China has a property bubble second to none in the world. Evergrande is the second largest property developer in China and one of the largest in the world.

Could Evergrande’s troubles burst the Chinese property bubble?

Source: Macmillan Publishing, 2016

Michele Wucker wrote the book on gray rhinos, called “The Gray Rhino: How to Recognize and Act on the Obvious Dangers We Ignore”.

A “gray rhino” is defined as a “high impact, highly probable threat that has been neglected.”

There are many “highly probable threats” that are being ignored. The impact of climate change, residential real estate bubbles in Canada and elsewhere and the “long-delayed debt reckoning” of China’s Evergrande property behemoth.

Evergrande is huge by any measure. The company owes an estimated US$120 billion, but that is not all of their liabilities. In China property buyers deposit the purchase price of their new home with the developer, even before the property is completed. That money is supposed to be held in trust.

According to the Wall Street Journal, “a court order freezing about $20 million of China Evergrande’s assets — requested by one of its lenders — triggered the latest panic.”

Evergrande’s bonds maturing in 2023 and paying in US dollars offered a generous yield of 35 percent recently.

This time the Chinese government seems to be on a campaign to hurt some of the largest developers, by making it harder for them to access finance. China observers say that it is just a warning, and, in the end, government help will be there.

China Evergrande missed a few payments on some debts, in spite of holding $25 billion in cash, and banks with $7.1 billion exposure to Evergrande have decided not to renew the loans.

The freezing of a $20 million deposit (a tiny amount for a company this size) at the request of a bank when the loan is not due until March 2022 rang alarm bells. The loans due in twelve months total about $55 billion and if banks are not willing to extend new loans the threat will quickly become real.

So far, Evergrande’s financial problems have not impacted other large developers or the Chinese banks. The largest Chinese developer, Country Gardens, is still trading near its all-time high share price, a gain of eight-fold since 2018.

But aggressive price cuts on home pre-sales by Evergrande pushed home prices back to 2016 levels. Land costs have risen substantially, so profit margins are eroding. This could impact all developers, as buyers wait for price reductions before buying.

Source: Bloomberg

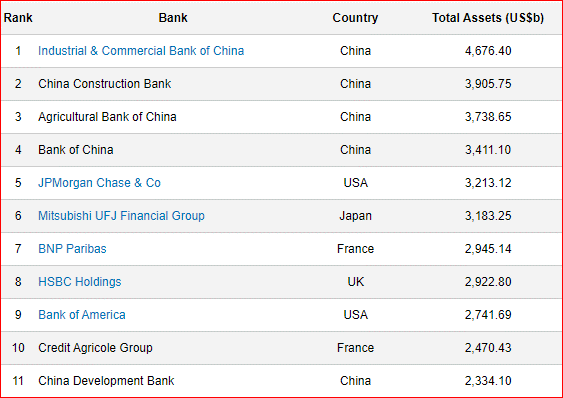

The largest banks in the world are Chinese, with six of the top 11:

Source: ADVRatings

The exposure of Chinese banks to Chinese real estate developers is enormous. About half of the assets (loans) held by the top ten banks are in China, about $15 trillion.

The government will probably save China Evergrande from default because of fears of contagion to the banks.

If it does, Evergrande and China’s real estate bubble could continue to be a gray rhino, for a little while longer.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.