The Department of Government Efficiency, known as DOGE, is headed by Elon Musk and Vivek Ramaswamy. Elon Musk is well known as the world’s wealthiest entrepreneur, while Ramaswamy was a candidate for the Republican nomination in 2023.

The goal of DOGE is to “cut the federal government down to size”.

This could have a positive impact by reducing the out-of-control federal government deficit, which is running at $2 trillion annually.

Can DOGE succeed?

Next week Trump will take office and he has promised to let Musk’s group examine every aspect of government spending and regulations with the goal of dramatically shrinking what is viewed as an “entrenched and ever-growing bureaucracy (which) represents an existential threat to our republic”, according to Musk in an editorial published in the Wall Street Journal in November.

One of the premises of this effort is the contention that the Founders of the U.S. constitution never authorized a government that could make regulations and spend money without direct authorization from Congress. There are approximately 400-500 agencies that operate under the government umbrella.

The goal is to cut wasteful spending and to nullify thousands of regulations which Musk alleges were created by executive overreach that was never authorized by Congress.

How much room does DOGE have to cut spending?

Most of the government budget is difficult to attack because it belongs to Defense, Social Security, Medicare and Medicaid. And one of the biggest costs is the interest on the debt, at close to $1 trillion. Whenever Republicans suggest spending cuts the Democrats point out to voters that they might lose their Social Security checks or their access to medical services. The spending cuts never get passed through Congress as elected representatives get the message loud and clear from voters, especially older ones who vote at every election.

So, instead, the GOP pushes ahead with tax cuts but not the spending cuts. And the debt and the deficit grows ever larger.

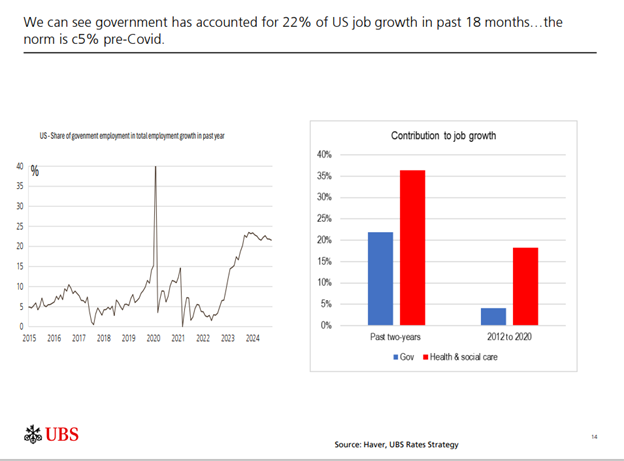

There is another aspect to this. One of the biggest driver of the economy in the last decade has been growth in government employment under both Trump 1.0 and Biden:

Much of this growth in jobs has been at the state and local level where most government employees work, but those jobs are financed in part by grants from the federal government in Health and Education. If those government jobs are cut it will show up in unemployment.

The Sahm Rule was triggered in July 2024, predicting a sharp rise in unemployment and a recession. The prediction has come true partially with unemployment rising to 4.1-4.2 from 3.5 percent. But the prediction of recession is still pending.

Any attempt by DOGE to cut government employment could push the economy into recession. Even a slowdown in the growth of government employment might be enough to cause negative GDP.

In a recession DOGE will not be allowed to carry out its full agenda, but some positive improvements in improved government administration might be achieved.

Hilliar MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.