The current inflation surge in Canada and around the world demands answers from government. Will inflation be brought under control? How?

I was invited along, with others, to present on March 28, 2022, to the Standing Committee on Finance for the House of Commons on a Zoom call. The topic is inflation, and the housing bubble is a key part of that.

You can watch the whole two hours, including my statement and the Question-and-Answer period. There were several witnesses and committee members who asked questions. I was the first presenter as a witness, about 6 minutes from the beginning of the video.

Following is my written submission which includes speaking notes for the five-minute opening statement and some short comments on several ideas for getting the housing bubble and inflation under control.

1. Opening statement to House of Commons Finance Committee

March 28, 2022

Thank you for the invitation to contribute to this very important work, tackling the question of what to do about inflation.

I am here as a private individual and author of 3 books on finance. I also work as an investment advisor and portfolio manager with one of Canada’s largest independent wealth management firms and I am now in my 43rd year of doing that work.

My first book, called “Investment Traps and How to Avoid Them” warned of the stock market bubble in 1999.

The second and third publications came out in 2015 and 2018, as first and second editions of the book titled: “When the Bubble Bursts: Surviving the Canadian Real Estate Crash”.

People have noticed that it has been six years since the first edition was released, and the housing bubble keeps getting bigger and bigger. Does that mean the bubble will never burst and my thesis is wrong?

I like to explain it this way:

I am not going to be wrong about the housing bubble bursting, but I am very early!

I wrote books on housing bubbles because I kept hearing from my clients and others that house prices will always go up. As an investment professional I get nervous when people become so certain about an investment but especially one that involves borrowing so much money. And each year more people were getting themselves, and their children, heavily invested in housing. By 2010 the housing bubble was well on its way and since the brief COVID-19 recession in 2020 it has become a full-blown mania, probably unsurpassed anywhere in the world.

I see parents and grandparents putting a secure retirement at risk by gifting large down payments to their offspring, co-signing huge mortgage loans and buying second and third properties often used to provide housing for their children at little or no rent. While this will be fine if house prices never drop, it will be a disaster if we see a crash as happened in the US, Ireland and Spain during the Global Financial Crisis.

The topic today is inflation, not housing bubbles. But there is an important connection between the two.

When people say inflation, they usually mean the Consumer Price index. In my research I found there is a complicated relationship between the CPI and house prices.

House prices in Canada, on average, have grown at more than 7% per annum over 22 years. This means a 4-to-5-fold increase in total.

In dollar terms a $200,000 house in the year 2000 is now costing about $800,000 to $900,000. And even more in Toronto and Vancouver.

This is obviously inflation, and the CPI considers the cost of housing as its most important component. In the CPI “shelter costs” are weighted 31%. But while house prices increase at 7% or more the shelter component of inflation increased by only 2.6 percent per annum.

It might be a surprise to learn that the CPI does not include house prices when calculating inflation.

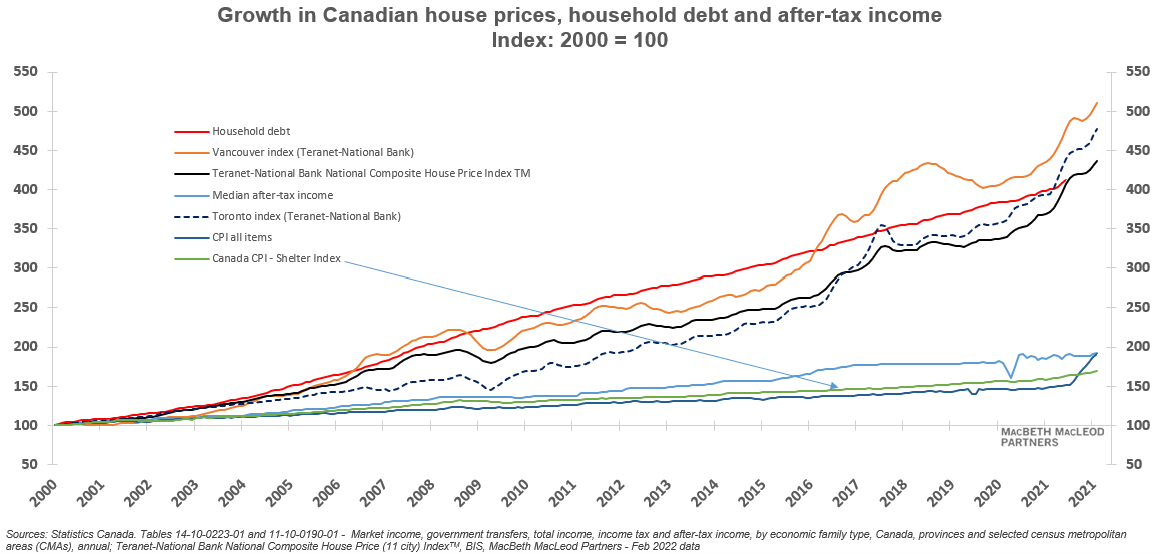

To illustrate this, I distributed a chart to members of the committee that shows 7 indexes, a very busy chart. The chart shows house prices in Vancouver, Toronto and the average Canadian house price as well as outstanding household debt.

The chart also shows the median after-tax income, CPI and shelter costs.

All data series are re-based to start at index level 100 in 2000.

In 2022 house prices and household debt are all well over 400, with Vancouver over 500.

But the shelter cost index has increased to only 175, while CPI and after-tax median income are both just under 200. So, house prices more than four-fold, shelter costs less than two-fold.

So, if the house prices followed the shelter component of CPI that $800,000 or $900,000 house would cost only $350,000. Now that would be nice, at least for the first-time buyer!

Instead of house purchase prices the CPI uses a monthly payment approach to shelter costs. Since the interest cost in the monthly mortgage payment is usually the largest part of shelter costs, when interest rates are low or are pushed lower by central banks, the cost of shelter also remains low. Keeping interest rates low and therefore the cost of shelter low in the CPI allowed the central bank to ignore the housing bubble.

But now if the Bank of Canada allows mortgage rates to rise above inflation, there will be a sharp increase in that monthly payment causing the shelter component to rise faster than the CPI.

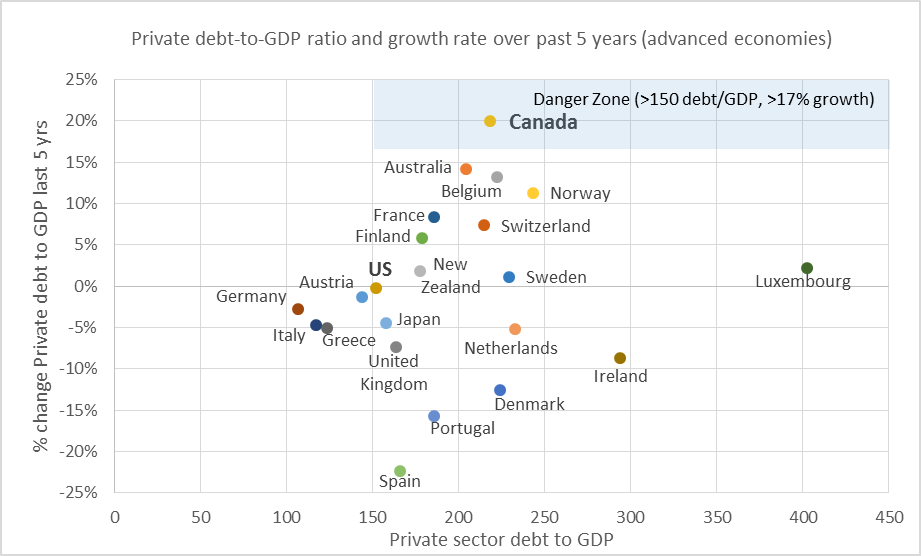

Before I wrap up my statement, I want to mention one other key issue that connects housing and inflation. That is the world-leading burden of private sector debt in Canada. Private sector debt is household debt plus corporate debt, not including the financial sector, usually as a ratio of GDP.

The need to borrow to keep up with house prices has led Canadians into a dangerous place when comparing private sector debt to other countries. Research shows that any country that has a ratio of private sector debt to GDP over 150% and has experienced rapid growth in that ratio will endure a financial crisis eventually.

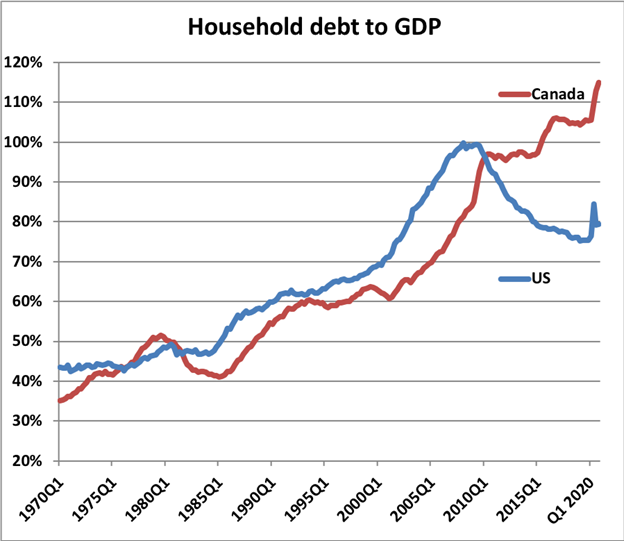

Household debt is 110 percent of GDP. Of course, most of that is mortgage debt.

Recently corporate debt has grown rapidly also, to about 123 percent of GDP. So, total private sector debt at 233 percent is well above the minimum threshold for a financial crisis.

Raising interest rates with such an elevated burden of private sector debt will be difficult.

But inflation must be lowered, even if it means bursting the housing bubble and triggering a recession.

Thank you for your attention and I look forward to your questions.

2. Expansion of debts related to housing inflation in Canada

Canada’s private sector debt is in the danger zone. This is measured by the level of debt compared to GDP, with Canada at 233% of GDP compared to the threshold of 150% to reach the danger zone. And there’s been a rapid increase in the ratio of debt to GDP of greater than 17% over a five-year period.

Source: Bank for International Settlements. BIS.org

Chart that shows how Canada’s household debt compares to the U.S.:

Source: North Cove Advisors and Statistics Canada

3. Role of government mortgage insurance in encouraging bubbles

The Canadian government offers generous insurance terms to protect the lenders, mostly banks, against default for mortgage finance lending to households backed by real estate. This insurance allows lenders to take on mortgage lending that they would not otherwise tolerate because the government will take the risk and absorb the losses. CMHC and Sagen are the two providers of such insurance backed by the Canadian government.

4. Incentives for banks to do mortgage lending rather than lending for more productive endeavors

One important profit metric to measure banks’ performance is “return on equity” or ROE. The smaller the E, or equity or capital, the higher the ROE and the better the performance. The amount of equity required by regulators depends on the type of loan. For example, a business loan is considered risky and therefore a capital requirement of 100% or more is needed. A mortgage loan, on the other hand, is considered low-risk and even zero-risk if backed by government mortgage insurance. By emphasizing mortgage lending Canada’s banks can keep their capital requirement low and their ROE high.

5. Minsky financial instability hypothesis

Hyman Minsky was an American economist who did not become famous until the term “Minsky Moment” was popularized. He theorized the bank finance cycle came in three stages:

- Hedge finance – all loans can be repaid out of income

- Speculative finance – income is enough to pay the interest on the loan only

- Ponzi finance – income is insufficient to pay the capital and interest, requiring a continuous flow of new finance

This last stage occurs when borrowers need new loans to refinance their existing loans and cannot afford to pay even the interest on the loan unless they sell assets. Once new loans to those borrowers dry up, when the lenders get nervous, a Minsky Moment arrives, and assets must be sold to cover loans in default. This leads to a deflationary spiral when heavily financed assets, like real estate are sold at lower and lower prices by the lenders.

Canada’s residential real estate market has been in the Ponzi finance stage for several years now. Lenders are still confident in providing credit to real estate speculators, but this will end at some point, perhaps when rate rise.

6. Recommendations to end the boom-and-bust cycle in housing

- Measure house price inflation properly.

- Reduce or eliminate government insurance on mortgage lending

- Require banks to carry a higher level of capital for real estate loans

- Introduce legislation to protect renters, especially for families with children.

- Encourage the construction of purpose-built rental homes that accommodate families with children

- Limit the amount of household debt for home purchase to 3-4 times family income

- Establish a Royal Commission to examine all aspects of the inflation in residential real prices. Make recommendations to formulate rules to prevent a repeat of house price inflation and overreliance on mortgage debt finance.

Further information on all these topics and much more can be found in the second edition of “When the Bubble Bursts: Surviving the Canadian Real Estate Crash”. Dundurn 2018.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.