China entered full panic mode, announcing stimulus measures to counteract the deflationary impact of weak property prices.

But those policies may not be enough to lift the economy to the 5 percent growth target.

This week China announced several measures to stimulate demand in a weak economy, a last-ditch effort to meet GDP growth goals for 2024.

Here’s a list of the most important measures:

- A half-point cut in the reserve requirement ratio – the amount of money commercial banks must hold. This move is designed to stimulate lending by commercial banks and is expected to improve liquidity in the financial markets by US$140 billion.

- The People’s Bank of China (PBOC) will guide commercial banks to lower existing mortgage rates by one-half percent. The new rate on mortgages will be less than 3.5 percent. Also, the minimum down payment for second mortgages will be cut to 15 percent from 25 percent, a move designed to stimulate speculation in housing.

- The PBOC also announced that it will increase the intensity of monetary policy, a vague measure but clearly indicating support for financial markets and lending.

- The government will inject money into commercial banks — the six largest banks — in order to improve their capital positions. These banks are largely owned by the government but also trade publicly on the stock market. Four of these banks are the largest in the world by the size of their assets - from US$4.5 to $6.3 trillion.

- The PBOC announced a new loan facility to allow banks to lend money to listed companies and major shareholders to buyback shares on the stock market.

- Improved measures for banks to lend 100 percent to buy properties that are sitting unsold. This measure was announced at 60 percent in May but there was little interest from investors.

- Announcement of a new plan to support the stock market by buying shares up to US$113 billion.

In addition, the 40-member Politburo made this announcement:

“Leadership acknowledged the scale of the economic issue and noted the need ‘to intensify the counter-cyclical adjustment of fiscal and monetary policies’ and ‘ensure necessary financial expenditures”.

These announcements on Tuesday triggered a surge in the Shanghai Shenzen CSI 300 index - the best week of gains in ten years:

But this index is still down about 4 percent this year, compared to U.S. markets that are up more than 20 percent. This rally in Chinese stocks arrived just in time for the 75th anniversary of the People’s Republic of China on October 1.

The broad consensus among commentators is that these stimulus measures will fail to push economic growth up to the announced projections. These new moves are much smaller than the dollars injected in the financial crisis of 2008.

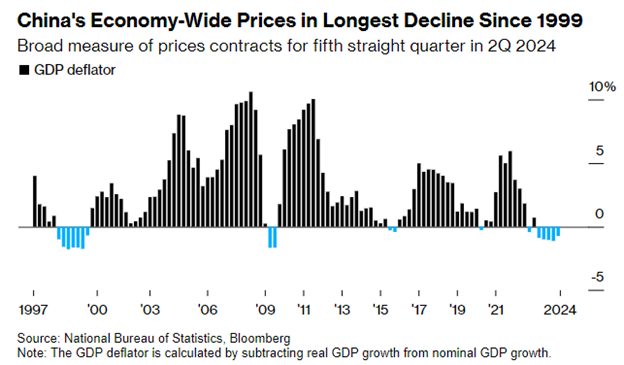

And if that is not enough, China has been suffering from persistent deflation for more than one year.

Deflationary pressures from the bursting of a property bubble are usually very hard to counteract.

Look for the enactment of more aggressive measures in the future.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.