The China Evergrande debacle continues to worsen.

China Evergrande, the second largest property developer in China and the most indebted in the world, missed loan payments this week, triggering a technical default.

Is the China Evergrande crisis like the Lehman Brothers bankruptcy?

Lehman failed in 2008 with $630 billion in liabilities and $600 billion in assets. (figures in U.S. dollars).

China Evergrande’s total liabilities are about $300 billion. Net debt is less than $100 billion, but other liabilities are more than $200 billion. Home buyers have deposits on unfinished apartments while contractors have unpaid invoices. Evergrande is large, operating in 200 cities with over 1,000 projects, so millions of Chinese businesses and families will be impacted by its collapse.

Evergrande’s struggles will have a significant impact on the property market. It is normal for families to give their savings (and sometimes borrowed funds) to the developer before the building is constructed. This seems risky, but buyers assume that the government would never let them down. If that trust is broken, developers lose an important financing facility.

Michael Pettis, author of books on China, wrote for the Carnegie Endowment for International Peace.

Pettis points out that the problem is complicated by the fact that “property developers, state-owned enterprises, local governments and even ordinary households … all have excessively high debt levels”. Regulators are worried about moral hazard if all the players are bailed out as the property sector is “notorious for its addiction to debt.”

Chinese leader Xi Jinping has disparaged excess credit expansion as leading to “fictional growth”.

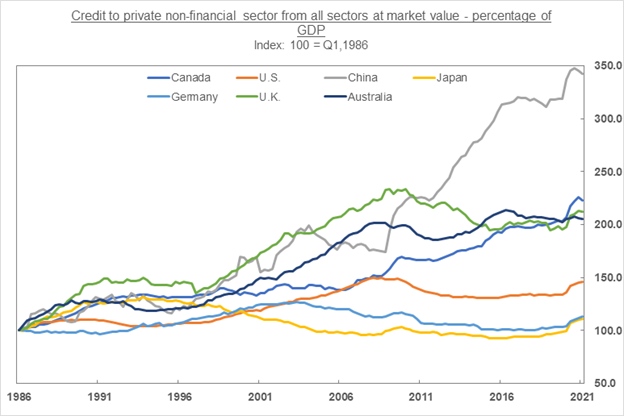

China leads the world in growing private sector debt while its enormous property sector makes up a world-leading twenty-five percent of GDP.

On this chart a flat line indicates debt and GDP grew at the same rate:

Source: BIS, MacBeth MacLeod Partners

China’s debt grew more than three times faster than GDP.

So, the Lehman parallel is not apt. “Minsky Moment” is a better reference.

Hyman Minsky (1919-1996), American economist, argued that there are three stages of finance. In his book “Stabilizing an Unstable Economy” Minsky describes the first stage as “hedge finance” where principal and interest is covered from income. “Speculative Finance” follows where lenders use asset price growth to cover loans as incomes are insufficient for repayment of the loan. The last stage, “Ponzi Finance”, happens when income cannot cover even the interest on loans.

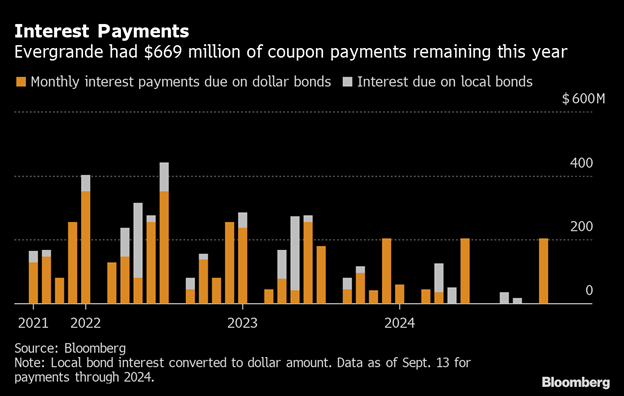

China Evergrande’s failure to make interest payments this week suggests that Evergrande, if not the entire Chinese property sector, is in the third stage, the Ponzi phase.

Evergrande’s failure would have a much wider impact on China than the failure of a Wall Street firm like Lehman Brothers.

Evergrande will prioritize interest payments on local over foreign (dollar) bonds.

A Minsky Moment arrives when lenders and regulators realize that borrowers are using Ponzi finance. Then lenders become reluctant to advance new loans and regulators tighten borrowing rules.

Debt deflation follows with widespread foreclosures and court-ordered sales, property prices plummeting, and GDP goes into a significant decline.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.