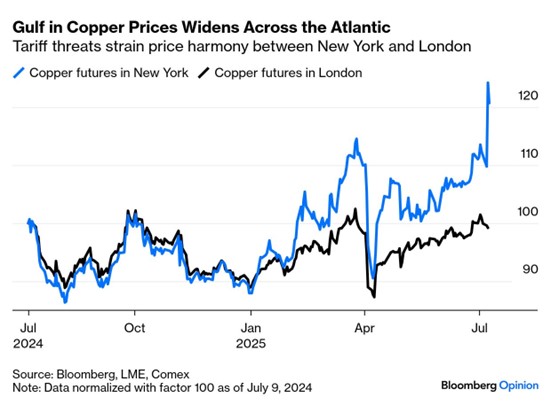

In the short term, tariffs are inflationary. COMEX copper surged to a record $5.90/lb after the announcement, with U.S. prices now carrying a 25–30% premium over the London Metal Exchange benchmark. That’s bad news for American manufacturers, who will pay more for a commodity that’s already difficult to source. Meanwhile, global inventories are thinning, Chinese buyers are stockpiling, and trade flows are being distorted — all contributing to broader market volatility.

Copper miners with existing U.S. operations are the clear winners here. Freeport-McMoRan, which accounts for roughly 60% of U.S. copper output, is likely to see a meaningful increase in free cash flow — Jefferies estimates as much as $2.8 billion annually. Arizona Sonoran and Rio Tinto also stand to benefit if the tariffs remain in place long-term. Investors should tread carefully, however: this rally is tariff-driven, not fundamentally supported, and any political reversal (or a sudden TACO moment — Trump Always Chickens Out) could unwind gains quickly.

Tariffs might tweak price signals, but they don’t build mines. U.S. copper output can’t be conjured overnight—and tariffs won’t fix permitting bottlenecks, local pushback, or years of neglect. For investors, it’s a fleeting play capped by deep structural hurdles.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.