Inflation is threatening to get out of control and central banks could be asleep at the switch. In the U.S. the Fed remains supremely confident of its ability to control rising prices, if needed.

Is the Fed overconfident?

US inflation CPI hit a 13-year high this week at 5.4 percent growth year-over-year, but central bankers still cling to the notion that this latest bout of inflation is temporary and related to the re-opening of the economy after COVID-19.

Analysts have started to question the Fed’s complacency.

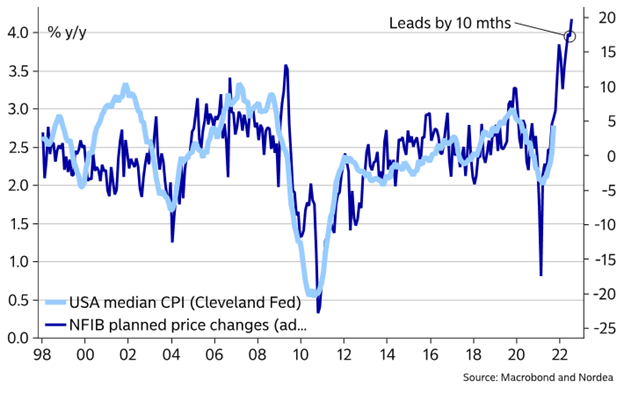

Andreas Steno Larsen and Helene Ostergaard of Finland’s Nordea Bank said on October 13, 2021, that the US median CPI could surge to levels not seen for more than two decades.

“This is a whole new scenario for the Fed to deal with and a whole new scenario for the markets to deal with as well.”

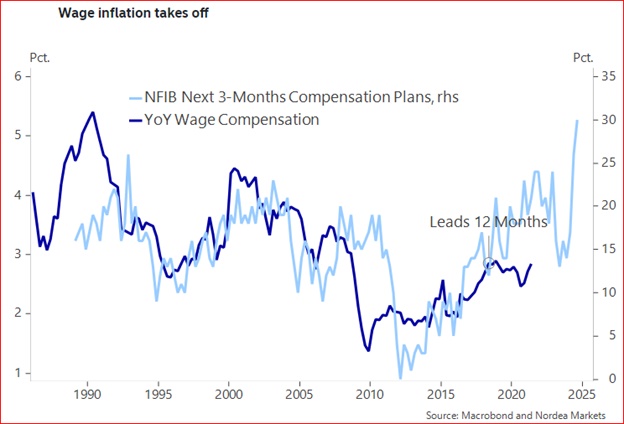

The dark blue line shows that small businesses are planning to raise prices and intentions lead actual inflation by 10 months. And a significant number from that same group plan to raise wages in the next 3 months:

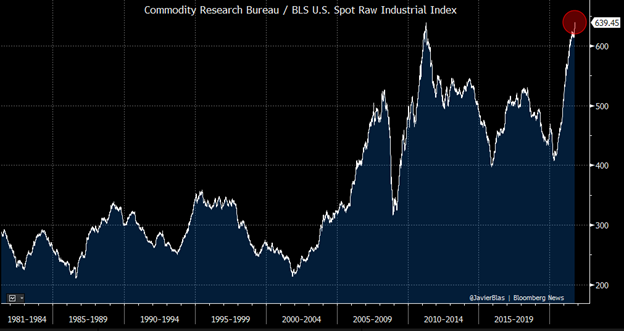

But it is not just wages that are a problem. The CRB/BLS US spot raw materials industrials index (I had never heard of this one) just touched a decades-long high. This index can trace its origin to January 1934:

Source: Bloomberg, @javierBlas

This index tracks obscure things like burlap, cloth, tin, copper scrap, rosin, wool, cotton, rubber, zinc, hides, steel scrap, lead scrap and tallow. Follow @javierblas for the full story.

With thousands of small businesses searching for workers to fill empty job positions substantial wage increases are possible.

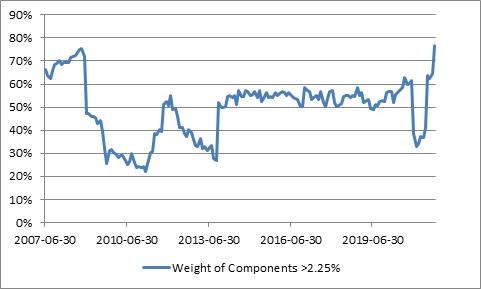

From Michael Ashton @inflation_guy here is a chart that shows the percentage of CPI components that are moving higher at a faster rate than the Fed’s official. At nearly 80 percent this indicator is at a record high:

Source: Michael Ashton @inflation_guy

There must be some concern at the Fed as at least one member has spoken publicly about it:

Raphael Bostic, a voting member of the Fed’s policy-setting Open Market Committee, wants the Fed to act sooner by raising interest rates next year, if necessary.

On raising rates, the Fed’s key policy tool, Bostic has penciled in one increase in 2022. Talking to CNBC this week he said:

“These upside risks to the inflation outlook bear watching closely…We will be watching carefully.”

Raphael Bostic Atlanta Fed president Source Bloomberg

All indicators are suggesting that the Fed could be making another major blunder by waiting too long to act. Studies of past inflationary periods show clearly that the Fed is more likely to follow events than lead.

The most reliable indicator of future inflation, consumer expectations, is flashing a red alert at levels not seen for a decade:

Economists know that once inflationary expectations get established they are difficult to break without triggering a recession. Interest rate increases above the inflation rate are usually required, as in the 1980s.

Watch for analyst talk about a Fed which is falling “behind the curve”.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.