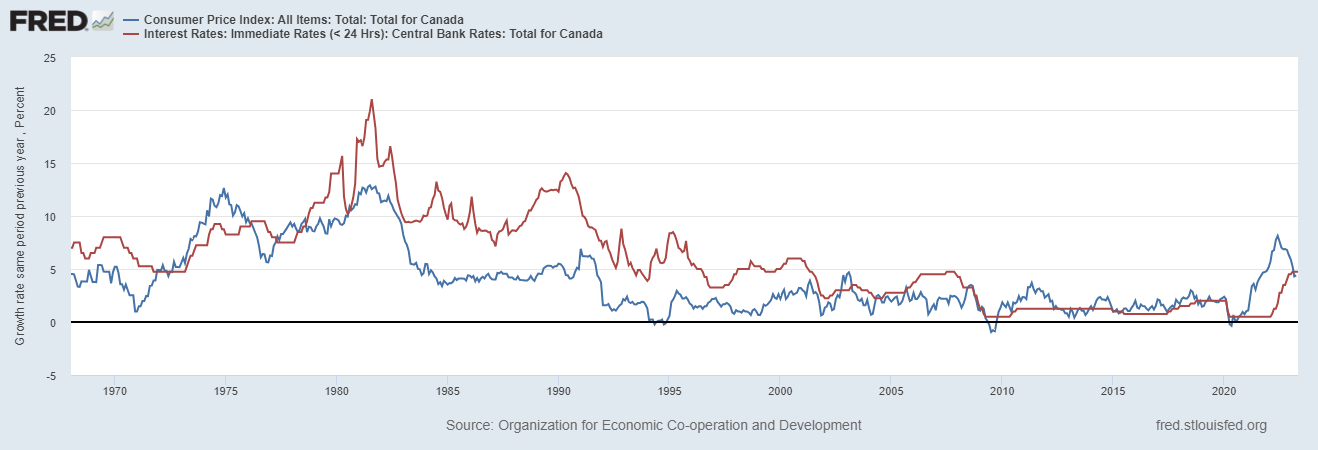

The Bank of Canada raised its interest rate again this week, the tenth increase since March 2022.

The new level, at 5 percent, means that many borrowers will face rates of 7 percent and higher on bank loans and mortgages.

Why does the Bank of Canada keep raising rates?

The Bank of Canada (BOC) set out its reasoning for continuing to raise rates in the press release on Wednesday.

The most important factor is the worry about inflation. While the CPI is moderating, as we saw in the US CPI report this week with core CPI below 5 percent, the BOC still sees a strong economy in Canada, with wage increases of 5 percent and shortages of workers. Inflation in the service component is too strong and the most important sector of the CPI, shelter, was still elevated in Canada and the US. The BOC mentioned the rising cost of houses in its press release.

The next meeting of the BOC is September 6, and observers believe there will be one more hike then.

The Bank of Canada rate was as low as 0.25 percent as recently as January 2022. Mortgage rates were as low as 1.5 percent on variable rates at that time.

In this week’s press release the BOC said, “Global inflation is easing, with lower energy prices and a decline in goods inflation. However, robust demand and tight labour markets are causing persistent inflationary pressures in services.”

In a press conference after the release the governor of the Bank of Canada, Tiff Macklem, said that that CPI inflation will come down to its 2 percent target by 2025.

Most mortgage holders have not seen their payments increase yet, but mortgage rates on new loans are much higher now. About 50 percent of mortgage holders are facing much higher rates in the next two years, when considering both 5-year term renewals and variable rate mortgages. The payment shock will cause most heavily indebted homeowners to radically alter their spending habits in order to handle the large increase in monthly mortgage payments.

On a 25-yr amortization a household with a $500,000 mortgage that renews with an increase from 1.50 to 6.00 percent would see payments rise from $2,000 to $3,200 per month, a 60 percent increase. Since many Canadians are living close to their manageable limit of monthly expenses, they will have to cut $1,200 of discretionary spending immediately. Expect reductions on things like new cars, vacations, renovations, gym memberships, clothing and restaurant meals etc. This change in behaviour will help the BOC meet its goal by reducing consumer demand but will hurt the economy and probably cause a recession.

The BOC will keep rates high until the effects ripple through the system. But many borrowers will get into trouble soon with such a large payment increase in such a short time.

Watch for the BOC to reverse its stand on high rates by 2025 or sooner if there’s a recession and mortgage defaults soar.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.