Famed investor Warren Buffett, of Berkshire Hathaway, has a saying about market bubbles. He says, “You only find out who is swimming naked when the tide goes out.”

Is the tide going out? Who is swimming naked?

As discussed last week the bear market is about one year old, and the markets are down slightly less than 20 percent.

A proxy for “the tide going out” could be removal of liquidity as provided by central banks, as that injection of funds has been the key factor in keeping markets afloat during decades of booms, busts and bubbles.

As the central banks of the world recently have been raising rates and pressuring heavily indebted speculators, we could say that the tide is definitely going out now. And soon we should see who has a bathing suit and who is naked.

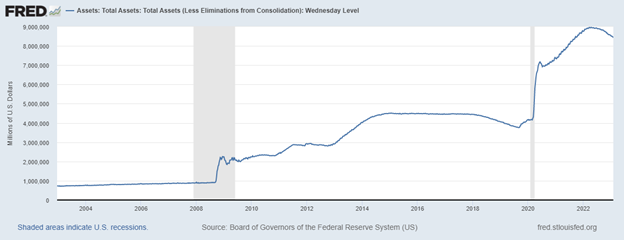

But the central banks have only started removing liquidity from the markets. The Federal Reserve is the most important of all central banks and its balance sheet is still enormous compared to just a few years ago.

We can see from the graph that the Fed has shrunk its balance sheet only fractionally compared to the massive amounts injected since the 2009 crash and especially after the 2020 Covid-19 crisis and recession.

Prior to 2009 the Fed balance sheet, its holdings of government bonds, mortgage-backed securities (MBS) and other liquid securities such as T-bills, was about $1 trillion. Today it is close to $8.5 trillion and is within a trillion of its all-time high in 2022.

There are already some views of a few naked bodies wading in the water, and there’s a long way to go until the tide is fully retracted.

For example, last year we had the crypto collapse, with many tokens and exchanges that were in the cryptocurrency universe failing completely. So far Bitcoin has managed to stay above the fray.

A very large player, FTX, went bankrupt and its founder, Samuel Bankman-Fried, is facing several criminal charges. This was a big blow to the $1 trillion valuation of the crypto universe.

Recently a huge conglomerate based in India has come under scrutiny again. Its founder, Gautam Adani, formerly the second most wealthy person in the world, this time is under fire from a short-sellers report that describes a complex network of closely held companies that may be poorly financed, under-collateralized and overvalued. Hindenburg Research issued it in late January.

Shares of the flagship company symbol ADE: India were down close to $100 billion (44%) in just a few days.

The research firm called Adani Enterprises “the largest con in corporate history” due to potential manipulation of asset values.

One red flag highlighted is the fact that the Adani auditor has only 4 partners and 11 employees, not enough to audit an entity worth $218 billion.

Here is the report, with a conclusion that asks 88 questions of Adani.

I expect to see many more people swimming naked before this cycle ends.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.