Gold prices took off higher this week as doubts about the US dollar spread throughout the markets.

The gold bugs have been very quiet during this inflationary period, until now.

Are gold and gold miners about to catch a bid?

Early articles I've written in this weekend note series were on gold, in 2015 and again in 2018. Those turned out to be way too early, as gold and gold miners have consistently underperformed.

Looking back on eight years it seems obvious that the people who would have normally speculated with gold had been lured to the crypto world, which claims similar benefits to gold.

Now that the cryptocurrency universe is at least partially imploding it might be time for gold to have its day in the sun.

Crypto aside, gold prices usually do better when real interest rates are negative, when overnight interest rates are lower than the CPI. This prevails today, although rates are only slightly negative after many rate increases and moderating inflation.

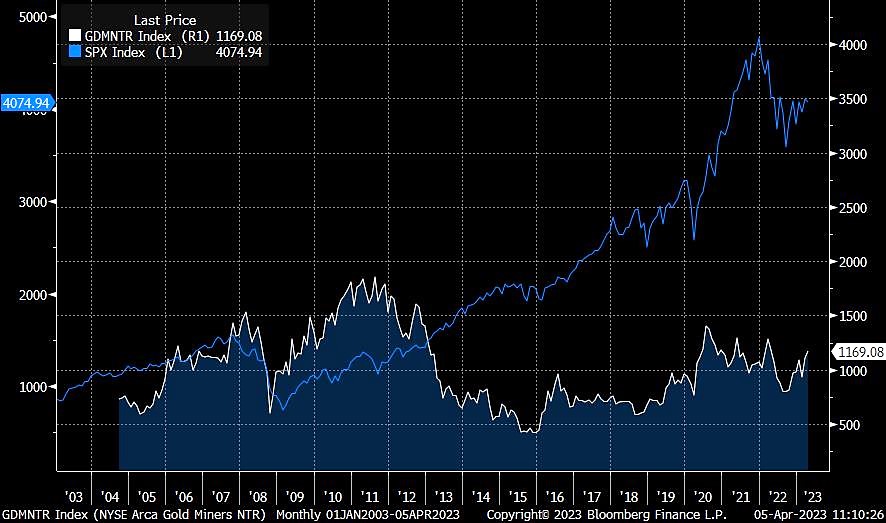

Using twenty years as the time horizon we can see that gold miners have vastly underperformed the S&P 500, as valuations on that stock index have soared, led by large-cap technology companies like Apple and Microsoft.

Source: Bloomberg

While the S&P500 gained about four-fold, from 1,000 to 4,000 (left axis), the Gold Miners Index ARCA was basically unchanged over the twenty years.

The gold price gained about 5 percent this week and is up substantially over the same period.

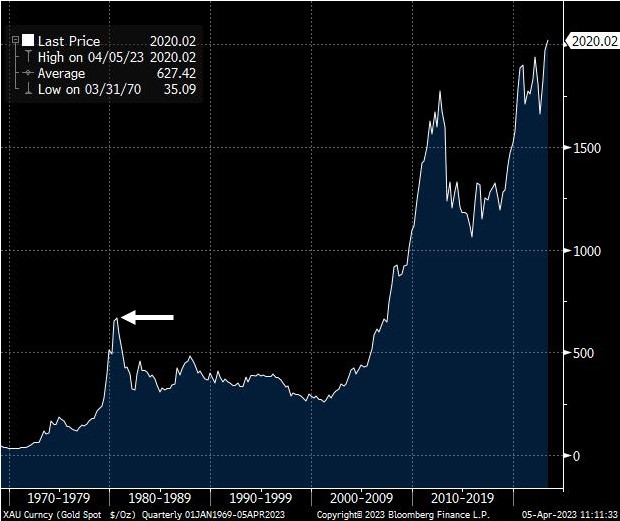

This chart goes back to the 1960s, when gold was fixed at $35 per ounce.

Source: Bloomberg

The price peaked at $850 per ounce in 1980, and it took until about 2008 to regain that price in nominal terms (unadjusted for inflation). If we do an inflation-adjusted price, gold only needs to gain another $1,000 from today’s price, to $3,100 to equal that peak.

Gold bugs believe that gold will protect us from inflation over the long term, as it cannot be debased by central banks printing excessive fiat money.

If someone had bought gold at $600 in 2009, they would gained 4-fold in just 14 years. But the S&P500 would have beaten that with a 6-fold return.

Given the worry about regional banks and bank bailouts as well as ballooning government debt after the COVID-19 crisis in 2020, it’s a decent bet to expect bigger gains for gold this time.

But gold miners might be the even better wager.

Gold miners have an advantage over gold. The miners can find more gold for shareholders through exploration. There has not been a discovery of a major new gold mine for at least ten years, because companies were concentrating on reducing their expenses. But at these gold prices exploration expenditures will expand.

If you want to bet on gold surpassing its old 1980 high of $850 per ounce, consider investing in some gold mining companies.

But be careful. As Mark Twain said after a bad experience, “a gold mine is just a hole in the ground owned by a liar.”

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.