President Trump mused recently that NATO members should be spending 5 percent of their GDP on defense. This new goal is a large increase from the current target of 2 percent of GDP.

Trump has also claimed that NATO member countries have failed to pay their dues to NATO. But countries do not “pay money into NATO”. NATO members have committed to a 2 percent target for defense expenditure as a goal.

How does Canada stack up in the defense spending category?

Members of NATO (North Atlantic Treaty Organisation) have agreed to spend 2 percent of GDP on defense as a contribution to their share of military defense. They have also agreed to spend 20 percent of that total on defense-related equipment and research and development.

Poland spends the most at more than 4 percent of GDP. No NATO country currently spends 5 percent. The U.S. is spending 3.4 percent of GDP. Most countries spend between 1.3 and 2.5 percent.

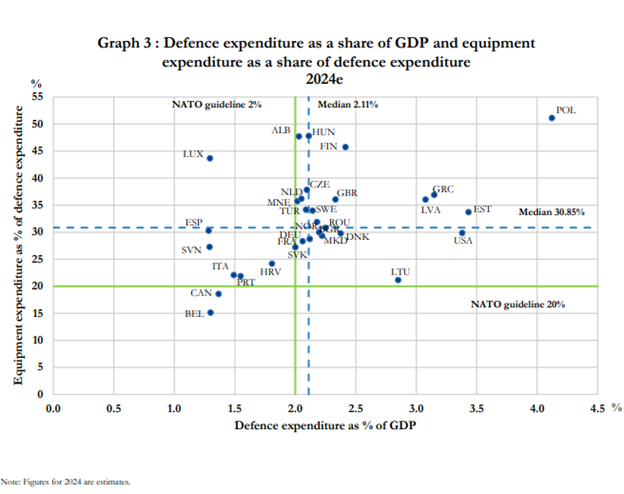

This chart shows each NATO country's spending:

Source: NATO

The 2% target is marked by the vertical solid green line. The vertical dotted blue line represents the average NATO expenditure - 2.11 percent. France and Germany spend near the average but will be increasing their spending substantially.

The horizontal solid green line shows the 20 percent guideline for expenditure on equipment, and the average spend is about 31 percent.

Canada is well below the overall 2 percent spending target, at 1.37 percent. Canada is one of 8 NATO countries that is spending below the current target. As Canada’s GDP is about C$2.4 trillion, a 0.6 percent increase, or $14.1 billion, would move Canada close to the current target.

Canada’s defense spending is small compared to the federal government budget deficit of $325 billion in the 2020-2021 fiscal year, the projected 2025 deficit of $42 billion, and last year’s deficit of $62 billion.

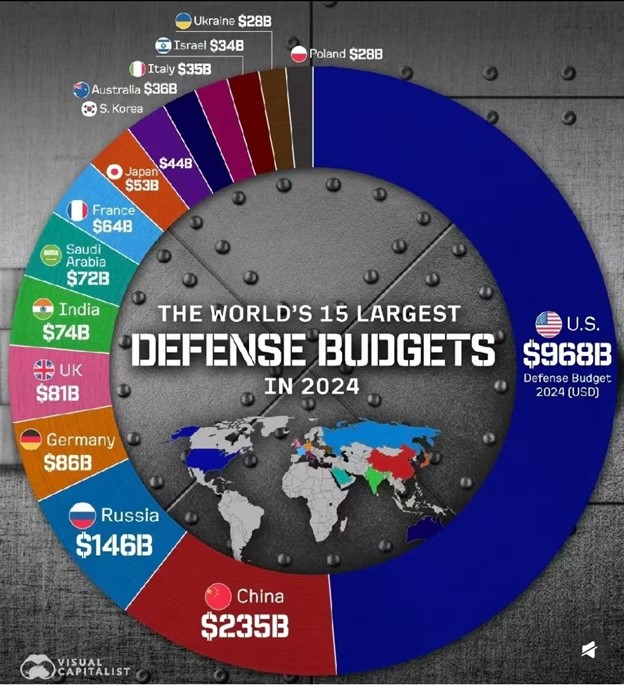

The U.S. spends about US$968 billion on defense. The U.S. has many companies that sell defense equipment, such as the F-35 fighter jet made by Lockheed Martin. Canada has ordered 88 F-35s, with first delivery of that order expected in 2026 at a cost of US$90 million per plane.

Source: Visual Capitalist

Canada (not shown) spends about US$30 billion, less than Australia and Italy.

Obviously, the U.S. would be the biggest beneficiary of any increase in NATO spending because most of the world’s suppliers are American — including General Dynamics, Northrop Grumman, Boeing, Lockheed Martin and Raytheon. Other U.S. companies like Palantir, Honeywell, General Electric, GM, Ford, Space-X, and Collins Aerospace receive significant amounts of revenue from lucrative defense contracts.

Great Britain has BAE Systems, an important supplier of defense equipment to NATO. Only a handful of companies in France and Germany operate in the defense industry.

The U.S. is by far the world’s largest arms exporter, selling 40 percent of total annual sales.

Defense is a very big business in the U.S., so it makes sense that President Trump would be a cheerleader for increased NATO defense spending.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.