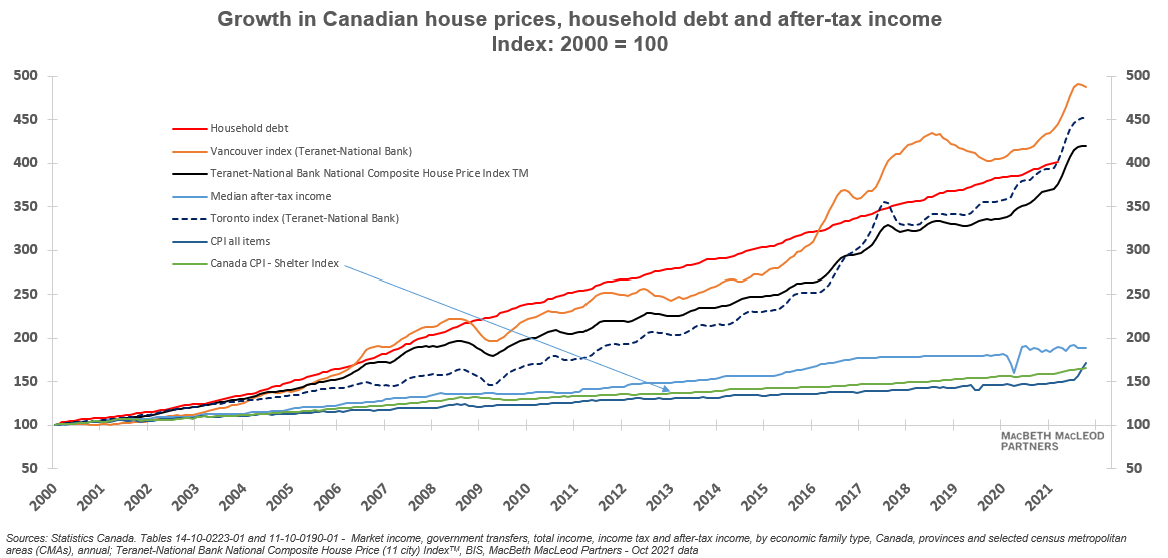

The Canadian housing mania is two decades old. During that period various house prices are up to three to four times in most cities while the largest CPI component — shelter — is up only marginally.

How is such a flawed method of calculating housing costs used in the CPI?

The largest component of the CPI is the cost of shelter. Because of the way that Statistics Canada has decided to calculate shelter the true cost of house price inflation over the last two decades has never shown up in the CPI.

Shelter makes up 30 percent of CPI, and at least that much in the household budget of most young families. The inflation index known as the CPI (consumer price index) has never reflected this large cost increase that has hit first-time home buyers since the start of this century.

Fraser Betkowski, my associate, updates this ‘bubble chart’ each month. The chart shows house prices nationally, prices in Toronto and Vancouver, household debt levels, after-tax income and CPI. He decided to add the cost of shelter this month to show visually how ridiculously large the understatement of housing costs in the Canadian CPI is. It is easy to see the huge gap between the green line near the bottom of the chart and the three housing indices and household debt at the top.

In the housing bubble that has lasted for nearly two decades (depending on one’s view on when the bubble started to form) house prices have left the CPI method of measuring housing inflation far, far behind.

The green line with the arrow shows where “shelter costs” are in relation to all the other measures. The CPI and shelter tracked very closely until recently and this makes sense since the shelter category is the largest weighted component in the index.

I examined aspects of this in the post on October 22, 2021 which can be accessed here.

Now that inflation in the U.S. has hit a 40-year high of 6.8 percent it is clear that inflation is threatening to go out of control, which would have major implications for interest rates and housing markets as well as stocks and bonds.

Even though CPI measures inflation imperfectly, when people think inflation they use the CPI. When people say, “inflation is 5 percent in Canada and 6.8 percent in the US” what they mean is the CPI has moved by that much. But inflation can be measured different ways.

If shelter inflation is pushed higher by interest rate increases the CPI will rise, other things being equal. And the central bankers’ efforts to reign in inflation will be countered by a rise in shelter costs. It could take years to get inflation under control by raising interest rates partly because the public might decide that housing makes a good hedge against inflation and will push to buy even more expensive housing.

The job of being a central banker is about to get a lot more difficult.

We'll be taking a break for the next two weeks with the blog posts resuming on January 7. Wishing you and your family a relaxing and safe holiday season. Thank you for subscribing to Hilliard's Weekend Notebook, it's appreciated.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.