The Bank of Canada uses more alarmist language in its latest Financial System Review (FSR), a regular report that discusses the risks to the Canadian financial system.

Should we be more worried about Canadian banks?

Canadian central bankers write an assessment of the health of the Canadian financial system on a regular basis, highlighting risks like high household and corporate debt. In most of these reports the conclusion is that the system is in better shape than its counterparts in the rest of the world, and barring an unusual exogenous event, the Canadian financial system, led by several very large banks, will survive and avoid any serious difficulties.

In May 2023 a new FSR report took on a more serious tone, even contemplating the possibility of some losses at the Canadian banks.

For example:

“If a severe recession were to occur, the balance sheets of Canadian banks could face pressures through credit and funding channels. Significant unemployment and a large drop in house prices could lead to a deterioration in asset quality and increased credit losses for banks. This could weaken market sentiment and raise funding costs. In response, banks would likely reduce the supply of credit to households and businesses as well as that of liquidity to non-bank financial intermediaries.”

The idea seems to be that difficulties at the banks would be transmitted to the economy through a reduced supply of credit to households and businesses. Since the Canadian private sector is one of the most indebted in the world, at about 220 percent of GDP, this situation could be a disaster for some families and businesses who would be unable to refinance or rollover their loans.

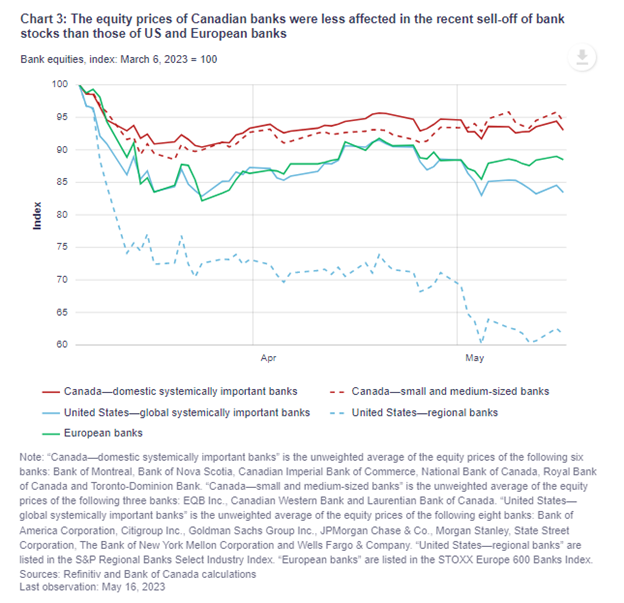

This report was written during a period when several “regional banks” in the U.S. had to be closed or rescued, along with a large Swiss banking institution, Credit Suisse. Most U.S. regional banks are not small and collectively hold trillions of dollars of assets and deposits.

This chart shows that the Canadian banks held up better in the stock market than the U.S. regional banks and large European and U.S. globally systemically important banks. This might reflect the health of the Canadian banks, or it might just show the love that Canadian investors feel for their heavily owned shares of Canadian banks.

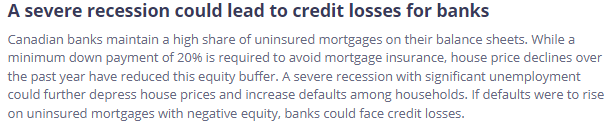

But the BOC does mention that a severe recession could mean credit losses for banks:

Banks hold minimal “provisions for credit losses” as is allowed based on the amount of losses experienced in the last few years, especially during the Covid-19 crisis.

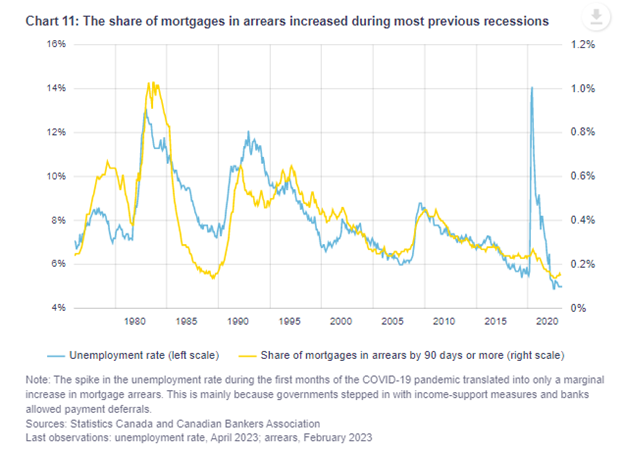

The increase in arrears (yellow line) is muted compared to cycles going back to the 1970s:

But there has not been any recession yet, which would lead to higher unemployment, arrears and credit losses.

A recession seems likely given widespread tightening of credit conditions. The ability of banks, businesses and households to absorb the impact of a recession with record high debts will determine how they cope with this latest bout of uncertainty.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.