Anticipation ahead of the U.S. Federal Reserve’s first rate cut is growing. Traders are betting on a first quarter-point cut at the meeting on September 17-18 as the most likely date, with more cuts to come later this year in November and December.

But traders are wrong in thinking that rate cuts are good for the economy and the stock market in the short term.

Academic studies show that the Federal Reserve acts too late to curb inflation or to prevent recessions. We saw that in 2020-2022 when the CPI was rising rapidly but the Fed and the Bank of Canada both decided to wait before raising rates. Central bankers called inflation “temporary, transient and transitory” to justify their lack of action.

The period of elevated inflation started just after the discovery of COVID-19 in January 2020 and continued to mid-2022. The highest annual inflation rate occurred in June 2022 at 9 percent.

The Fed started to raise the Fed Funds rate in March 2022, with a quarter-point rise from 0 to 0.25%. The Fed went on to raise interest rates eleven times after that, making its last hike in July 2023 to the cycle high of 5.25% — a total of 500 basis points in 15 months. So, the Fed kept raising rates for a year after peak inflation and these hikes were ineffective in preventing inflation from reaching almost double digits.

Now signs of a recession are abundant in the U.S., especially with the increase of unemployment from a low of 3.5 percent to the latest observation of 4.1 percent for June 2024. But, in this cycle, the Fed has yet to cut rates. The Bank of Canada was one of the first central banks to cut rates by a quarter of a point in June, to 4.75 percent.

It is likely that the Fed will be cutting rates starting in September and will continue to cut if the economy is in a recession. But these initial cuts will be too small to have much impact, and definitely too late to prevent the start of a recession.

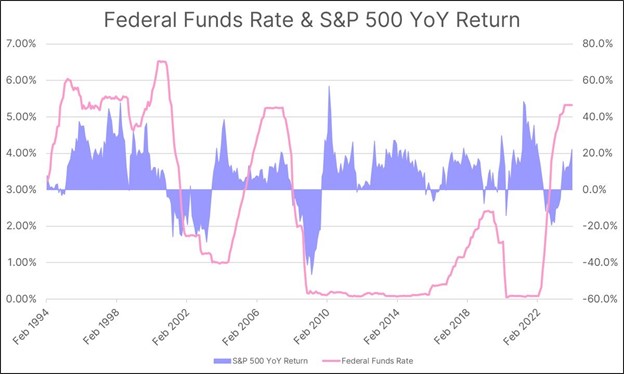

Reef Insights published an insight about stock market cycles and rate cuts. Here is their chart from 1994 to present:

Source: Reef Insights

We see that multiple rate cuts from 2000 to 2002 came too late to prevent a bear market and “did not serve as a parachute for equity markets”. Again, six years later, the Fed acted too slowly when banks, Wall Street firms and auto makers had to be rescued or went bankrupt in the U.S. and around the world.

Of course, the lowering of interest rates by the Fed probably wouldn’t have been sufficient to avoid the crisis which started because of excessive financial leverage throughout the system.

The Fed is already too late in this cycle to delay the start of a U.S. recession. Traders will be disappointed that multiple Fed interest rate cuts will not keep the stock market at record highs either.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.