Financial markets love an acronym and TACO or Trump Always Chickens Out, is the latest.

Source: AI generated image - REDDIT

It was coined by Rob Armstrong of the Financial Times on May 2 and last week gained traction among commentators to explain the recent rally in U.S. stocks.

Will the TACO trade continue to pacify markets or will Trump’s tariff threats actually be fully implemented?

Here’s how Armstrong brought TACO to life in his column:

The recent rally has a lot to do with markets realising that the US administration does not have a very high tolerance for market and economic pressure, and will be quick to back off when tariffs cause pain. This is the Taco theory: Trump Always Chickens Out. But why doesn’t that translate to resurgent growth hopes, higher yields and more expensive oil?

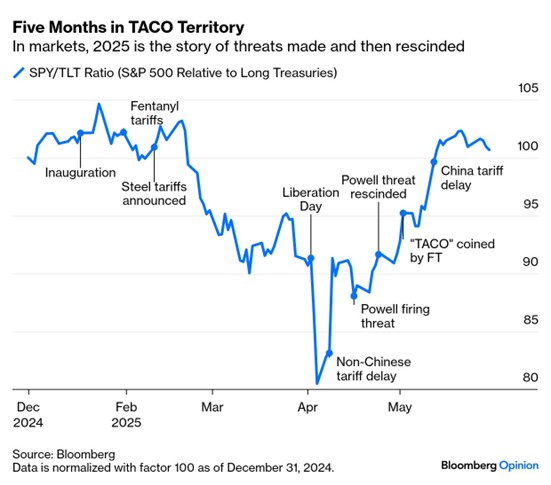

From the chart below we can see that the TACO trend was evident by early May.

Markets responded positively to significant concessions on Chinese tariffs, initially set at 145%, and the swift reevaluation of proposed 50% levies on the European Union.

However, TACO isn't an unbreakable rule. For instance, steel tariffs have recently doubled to 50%, and the newly proposed "Big Beautiful Bill Act" includes plans to impose costs on foreign investment and U.S. imports.

Despite these exceptions, markets seem eager to embrace the TACO narrative. Equity volatility has subsided since the April selloff, while U.S. stock growth has also tapered. The U.S. dollar's decline has positioned emerging markets as primary beneficiaries. With competitive labor markets and roles as manufacturing hubs, these countries are seeing strengthened currencies relative to the dollar. This shift provides their central banks with leeway to lower interest rates and attract additional investment without destabilizing their currencies.

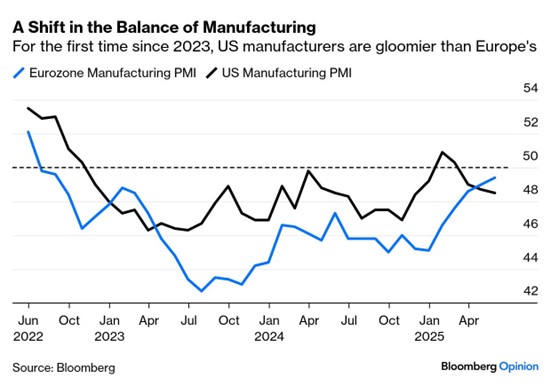

In the Eurozone, the purchasing managers' index indicates a more optimistic outlook compared to the U.S. for the first time since April 2023. This sentiment could favor European industrial companies and firms with high production costs.

Amid U.S. uncertainties, it's prudent to recognize alternative investment opportunities. Companies based in other parts of the world that were oversold in April may benefit from the market's TACO-driven optimism, for now.

Fraser Betkowski

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.