The Bank of Canada goes on hold, with no rate hike this week. But those expecting significant interest rate cuts any time soon will be disappointed.

The end of the multi-decade period of declining rates passed without much fanfare. But rates in Canada are now as high as they were 23 years ago. This happened suddenly, as inflation soared to more than 8 percent last year and the Bank of Canada was forced to raise rates aggressively.

Inflation in Canada was below 2 percent until early 2021, depending on which measure is used, and peaked at 8 percent in mid-2022.

Source: Bank of Canada

The blue shaded area shows the target range for inflation (1-3%) and note how the yellow line – CPI inflation - exceeded that range for the last couple of years.

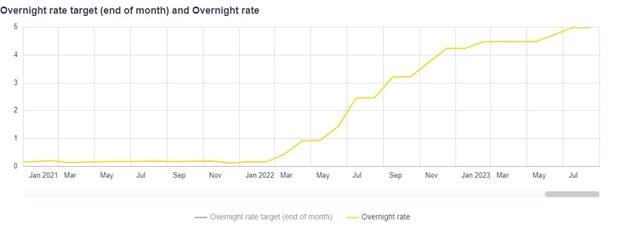

The interest rate that the BOC charges for overnight loans to banks was pushed up from close to zero in early 2022 to 5.01 percent this year.

Source: Bank of Canada

The wishful thinking displayed by many market participants that rates might start to come down soon is supported by the CPI coming close to the top end of the BOC’s target range. But the harsh reality is that central banks are no longer operating in a low interest rate environment, and monetary authorities all over the world have changed to more hawkish views on inflation.

According to James Grant, of Grant’s Interest Rate Observer, U.S. interest rates move in 150-year cycles. Canada’s rates follow a similar pattern. If this is true, we are in for more rate hikes eventually, or at least no more rate cuts for a very long time.

You could say rates will be “higher for much, much longer”, as Grant wrote on August 18.

The BOC paused rate hikes in March and April this year, because they believed that they had done enough tightening and wanted to see the impact when higher rates worked their way through the system. But decision makers at Canada’s central bank had to do resume rate hikes in June and July as inflationary pressures continued to build.

Central bankers in advanced economies remain focused on restoring price stability. While global growth slowed, led by weakness in China, a slower growth rate will not be enough to keep inflation below 2 percent.

In the U.S., the economy that matters the most to all central bankers, growth is still strong. Consumer spending is robust, as the U.S. practice of locking in mortgage rates for 30 years protects most consumers from interest rate increases for a very long time. A recession is unlikely to start there before 2024.

Inflation is still worrisome because there could be widespread demands for higher wages. Shelter costs (largest component of CPI) are still rising. Energy costs are up recently.

The BOC said, “The Bank remains resolute in its commitment to restoring price stability for Canadians.”

The next meeting is in October. Unless there’s a deep recession gripping Canada then, rate cuts will not arrive that soon.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.