Growing China-based production of solar panels and other key components ensures that a massive supply glut will arrive in 2024.

Prices for solar panels are plummeting in most world markets, but the U.S. consumer will pay substantially higher prices.

According to Bloomberg BNEF, China-based manufacturers continue to build new capacity beyond the level of expected demand for solar modules (panels). Capacity doubled in 2023 and soon there may be 1,000 Gigawatts or 1 terawatt of capacity. Overcapacity is present in other key components for panels also.

China makes 93 percent of all solar-grade polysilicon, a key ingredient in the cells that are made into solar panels.

Polysilicon manufacturing increased 52 percent from 2022 to 2023, resulting in collapsing prices, from $35 to $8 per kilo.

As Chinese manufacturers increased production and lowered costs and prices other suppliers outside China struggled to match those prices and lost market share. The record of the last five years of production shows how Chinese manufacturers have increased their dominance in polysilicon:

![]()

We see that non-Chinese polysilicon manufacturers provided 34 percent of supply in 2019 and now they produce only 7 percent.

The oversupply of polysilicon has pushed prices lower, and China is making too much of the product to absorb at home.

Photovoltaic cells are used to convert sunlight into electricity. Cells are assembled into panels. Chinese companies supply 91 percent of the cells sold to the global market.

The Chinese are installing solar panels at a rate that is much faster than anywhere else in the world, but the supply is more than China can use.

In 2023, solar panel production globally increased to about 623 gigawatts, while only 444 GWs were installed worldwide. And the oversupply will be worse in 2024 even as installations grow to 585 GWs. The U.S. will install about 45 GWs.

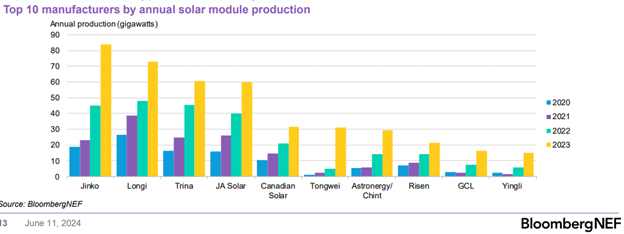

As mentioned above, global manufacturing capacity in solar modules may approach 1,000 Gigawatts or 1 terawatt in 2024, led by China. All that capacity cannot be absorbed by the market in 2024. All large solar panel producers are based in China, although Canadian Solar supplies more than a third as much as the leading producer, Jinko Solar.

Similar to polysilicon, oversupply of solar panels is triggering a price war, with prices as low as $0.12 per watt at the end of 2023.

Although the U.S. and Europe have a very small share of the market in this sector, tariffs against Chinese solar products have gone up as policy makers eye this excess capacity. One U.S. based producer, First Solar ($FLSR) made about 12 GW of modules, which is 2 percent of the global production.

Efforts to circumvent tariffs on Chinese exports to the U.S. by routing shipments through Vietnam, Cambodia, Malaysia and Thailand are being thwarted by new tariffs to be set up against those countries. Duties could be applied retroactively to earlier shipments.

Solar panel prices that are $0.10 per watt globally could be as high as $0.30 per watt in the U.S.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.