The inflation rate in Canada hit a new high for this cycle as it reached 7.7 percent growth.

The Bank of Canada’s goal is to get inflation to 2 percent.

Can the Bank of Canada succeed?

Carolyn Rogers. Source: Bank of Canada

Carolyn Rogers, senior deputy governor of the Bank of Canada said that “inflation is keeping us up at night and we will not rest easy until we get it back down to target”.

That target will be very difficult to reach.

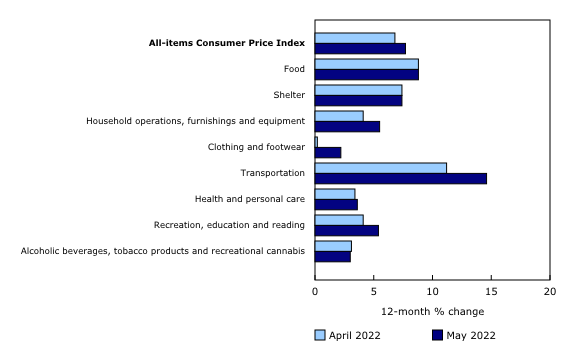

Source: Statistics Canada

The chart shows that food, shelter, and transportation are rising. The CPI at 7.7 percent was the fastest growth since January 1983.

The largest component — shelter — is poised to push even higher. Here are the sub-components of shelter:

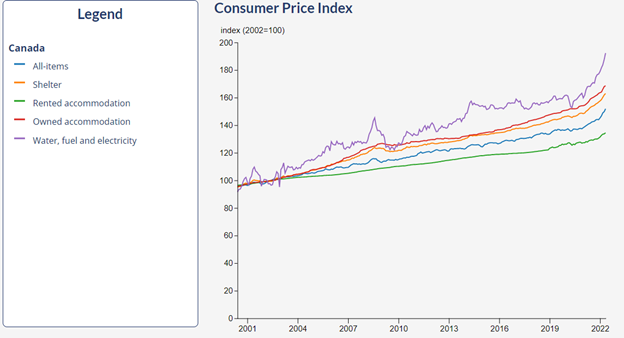

Source: Statistics Canada Consumer Price Index Data Visualization Tool (statcan.gc.ca)

Shelter is about 30 percent, the largest weighting in the CPI.

The fastest rising costs in shelter are “water, fuel and electricity”, shown in the top line (purple) but that component has a small weight.

The most important sub-index, “owned accommodation”, shown in red, is starting to outpace both shelter and the CPI.

As regular readers know, the cost of buying a house is not included in the CPI. As a result of this omission, it has been possible for Canadian house prices to grow at an average 7 percent per annum for more than two decades (a four-fold increase), while the CPI and the shelter sub-index have remained below 3 percent annually, until recently.

That disconnect between house prices and inflation is changing because of the key drivers of the shelter cost index.

Shelter has 3 sub-components: Rented accommodation, Owned accommodation, and Water, Fuel and Electricity. The weightings of those sub-components are 6.63%, 19.73% and 3.67% respectively.

Since the “owned accommodation” component is about 2/3rds of “shelter” at 19.73 percent, and about 1/5 of the entire CPI, it makes sense to examine what goes into that sub-index to find clues to what is likely to happen to inflation in the near future.

The “owned accommodation” sub-component comprises these elements:

- Mortgage interest cost 3.4%

- Homeowners’ replacement cost 5.61%

- Property taxes and other special charges 3.40%

- Homeowners’ home and mortgage insurance 1.38%

- Homeowners’ maintenance and repairs 1.66%

- Other 4.26%

Source: Statistics Canada Table 18-10-0007-01

These weightings are of the entire CPI so two components, mortgage interest and replacement costs make up about 9 percent of the CPI while adding property taxes and other special charges bring that to 12 percent.

These heavily weighted components are likely to rise, perhaps much higher, for many more months as interest rates, taxes and building costs increase.

The five-year fixed-rate mortgage interest reached 5.8% this week, and housing construction costs are rising at an estimated 20 percent year-over-year.

Most of the recent surge in mortgage interest was not included in the May report of CPI.

So, the Bank of Canada has a difficult task ahead as it tries to fight inflation by raising interest rates, but that will push the CPI ever higher.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.