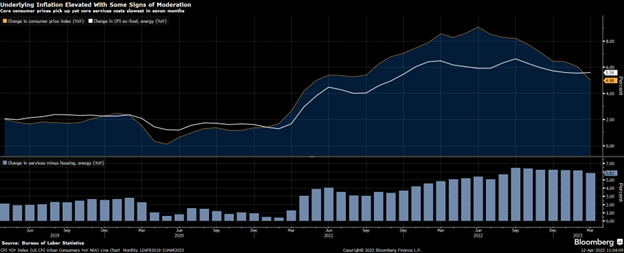

Inflation moderated slightly in March but remains stubbornly high. The consensus is that central banks must cut rates later this year, but the latest CPI for March puts that type of wishful thinking into doubt.

Will central banks hold the line on interest rates even as demands to cut rates grow louder?

The CPI showed a slight deceleration as it dipped to 5 percent. But unfortunately for those who are desperate for cuts, such as some real estate investors, the Core CPI actually climbed a bit.

The word used by many observers today is that inflation is “sticky”. We used “temporary, transient and transitory” a year ago, but inflation persisted for much longer than expected.

Now the thing that worries observers the most is the white line — Core inflation — that has been growing steadily for about a year and is now above headline CPI. The Core increased by 5.6 percent year-over-year.

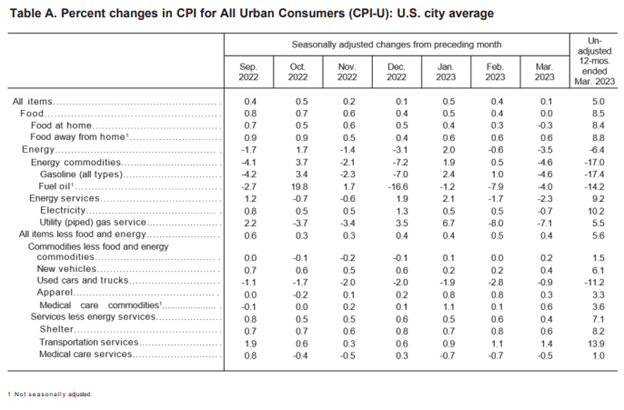

Of course, the largest component of inflation is Shelter. And the news in that category is mixed. Here is the inflation table by category, which shows Shelter growing at more than 8 percent from a year ago (third line from the bottom):

Source: Bureau of Labor Statistics

The problem is that Shelter includes some measures, such as Owner Equivalent Rent, that are not correlated with the economy. For example, Shelter inflation stayed under 2 percent while house prices grew at about 7 percent for about two decades in Canada.

Fed officials and other commentators are divided on what these numbers mean. Most Fed officials want to stick to their commitment to get inflation down to 2 percent before easing up on interest rates and quantitative tightening. But there is enormous pressure from all sides, especially those who are carrying a lot of debt, to start to cut rates as soon as possible.

Barry Sternlicht has been on the CNBC financial network criticizing the Fed (which he calls a “merry band of lunatics”) for continuing to raise interest rates. He has an estimated net worth of $4 billion. He, along with other investors, owned Starwood Hotels which he sold to Marriott in 2015 for $12.2 billion.

Sources: Bloomberg and Fortune

According to the article, Sternlicht’s private company owns about 125,000 apartments so he can track rents being charged. He sees a deflationary impulse coming from rent, which is one of the components of the Shelter category.

The underlying issue for most of these real estate speculators is that interest payments on large amounts of debt are starting to hit hard. After more than a decade of extremely low rates, the amount of leverage that was built up in the system is at an unprecedented level.

There is no way for a large number of real estate investors to pay down that debt without triggering an implosion of asset prices.

Widespread reckless borrowing always leads to a painful shakeout. A premature cut in rates might delay that phase of the credit cycle for now, but it has to happen sooner or later.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.