The Federal Reserve has been promoting asset bubbles for years. This easy money policy has created a series of booms, widened income and wealth inequality and added massive debt to the system.

This week the Fed signaled it is ready to end this misguided policy.

Will the Fed have the backbone to stop promoting asset bubbles?

In a pivotal meeting Wednesday the Federal Reserve Open Market Committee decided to start raising rates. Not this week, although that would have made sense, but soon, which means probably at its March meeting. The chair of the Fed, Jerome Powell, hinted that several more hikes are likely after the March meeting. The stock market sold off on this news.

The ridiculous situation where the Fed funds rate is essentially at zero while inflation is near 7 percent may finally be coming to an end. The spread between inflation and the Fed rate is now the widest since the 1970s.

Back then it took the unceremonious dumping of one Fed chair, Arthur Burns, and the hiring of a true hawk, Paul Volcker, to begin the process of getting inflation under control. Even then it took three more years and interest rates reaching almost 20 percent before the markets became convinced that easy money policies were ended.

Burns was appointed by President Richard Nixon with instructions to provide easy access to credit until the 1972 election. Nixon won that election in a landslide, but inflation surged higher, eventually requiring wage and price controls. By the time that President Jimmy Carter appointed Volcker to the Fed in 1979 it required extraordinary discipline to get inflation back under control.

Until now the Fed has been playing a dangerous waiting game, hoping that inflation will subside on its own.

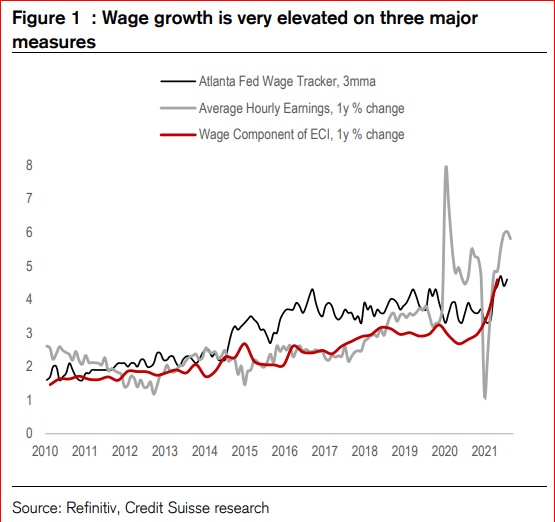

But all signs point to inflationary pressures continuing to build. Wage settlements and house prices are just two indications that the average person on main street is not listening to economists. Their gut instinct is that inflation will get stronger, and they are adjusting their behaviour accordingly.

Wage demands are gaining strength and given the difficulty reported by employers in finding people to work the employers will have to accommodate these demands.

According to Credit Suisse the Fed will gradually increase its Fed funds rate to 2–2.5 percent by the end of 2023. This pace implies rate hikes every quarter if the Fed sticks to its convention of hiking only 0.25 percent at each meeting. At the end of that period, two years hence, the real interest rate (Fed funds minus inflation) could still be negative if inflation stays elevated.

The Fed’s easy money policy is very detrimental to all those who eschewed speculation in their borrowing and investments decisions.

Hopefully the Fed will speed up the pace of interest rate increases to choke off rampant speculation on borrowed money and restore the Fed’s tarnished credibility.

It will be difficult for the Fed to convince the market that the easy money spigot is closed for good.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.