Persistent increases in inflation signal the end of this bull market.

The increase in inflation will push interest rates higher and stock market valuations will come down.

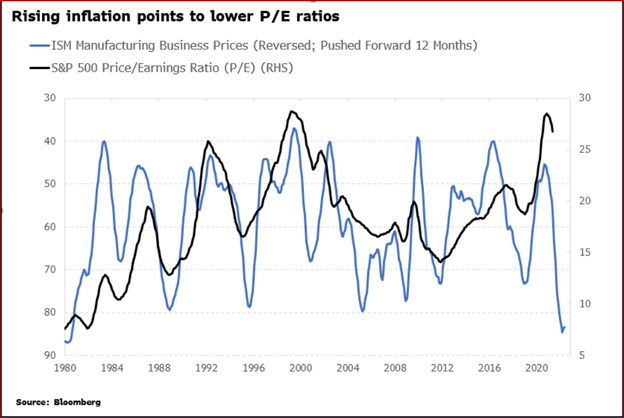

The Markets Live segment of Bloomberg published a chart a few days ago that caught my eye. The chart shows the relationship between Manufacturing Business Prices Paid and the S&P 500 Price Earnings ratio. Prices Paid is not a component of CPI but is a survey that has been reliable as a predictor of future inflation.

The chart creator inverted the Prices Paid index and pushed the timeline forward by 12 months:

We can see that when prices paid soared above 10 percent in the early 1980s, the P/E ratio of the S&P 500 was below 10 using the right-hand vertical axis. The P/E ratio is a proxy for market valuations.

The latest reading of the Prices paid component (shown inverted), is found at the bottom right in blue, and at close to 90 is at the highest since 1980 (left hand axis)

Today the P/E ratio (black line) is close to 30 (upper right) so the valuation of the S&P 500 is about triple what it was in 1980 and equal to its peak in 2000.

The discrepancy is the widest it has been in four decades as the blue line and the black line generally track each other pretty closely.

This 42-year period was dominated by inflation trending lower and lower. And P/E ratios generally moved higher. So it’s understandable that people are confused by this possible reversal of trend. Is it temporary as has happened countless times? Or is this the start of a new trend to higher inflation and interest rates and lower P/Es?

The initial reaction of central bankers and investors was to shout that inflation is “transitory, temporary and transient”, as mentioned by Jerome Powell of the Federal Reserve.

Here’s a report from August 2021 showing his conviction, at that time, that inflation is temporary.

But now it is clear that inflation might not be temporary. And if the U.S. CPI were to soar about 10 percent we can expect a very negative impact on the S&P 500 and P/E ratios. The January CPI report was 7.5 percent. In Canada the CPI was calculated at 5.1 percent in the most recent report.

Higher inflation could be good for investors.

I remember trying to place a new issue of Bell Canada preferred shares at $20 par value with a 13.5 percent dividend circa 1981. The shares were convertible into Bell Canada common shares, which owned 37 percent of Nortel Networks.

Investors hesitated because they received 15 percent from their risk-free GICs. It was a tough sell, but I placed my allocation.

Those shares went above $200 per share around March 2000 after investors traded them for Bell common shares and the Nortel share price peaked.

The best time to buy stocks is when inflation and interest rates are high and P/E ratios are very low.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.