The Bank of Canada made a jumbo rate cut, its fourth cut to the benchmark interest rate. The 50 basis points cut brought the policy rate to 3.75 percent.

The justification for such a large cut is that CPI inflation has dropped below the target of 2 percent. The actual increase from a year ago is just 1.6 percent.

Is the Bank of Canada worried about deflation?

The Bank of Canada chair made an unusual comment after its jumbo rate cut of 50 basis points. Tiff Macklem said, “We took a bigger step today because inflation is now back to the 2 percent target, and we want to keep it close to the target.”

Since the direction of inflation is lower and lower, that remark must mean that the BOC is worried that the inflation rate might overshoot the target on the downside, not the upside. It was only a couple of years ago that we were worried about inflation going above 10 percent, but now the perception among central bankers is that a weak economy might engender price declines. But wouldn’t that be a good thing?

The chair went on the say, “We need to stick the landing … the economy functions well when inflation is around two percent.”

Does that mean we are doomed to live with all of the price increases during the last four years, plus an average of 2 percent forever from this point?

CPI was most recently below 2 percent in February 2021, just before it shot up to more than 8 percent.

The average price of goods and services is about 18 percent higher than it was before the inflation outburst started in 2021. For most people, after-tax wages and salaries increases have not kept pace with inflation, especially the cost of shelter.

What gets missed in discussions about inflation is that a lower inflation rate, from the peak in June 2022 to below 2 percent in this recent cycle, does not help people cope with the elevated prices that were established during the years of high inflation. Only actual price declines or a faster increase in wages could fix that.

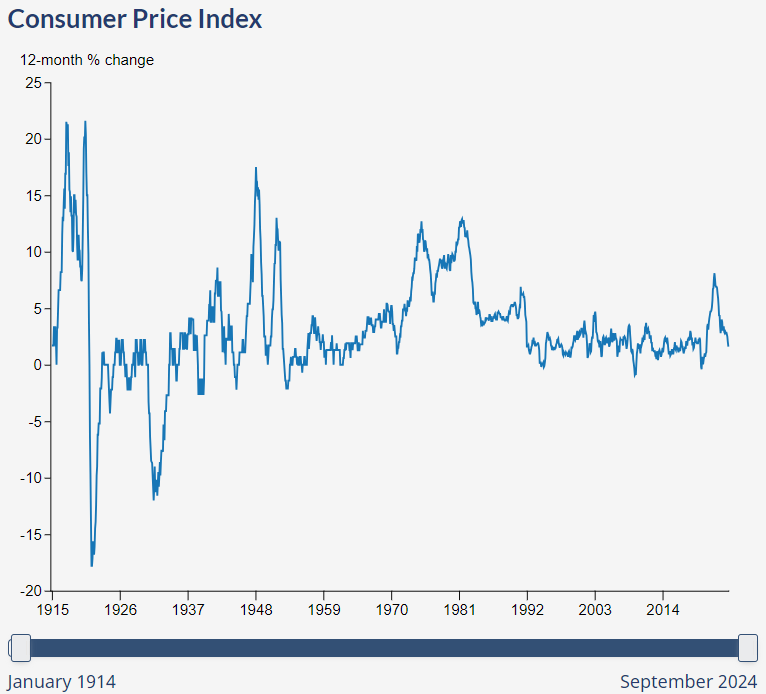

Here’s the long term chart of annual inflation rate changes for Canada, back to the early days of the last century (1914):

Source: Statistics Canada

We can see that from 1990 until 2020 CPI was below 4 percent for most of the time, and even lower than 1 percent at times. To keep inflation under control it might be necessary to live with some deflationary episodes.

Central bankers associate deflation with depression (see the chart from 1930 to 34), and they have pulled out all stops to avoid this, moving rates to zero and lower.

But zero interest rate policies engendered multiple bubbles and a gross misallocation of capital.

Now central bankers are panicking as deflation is threatening, due to an excessive amount of debt held by households, governments and corporations.

The cure is sometimes worse than the disease.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.